EOS: The Late Arrival At the Bullish Party

EOS has finally joined the bullish frenzy that is taking place on the altcoin market, following months of tedious ranging between $2.5 and $3. Traders who missed out on profits or have already had their share of the loot from the monstrous rallies of the likes of BAND, LINK, and ERD, should start paying closer attention to the 10th cryptocurrency because it appears to be waking up after a lethargic sleep and trying to catch up with the rest of the market in order to stay relevant and maintain its place in the top 10.

Making preparations for the retracement

In the USD market, EOS has just started to recover from all the losses it suffered throughout 2019 and the first half of 2020. Thanks to a respectable 47.9% bull run that took place over the past 30 days, EOS was able to get its yearly ROI back into the green zone by 5.35%, while remaining 9.6% behind Bitcoin.

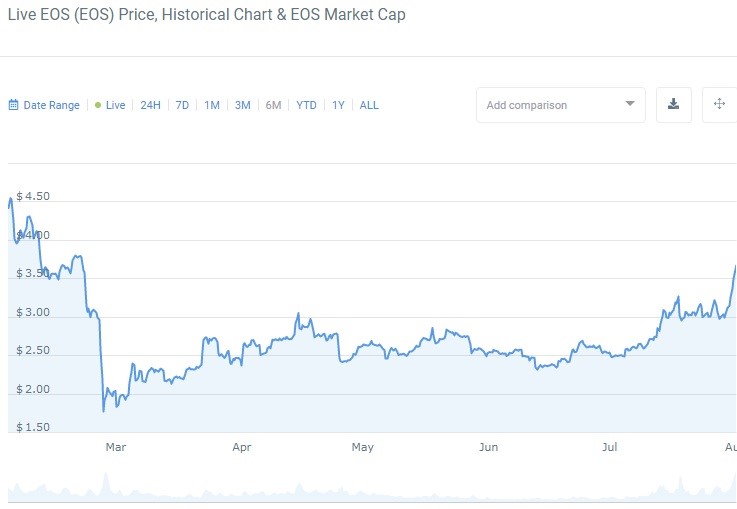

6-month EOS chart

The chart above displays how strongly EOS had been glued to the price level at $2.5 that served as an axis for price action for the entire post-crash period. Keep that level in mind because once EOS goes into a correction, which will happen eventually, it might travel back to that level because it has proven to be the magnetic point.

However, if EOS intends to compensate for lagging behind the entire altcoin market for weeks, then it won’t encounter $2.5 for quite a while. And judging from the way things are developing right now, EOS is going to try and push harder to the upside in the coming days, although first, it has to overcome a mighty resistance at $3,87 that happens to converge with the 0.618 Fibonacci retracement level.

The daily chart reveals that EOS has already been rejected at $3,87 after a successful breakout from another area of convergence between the price level at $3.33 and the 0.5 Fibonacci level.

1-day EOS/USDT chart

In doing so, the price action appears to have begun to form the bullish flag pattern, though it needs to be confirmed by the second rejection at $3.87 and the subsequent retracement that seems to have started already. If that retracement is to play out correctly, the price will travel downward no further than the 0.5 Fibonacci level or $3.39 price-wise, which should be a good entry point for a long trade, given that the key indicators would retain their bullish positioning.

- MACD is at its highest in the bullish zone since March, although it remains far away from the overbought area, which points at the presence of an extra upside potential;

- RSI, however, hasn’t been so distinctively bullish during the last two weeks of price action, and even created a bearish divergence, which confirms our notion that EOS won’t be able to breach $3,87, let alone the next resistance at $4.06 in one sitting, and will get pressurized to the downside by the bears.

- Stochastic also remains moderately bullish, but it needs to rise above 91.1 in order to avoid forming a bearish divergence.

We reckon that EOS won’t show any miracles of price appreciation in the near future, but instead, will keep on steadily pawing its way to the upside, with $4.5 being established as the top of the next upswing.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 74.4% | 54 | $68 221.63 | 1.27% | 2.38% | $1 346 132 518 889 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 76.8% | 47 | $3 277.70 | 0.62% | -6.01% | $394 072 124 681 | |||

| 3 | Tether predictions | 95.6% | 1 | $1.000294 | 0.04% | -0.03% | $114 362 869 613 | |||

| 4 | Solana predictions | 64.4% | 70 | $186.46 | 3.76% | 10.05% | $86 651 629 563 | |||

| 5 | Binance Coin predictions | 77.6% | 42 | $588.60 | 1.71% | -0.56% | $85 893 706 101 | |||

| 6 | USD Coin predictions | 90.8% | 1 | $1.000218 | 0.01% | 0.02% | $34 165 068 764 | |||

| 7 | XRP predictions | 62.4% | 86 | $0.601322 | 0.08% | 1.60% | $33 650 519 304 | |||

| 8 | Dogecoin predictions | 72% | 55 | $0.135778 | 4.40% | 6.72% | $19 726 589 838 | |||

| 9 | Toncoin predictions | 83.6% | 31 | $6.74 | -0.27% | -8.09% | $16 954 582 289 | |||

| 10 | Cardano predictions | 72.4% | 49 | $0.417851 | 0.74% | -4.48% | $15 002 527 040 | |||

| 11 | TRON predictions | 86.4% | 18 | $0.137290 | 0.44% | 2.02% | $11 952 578 512 | |||

| 12 | Avalanche predictions | 77.6% | 38 | $28.70 | 1.64% | 1.95% | $11 330 467 420 | |||

| 13 | Lido stETH predictions | 93.2% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | SHIBA INU predictions | 84.4% | 30 | $0.000017 | 2.35% | -3.05% | $10 173 129 198 | |||

| 15 | Wrapped TRON predictions | 90.8% | 1 | $0.116354 | -0.46% | 0.23% | $10 171 995 609 |