EOS (EOS) Still Clings to the Multi-Week Resistance

Contrary to other top and mid-ranked altcoins, EOS hasn’t been coping well with the consequences of the COVID-19 market collapse. The price of the 11th cryptocurrency did test the pre-crash level at $3.2 but was ultimately rejected to the long-standing support at $2.28, putting a halt on the aggressive bullish price action for the time being.

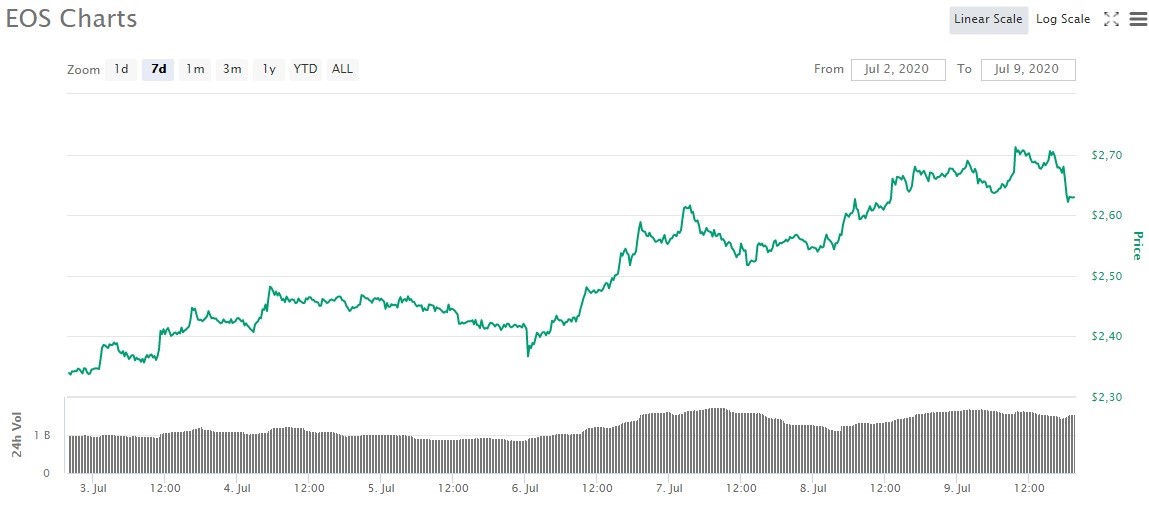

But presently, we see a small resurgence of the altcoin market that happens on the back of Bitcoin’s stagnation after the halving event and the sloping of BTC dominance. When it comes to EOS, the last seven days brought it the 12% appreciation of USD value and 10% in Bitcoin.

7-day EOS price action chart

Nevertheless, it is a weak performance on the part of a highly-ranked cryptocurrency with the underlying disruptive technology. Our EOS price analysis will tell whether the price would snap out of the state of catatonia and initiate a notable upswing or would it keep on ranging and eventually drops below the crucial level of support

Pressured down by the multiple layers of resistance

The weekly EOS/USDT chart shows that the price has been lying nearly flat for two months which could mean the departure of buyers from this market or the accumulation of a large position by big players before an explosive move to the upside, presumably to $4, where they could start offloading it.

1-week EOS/USDT chart

On the weekly time frame, we have designated four important price action level around which we based the further EOS price prediction:

- $2.28 - the current support level that was established after the price took a nosedive during the market crisis. It is important for the bulls to avoid letting the price slip below that level, which could cause a massive sell-off;

- $3.2 - the first of three major resistance areas of EOS’s way to the secondary uptrend. However, the convergence with the 0.382 Fibonacci retracement level makes it significantly harder for the bulls even to give it a proper test;

- $4 - a waterline between bearish and bullish zones and the spot of frequent price interaction, so expect a lot of trading activity once the price reaches that level;

- $5 - the bear’s final stronghold that will be very hard to breach, given how tough it has been for the bulls to establish a long-lasting momentum.

All major indicators hint that EOS has no intention of leaving the comfortable range between $2.28 and $2.83 any time soon. MACD has been literally lying flat for nearly two months, displaying no will to move in any direction. RSI is also stuck in the neutral zone, floating between 40 and 50, hence confirming the overall dullness of the market. Stochastic, on the other hand, has been distinctively bearish, having made the corresponding crossover on June 22, right after the price had tested the support once again.

On this time frame, the price action over the two weeks won’t be any different from what traders saw recently. There is still a chance for a quick long play - enter at $2.6 and exit at $2.8 - but that all EOS has to offer at the moment. Those who would be willing to wait a little longer could set the price target near $3, as it is likely to constitute another point of rejection come the time of another bull run.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 84.8% | 25 | $64 485.37 | 0.33% | 1.53% | $1 269 733 248 757 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 72.8% | 47 | $3 156.53 | 0.53% | 2.97% | $385 248 931 720 | |||

| 3 | Tether predictions | 93.2% | 1 | $0.999827 | 0.02% | -0.07% | $110 444 368 558 | |||

| 4 | Binance Coin predictions | 88.4% | 20 | $614.21 | 1.01% | 11.23% | $90 649 755 653 | |||

| 5 | Solana predictions | 69.6% | 68 | $144.92 | -1.92% | 1.99% | $64 801 943 270 | |||

| 6 | USD Coin predictions | 94% | 2 | $1.000042 | -0.01% | 0% | $33 354 239 535 | |||

| 7 | XRP predictions | 68.4% | 64 | $0.525514 | -0.36% | 4.48% | $28 971 123 639 | |||

| 8 | Dogecoin predictions | 70.4% | 60 | $0.151394 | 0.03% | -0.69% | $21 806 112 367 | |||

| 9 | Toncoin predictions | 68.8% | 64 | $5.41 | -2.56% | -16.87% | $18 789 466 535 | |||

| 10 | Cardano predictions | 62.4% | 72 | $0.471080 | -0.81% | 2.82% | $16 786 416 060 | |||

| 11 | SHIBA INU predictions | 62.4% | 79 | $0.000026 | 0.19% | 12.90% | $15 155 447 928 | |||

| 12 | Avalanche predictions | 66% | 69 | $35.58 | -2.16% | 2.12% | $13 458 015 785 | |||

| 13 | TRON predictions | 83.6% | 21 | $0.117230 | 3.54% | 7.22% | $10 265 718 725 | |||

| 14 | Lido stETH predictions | 96% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 15 | Wrapped TRON predictions | 84.4% | 18 | $0.117092 | 3.24% | 7.19% | $10 253 646 591 |