Stellar (XLM): Rolling Back to the March Price Levels

Stellar (XLM) was arguably one of the most bullish altcoins outside the DeFi space that made respectable gains ever since the market dived headfirst to its lowest levels when the first wave of the coronavirus pandemic had hit the world. After dropping to $0.026, XML rallied 355% over the course of 161 days without any considerable retracements, with only a brief period of consolidation between $0.063 and $0.079 that lasted for 70 days.

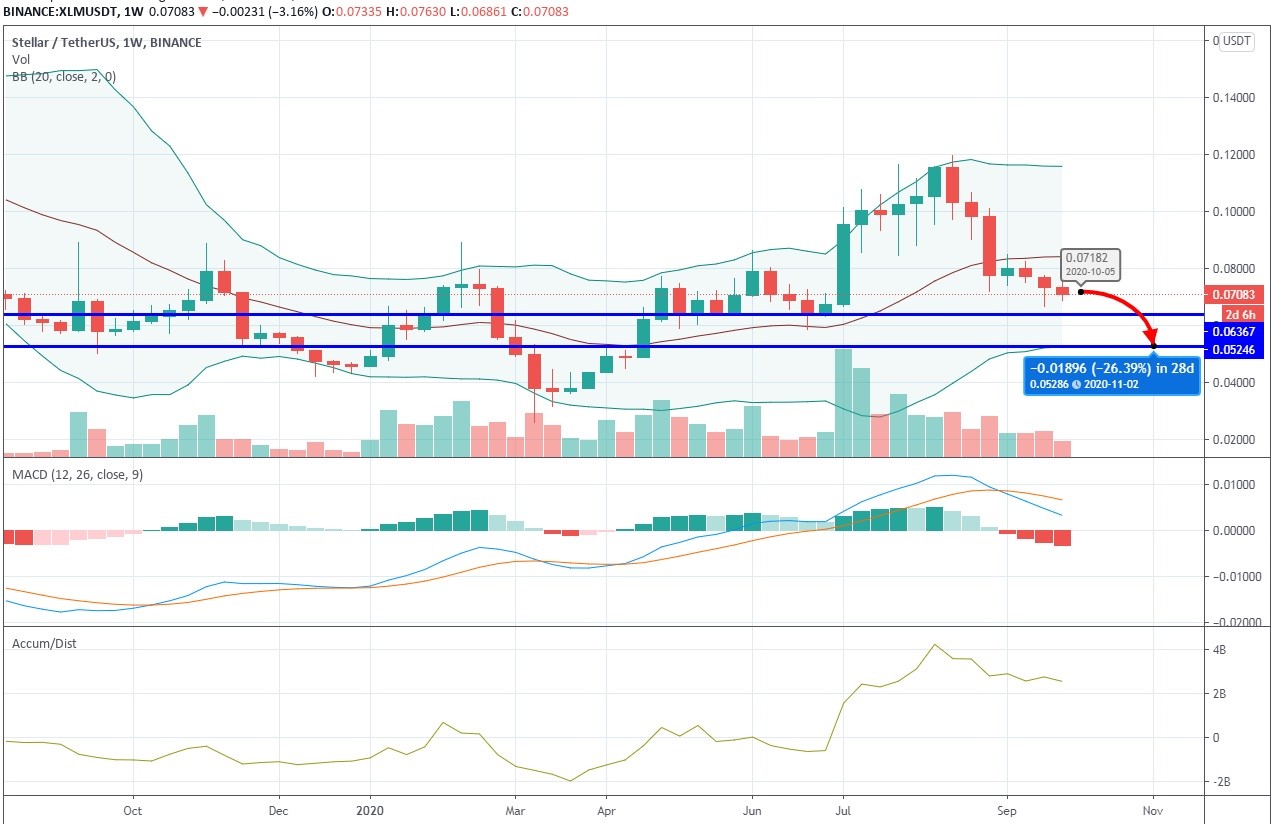

1-week XLM/USDT chart

Everything had been shaping up for Stellar to engage in a secondary uptrend after years of bear market, but the September selloff has thrown the bucket of cold water on the blazing hot rally. XLM has been nothing but bearish since August 17, having lost 44.1% in two episodes of price dump. Its performance profile remains 21.3% in the green against USD on the yearly scale, but other than that, it’s all red for Stellar, a clear signal to get out of this market, if you haven’t done so already.

Back from where it all started?

Going back to the weekly chart, the sellers aren’t willing to cut any slack to the opponents as they continue to pressurize the price to the downside. There is little doubt that Stellar will return to the support line at $0.63 over the course of the next seven days.

- The widening gap between the MACD lines leaves no doubt that the bearish momentum is in full force, which defies any chances of quick reversal to the upside.

- The Accumulation/Distribution indicator points out that the move to the downside from 4B to 2B is supported by the corresponding selling volume, which gives the sellers even more puff.

- The Bollinger Bands stays wide open, so traders must expect relatively large price fluctuations, with the main direction being to the downside.

Our XLM prediction is that on this time frame, the price will eventually drop to $0.052, another 26% decrease, though it might find support for a short period at $0.063. By that time, the signal line of MACD should reach the zero line, at which point traders should be looking for reversal signals that must be confirmed by the indicators and the rising bullish volume. Should MACD persist descending into bearish territory, the rollback to the March price levels ($0.036 - $0.044) would be practically inevitable.

1-day XLM/USDT chart

On the daily time frame, the price is about to reach the point of resolution of the inverted cup and handle pattern that has the bearish bias and supports our prediction of further price depreciation. To add salt to injury, Stellar has fallen below both trend-determining exponential moving averages (50 EMA and 200 EMA), which is a sure sign that the bears are prevailing in this market. Also, the current price action takes place within the context of the bearish checkmate pattern that almost always resolves to the downside.

All in all, Stellar went from having one of the most attractive bullish setups to being pulled back into the bearish zone, with the possibility of making a complete U-turn to the March price levels being very realistic.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 86% | 22 | $63 453.92 | 0.99% | -2.78% | $1 249 491 931 507 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 75.6% | 40 | $3 283.73 | 5.14% | 3.58% | $400 789 137 524 | |||

| 3 | Tether predictions | 96% | 1 | $0.999620 | 0.02% | -0.07% | $110 520 853 484 | |||

| 4 | Binance Coin predictions | 86.4% | 26 | $602.50 | 2.52% | 3.99% | $88 911 866 758 | |||

| 5 | Solana predictions | 64.4% | 75 | $141.19 | 3.82% | -6.88% | $63 151 826 270 | |||

| 6 | USD Coin predictions | 94.8% | 2 | $1.000047 | 0% | 0% | $33 496 631 232 | |||

| 7 | XRP predictions | 68.8% | 67 | $0.517078 | 0.71% | -2.62% | $28 561 302 937 | |||

| 8 | Dogecoin predictions | 66% | 71 | $0.148613 | 3.12% | -8.37% | $21 410 691 226 | |||

| 9 | Toncoin predictions | 69.2% | 60 | $5.43 | 4.29% | -12.60% | $18 871 516 084 | |||

| 10 | Cardano predictions | 64% | 78 | $0.468467 | 3.46% | -7.18% | $16 695 894 382 | |||

| 11 | SHIBA INU predictions | 60.8% | 82 | $0.000025 | 1.00% | -9.51% | $14 440 631 685 | |||

| 12 | Avalanche predictions | 58.8% | 81 | $34.38 | 1.42% | -8.35% | $13 010 646 344 | |||

| 13 | TRON predictions | 84.8% | 21 | $0.121311 | 1.08% | 9.15% | $10 621 821 587 | |||

| 14 | Wrapped TRON predictions | 86% | 18 | $0.120971 | 0.83% | 8.78% | $10 592 149 372 | |||

| 15 | Lido stETH predictions | 92.8% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |