BitTorrent (BTT) Is Reluctant to Break the Long-Standing Resistance

It’s hard to argue the fact that the coins and tokens based on the Ethereum network, and related to the concept of DeFi, are on a roll at the moment, while digital currencies that run on different blockchains, such as BitTorrent (BTT) that stems from the TRON blockchain, can’t boast any mouth-watering gains and display comparatively weak price action.

Nevertheless, BTT remains the token suitable for profitable trading, especially if chasing huge pumps doesn’t constitute your trading style, because it demonstrates a surprisingly stable average daily trading volume that fluctuates moderately between $25 million and $46 million. It means that the market has a steady pool of participants, which, in turn, provides for more predictable price action.

Preparing for a potentially big move

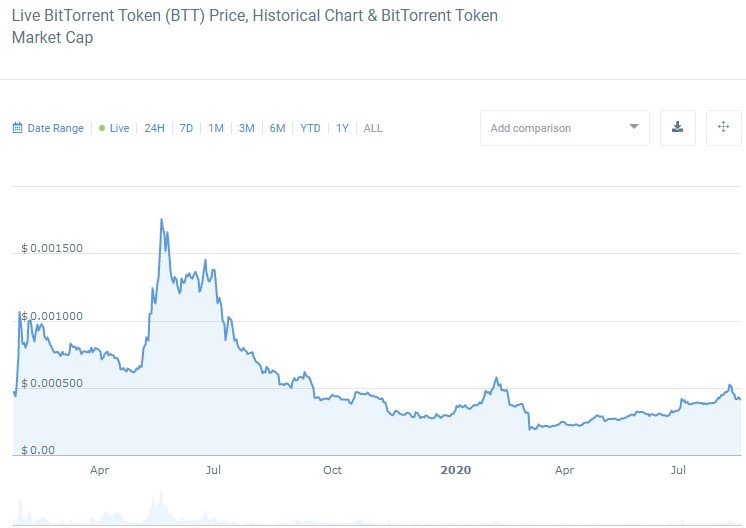

At the moment, there’s no news about any upcoming system upgrades, or any other impactful initiatives, coming from the BitTorrent team, so traders shouldn’t be relying too much on fundamental analysis right now to make BTT price predictions. The historical chart reveals that the token has had a decent 170% bull rally since the market meltdown in March, although it couldn’t help the price get to past an absolutely crucial resistance at $0.0006, where it also tripped and fell during the rally at the beginning of the year.

BTT historical chart

The all-time chart also shows us the first potential price target around $0.0007 that constituted a distinctive magnetic point during the last major bullish cycle in 2019. Given how laggy BTT is with regard to the rest of the altcoin market, we reckon that the price won’t go past that level in Q3 of 2020, even if the sentiment throughout the market will remain greedy.

The weekly time frame, however, shows that bulls appear to be preparing to launch an assault on the resistance level at $0.00053, having tested that level twice. It looks like it won’t occur this week as the coin is trading at $0.00046, some 12% away from the resistance that also happens to converge with 0.236 Fibonacci retracement level.

1-week BTT/USDT chart

You can see for yourselves that BitTorrent has been trapped at the lowest level of the Fibonacci retracement grid for many months, but as the indicators show, the buyers could be prepared to make a decisive push to the upside that would break this vicious circle of consolidation.

- MACD is expressively bullish, actually the most bullish it has been since last July. Notice that the oscillator didn’t get rejected near the zero line, which is a common occurrence during recovery after a prolonged consolidation. Instead, MACD drove straight through that level without narrowing the distance between two moving averages, hinting that the bullish price action might only now start getting momentum, thus increasing the probability of successful breach of resistance;

- RSI has also been on the rise ever since the notorious market crash, displaying no divergences or other inconsistencies in relation to the price action.

The only thing that should concern traders who want to go long on BTT is a lack of significant buying volume that is the main prerequisite for a successful breakout. Our concluding price prediction is that BTT will rise above $0.00052 eventually, and could rally on the back of positive momentum, to the next Fibonacci level that aligns with $0,00073, which is our next price target.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 81.6% | 26 | $62 581.52 | -2.82% | -1.78% | $1 232 274 056 286 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 76.4% | 43 | $3 092.33 | -1.80% | 1.20% | $377 422 868 005 | |||

| 3 | Tether predictions | 96% | 1 | $0.999701 | -0.03% | -0.07% | $110 392 718 693 | |||

| 4 | Binance Coin predictions | 83.2% | 22 | $587.28 | -3.88% | 5.38% | $86 675 077 068 | |||

| 5 | Solana predictions | 67.2% | 70 | $134.92 | -6.19% | -5.29% | $60 328 304 016 | |||

| 6 | USD Coin predictions | 94.8% | 2 | $1.000110 | -0.02% | -0.01% | $33 467 965 584 | |||

| 7 | XRP predictions | 68.4% | 69 | $0.514705 | -1.72% | 1.68% | $28 430 209 369 | |||

| 8 | Dogecoin predictions | 67.2% | 68 | $0.144143 | -3.96% | -7.68% | $20 763 960 737 | |||

| 9 | Toncoin predictions | 66.8% | 65 | $5.27 | -1.80% | -14.04% | $18 282 328 172 | |||

| 10 | Cardano predictions | 64.4% | 81 | $0.451818 | -4.06% | -5.90% | $16 100 189 712 | |||

| 11 | SHIBA INU predictions | 64% | 82 | $0.000024 | -4.25% | 5.67% | $14 406 279 325 | |||

| 12 | Avalanche predictions | 64.4% | 78 | $34.06 | -3.49% | -1.02% | $12 881 318 580 | |||

| 13 | Wrapped TRON predictions | 88.8% | 18 | $0.119353 | 2.19% | 8.54% | $10 450 913 619 | |||

| 14 | TRON predictions | 88.4% | 21 | $0.119116 | 1.74% | 8.00% | $10 430 161 283 | |||

| 15 | Lido stETH predictions | 93.6% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |