The Rise of DeFi: Would the New Financial Movement Make Banks Obsolete?

Alex Paulson

Crypto and Forex professional trader, analyst, contributor.

The world of blockchain and cryptocurrencies never fails to amaze us with the innovative solutions bound to reshape the world of finance and the industries of sports, healthcare, gaming, real estate, and even different forms of art. But it’s the finance, and above all, the banking, which is of the most significant interest because the primary objective of the entire blockchain space lies in the transformation of the way people and institutions handle money. Satoshi’s Bitcoin (BTC) became the icebreaker that had created a breach in the thick ice sheet of traditional banking and online payments, into which hundreds of blockchain startups have stormed to the consternation of those who had built the monetary system that is now crumbling before our eyes.

Over the past few years, many initiatives have put blockchain and cryptocurrencies at the center of the attention of financial media, institutions, and regulators. First, it was the initial coin offering (ICO) bubble that helped to attract the first big capital into this industry (though it turned out to be a flop); then there was a short-lived hype around the initial exchange offerings (IEO) that was even more disappointing since the overwhelming majority of coins that were distributed among investors through centralized exchanges eventually lost 50% or more percent of the value at the offering.

But then something new has emerged in this field, something that is now close to threatening the very existence of banks and other financial intermediaries and realizing a chief objective drawn out by Satoshi Nakamoto and other prominent cryptographers like Nicholas Szabo, who, by the way, had designed - back in 1998 - the mechanism that became the precursor to the current Bitcoin architecture, as well as Stuart Haber and Scott Stornetta who had laid the foundation for blockchain back in 1991.

Haber (right) and Stornetta (left) are discussing blockchain. Source: Forbes

They envisioned a financial system that is fully decentralized and characterized by self-governance, permissionless nature, and the absence of all intermediaries like banks, brokers, and clearinghouses. But while Satoshi and other founding fathers of cryptocurrencies provided the vision and the initial infrastructure, it was Vitalik Buterin and his Ethereum Foundation. They gave means for decentralized finance to come into existence by introducing smart contracts and the ERC-20 standard, which has given rise to DeFi, short for decentralized finance.

This financial movement took the crypto realm by storm in 2020 and showcased the ambition to reshape the centralized financial system that has been plagued by numerous problems that seem to be deliberately left unresolved. And seeing who the DeFi space is developing in leaps and bounds, how much money is being devoted to it by retail investors, one can’t help but wonder whether we are standing at the tipping point in the balance of financial power.

How DeFi came into existence

Even though the majority of cryptocurrency proponents became actively involved in this space only some years ago, the idea of a blockchain-based solution that would benefit from the inefficiencies of the traditional financial system had sparked in 2001 in the minds of aspiring fintech innovators who proposed an electronic system that would directly and automatically match buyers and sellers of a given asset, instead of them having to deal with multiple banks in order to get the affordable pricing and spread. At that time, the focus was primarily on the Forex market that has always been one of the main sources of profits for banks that charged the spread on operations with foreign currencies for acting as an intermediary.

At that time, this idea that was dubbed the client-to-client (C2C), which is synonymous to the current term peer-to-peer (P2P), trading met with fierce opposition from financial powerhouses like Citibank, whose experts like Richard Moore, then Head of Foreign Exchange at the said bank, had argued that the introduction of C2C model would perplex traders due to the (presumably) complicated process of credit assessment, low liquidity, and become an administrative disaster in general.

That reception of the original proposal for an electronic matching system, which can be viewed as an early DeFi model, had obviously been very disingenuous to banks’ customers and traders, though it wasn’t without a sound logic because bankers had already understood the threat that the electronic system imposed on one of the central pillars of their business model - the spreads. But even back then, the savvy institutions had begun trading via dark pools directly with each other, which showcased that the demand for peer-to-peer trading that offered a much lower transaction cost had already been forming, which means that the smart money had accepted the early version of his model, though, for many years, it remained concealed from retail traders and investors who were left at the mercy of banks with their predatory fees.

Enter Satoshi Nakamoto with the Bitcoin whitepaper that introduced that P2P payment system built on the foundation of the distributed ledger technology (DLT) and the Proof-of-Work consensus mechanism that came to be known as the blockchain. If we assume that the cryptocurrency industry is developing in an ascending spiral, the emergence of Bitcoin and the early blockchain technology was the first whorl of that spiral, at which point the solution dealt only with the issues of double spending, inflation, as well as security and cheapness of transaction, while not being able to offer more complex financial products like loans.

Nevertheless, Bitcoin has paved the way for all other blockchain solutions that followed, most notably Ethereum with its somewhat improved blockchain, and provided a firm foundation from which the DeFi movements stemmed. The next whorl of the spiral formed when the Ethereum Foundation introduced a platform for building decentralized applications (dAps) and smart contracts to its blockchain ecosystem that later became the cornerstone for numerous fintech startups that explored the possibility of a total decentralization of all financial processes through the elimination of all intermediaries, minimization of friction, and provision of genuine value to end-users.

Just a quick reminder that a smart contract is a self-executing transaction protocol that approves a certain electronic contract or agreement after the parties meet all predetermined conditions. By the way, the smart contract was originally the creation of Nick Szabo, though the Ethereum team should be given credit for polishing this idea almost to perfection and putting it into work.

To put it simply, the idea behind the whole DeFi movement was to replicate all available financial products and services but use the distributed ledger and smart contracts in order to make those products and services fully decentralized (that is not being subject to centralized authorities like banks), and substantially more accessible and advantageous to ordinary people and businesses that struggle to get them at banks due to the variety of reasons. Through DeFi products, anyone with a broadband connection, a smartphone, some cryptocurrencies in his or her wallet, and a bit of knowledge in digital finance was given an opportunity to instantaneously stream coins and tokens around the world, lend crypto at a very handsome interest, take out flash loans using crypto as collateral, and trade ERC-20 tokens.

And even though this movement became mainstream only in 2020, when the total value locked (TVL) in the different project began growing exponentially, its modern history dates back to 2014, the year of introduction of the Maker protocol by the eponymous foundation led by Rune Christensen, a Danish computer scientist who had also contributed to the creation of BitShares.

Maker’s significance lies in the fact that at the time, it was the first peer-to-contract lending platform that afforded means for taking over-collateralized loans, and also the one that introduced a unique stablecoin named DAI, previously known as Sai, that isn’t pegged directly to USD reserves like USDT or USDC. Instead, DAI utilizes a fully automated network of smart contracts that stabilizes the price of DAI through the collateralized debt position (CDP), a mechanism that is known as a soft peg. It implies that the price of the stablecoin is collateralized by several cryptocurrencies that are being sent to special smart-contract vaults every time a new DAI is issued.

DAI market capitalization chart. Source: Coinmarketcap

The chart above shows how DAI has been demonstrating a sharp rise of its market capitalization over the past year from a mere $90 million to the current $2.8 billion, which coincided with the rise of the entire sector and proves the importance of this particular stablecoin for the given industry. The main advantage of DAI over stablecoins like USDT is that it isn’t controlled by a single entity, like Tether Limited in case of the most popular stablecoin, but rather by DAO (decentralized autonomous organization). In this case, it’s MakerDAO, the subdivision of the Maker Foundation, whose primary goal is to administer the Maker Protocol.

Sai was a single-collateral currency, meaning one could use one cryptocurrency - ETH - as collateral when obtaining loans, while DAI is multi-collateral in nature. The only thing that was required for DeFi to take off was the exchange platform where people could trade ERC-20 tokens between each other and at a negligible fee.

The first project that introduced a sustainable decentralized exchange was called EtherDelta. It was fairly popular back in 2017 as people got excited about the prospects of trading tokens without the need for a centralized exchange. But then the infamous hack had happened (EtherDelta had been stripped of nearly $1 million), along with the SEC charges for illicit exchange operation, all of which had thrown the first more or less viable DeFi exchange into oblivion.

But the year 2017 had also seen the emergence of important projects like Bancor that represents the on-chain liquidity protocol; Kyber Network (also a liquidity protocol); Synthetix (a protocol tailored for crypto derivatives), Aave (a platform for lending/borrowing tokens), and Ren (an on-chain liquidity protocol) that helped shape the DeFi sector that we know today.

The current composition of decentralized finance

In less than three years after MakerDAO made its appearance on the crypto scene, decentralized finance, which, by the way, was called open finance at first, has seen a truly remarkable growth of both its ecosystem and infrastructure, as well as the amount of money locked in various DeFi projects and platforms.

1-year DeFi TVL chart. Source: DeFi Pulse

The TVL chart above displays how furious was the growth of this sector, which took the TVL from $615 million in March 2020 to the current $45 billion, which comes to show the degree of interest traders, investors, and, of course, profiteers have in products and services that DeFi has to offer.

As things stand, the five biggest DeFi projects by the amount of USD locked in them are Maker, Compound, Aave, SushiSwap, and Uniswap - we will review them in detail later in the article. Let’s just point out that Maker and Compound are dominating this industry, each having over $6 billion locked in the respective protocols. And since the bullish sentiment in the cryptocurrency market remains strong, the flow of money in DeFi should only become more intense, especially when Ethereum 2.0, the major upgrade of the Ethereum network, gets fully operational - the first stage was initiated in December 2020.

DeFi isn’t fully decentralized yet, but it’s still better than the banks’ total centralization

But what interests these people so much that they keep pouring money into this fledgling industry? Perhaps it’s the buzzword “decentralized” that implies the absence of any intermediaries. But we need to debunk a myth here - in its current state, the DeFi ecosystem is rather far from being fully decentralized. In fact, prominent dApp developers like Brendan Forster (Dharma), Nik Kunkel (MakerDAO), and Emilio Frangella (AAVE) admitted that at the moment, this sector isn’t entirely decentralized. They have classified it into five stages of decentralization - from fully centralized to totally decentralized. For instance, Dharma represents the most centralized version of a DeFi platform since their price feed sources, liquidity providers, and interest rates calculation tools are all centralized. The most influential MakerDAO and Compound have the third degree of decentralization, which means that all financial products offered on these platforms are of non-custodial nature, while the platforms are also characterized by the permissionless nature of margin calls and their liquidity, whereas the interest rates, the price feeds, and the technological development of the platforms are occurring in the centralized environment.

Projects like Fulcrum and dYdX offer a higher degree of decentralization where only interest rates and the course of platform development are determined by a central entity. Syntherix, yEarn Finance, and bZx are by far the most decentralized since all of their components, including price feed and interest rate estimation, are carried out by the corresponding protocol, leaving only the platform development fully in the hands of the team and the community.

Tokens that fuel this sector

As we have already mentioned, the entire DeFi ecosystem has been built on the foundation of the Ethereum blockchain, which means that all tokens present there are of the ERC-20 standard and its variations, such as ERC-721 and ERC-1155 that are applicable to non-fungible tokens. The fungible tokens, obviously, take up the largest chunk of DeFi’s tokenomics - they are utilized in all divisions of the industry, including lending and token swaps.

Next are the equity tokens that offer the ownership right to certain digital assets or a pool of assets. For instance, the price of an equity token often corresponds to a certain amount of ETH held in a smart contract. Then there are utility tokens that are needed to ensure the functionality of smart contracts, and, in many ways, are the main driving force for this entire industry because they can be used as collateral, determine the reputation where it’s required, and also used for staking. Utility tokens are often used as a part of the mentioned soft peg for the DAI stablecoin, and also to cover the fees in certain decentralized applications. Examples of utility tokens include SNX, REP, LINK, and ZRX.

There are also governance tokens like Maker (MKR) and Compound (COMP) that grant its holders the right to vote on system development, thus reducing the level of centralization. The supply of these tokens can be either static (simply buying the tokens) as well as inflationary and deflationary that are distributed via certain incentive schemes.

Lastly, there are non-fungible (non-interchangeable) tokens that represent a booming market. For example, a couple of weeks ago, a digital artist nicknamed Beeple (real name - Michael Winkelmann) sold a collage of images dubbed “Everydays”, packed into NFTs, for a mind-blowing sum of $69,3 million. This is only a single instance of the whole NFT mania that also provides an incentive for DeFi since most marketplaces that deal with NFT serve as yet another application of decentralized finance. In this particular case, DeFi platforms are bridging the gap between the realms of art and gaming with that of finance since many of those digital collectibles and non-fungible tokens grant the ownership rights on a piece of intellectual property, are now an integral part of the crypto economy, and DeFi in particular, thanks to the unprecedented interest from art lovers and collectors. This shows that DeFi, even in its infant age, already possesses a far more varied selection of financial instruments that can be used for different purposes (and they are accessible to all users), while the banks, especially in the developing countries, are keeping most financial instruments away from ordinary customers by setting up an insurmountable entry barrier.

Decentralized exchanges - gateway to safe and more profitable trading

The problem with all centralized cryptocurrency exchanges is that they retain the funds at all times while you are trading, and they are very prone to hacking. In other words, when trading on Binance or Coinbase Pro, you can never be sure that your precious coins are totally safe. That is why in recent years, we saw the rise of decentralized exchanges (DEXs) that allow traders to keep custody of their funds. But the main issue with DEXs that appeared before DeFi went mainstream is that they have always struggled to provide sufficient liquidity, which was a major turn-off for retail traders that operate with larger-than-average stacks.

With the rise of DeFi, the solution has arisen that took the form of swaps - an instant exchange of tokens that, in this case, can be characterized as atomic and non-custodial, meaning that all trades are executed at a negligible fee while trader’s tokens never stay on the exchange for longer than it takes a smart contract to execute the trade upon the completion of all conditions and see that the funds are released to digital wallets of the parties involved in that trade. The liquidity for these swaps is derived from the so-called liquidity pools that are formed by users themselves. In essence, liquidity pools on DeFi platforms are big collective funds that are locked in smart contracts. These pools are used not only to facilitate seamless token trading as well as lending.

Those who contribute to liquidity pools are called liquidity providers. Anyone who is willing to lock some of their ERC-20 tokens in such a pool can become the provider. In order to do that, one has to have the input and the output tokens ready, let’s say ETH and DAI. It’s important to note that it’s required to have the equal dollar value of both the input and the output coins. Then all that’s left is to select the pool and press the Add Liquidity button. Before adding the liquidity, you can see the approximate revenue (pool share) generated from accumulated trading fees and allocated among liquidity providers, depending on their overall contribution to the given pool. Besides, the decentralized exchanges associated with DeFi have other interesting features, such as the automated market maker (AMMs) system, which is a smart contract that eliminates all counterparty risks.

The Bancor project was the first to introduce the concept of liquidity pools on decentralized exchanges, though Uniswap, the decentralized exchange established by Hayden Adams, became the real difference-maker after showcasing the average daily trading volume of over $2 billion, which puts it on par with the major centralized exchanges like Binance and Coinbase, thus proving that DeFi is the real deal.

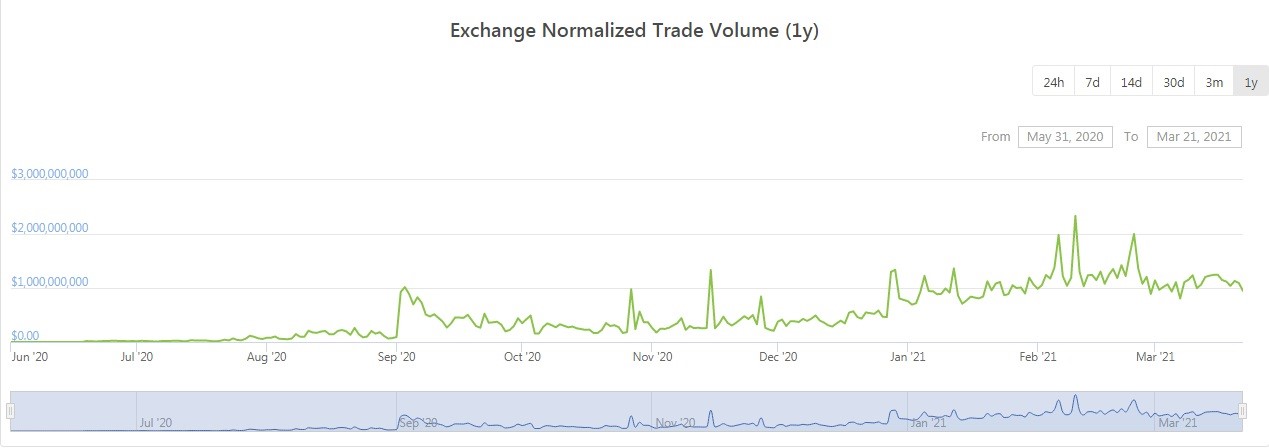

Uniswap ATV chart. Source: Coingecko

Uniswap and the rest of the DeFi-centered exchange platforms showed that profiting from trading fees is no longer the privilege of intermediaries like banks and brokers. Now everyone who has a few tokens to their name can reap the benefits from liquidity provision, and that’s the new financial reality created by the decentralized finance movement. But that isn’t the banks’ biggest nightmare with regard to DeFi that has impinged upon the most sacred source of revenue for traditional financial institutions - the loans.

DeFi loans and yield farming - the killers of traditional banks

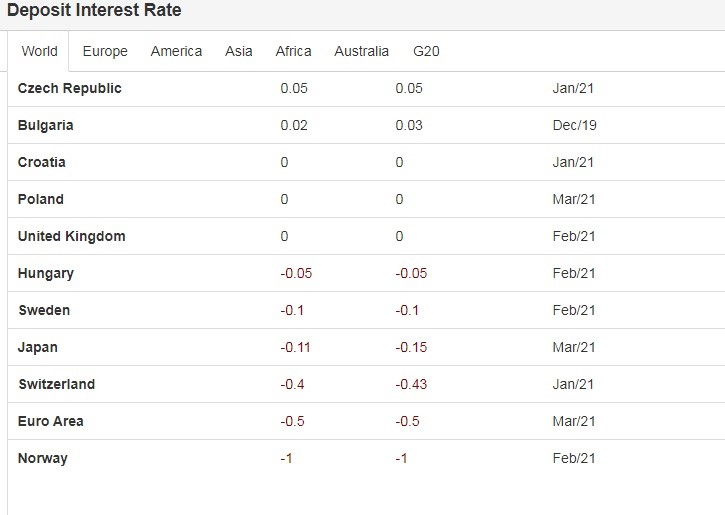

Receiving money from people in the form of deposits at a certain deposit rate and then issuing loans using that money was the bread and butter for banks - until DeFi arrived at the scene. Basically, the banks are borrowing money at a cheaper rate and loan them out to businesses and households at a higher rate - a simple scheme that allowed them to thrive for centuries. Major central banks have been cutting down the deposit interest rates systemically, even to the point of them being negative.

Deposit interest rate by country. Source: Trading Economics

You can see that the deposit interest rates in such developed countries as Norway, Switzerland, Japan, and Sweden are actually negative, which basically means that it’s more practical to keep your money under the mattress than opening a savings account. Also, it’s well known how immensely difficult it could be to take a loan at a bank, especially if one’s credit score isn’t particularly great. All that paperwork and tiresome interviews appear downright archaic in the age of decentralized finance when one can simply grab a smartphone and take a flash loan in crypto.

AAVE, Compound, and Maker are the three most prominent lending protocols that now have $5.11 billion, $6.15 billion, and $6.29 billion, respectively, locked in them that can be loaned out to any applicant that has the collateral ready. But the downside to DeFi loans is that most of them are over-collateralized, meaning that one would have to provide up to 50% more tokens as collateral in order to receive the loan.

Most loans issued by the banks are usually under-collateralized so that the borrower would have to give only a fraction of the loan as collateral and pay the rest from future earnings. But that comes at a price of the clerks sifting through your entire financial history, getting access to some very sensitive information, whereas DeFi platforms don’t have KYC per se, so the lender’s and the borrower’s identities remain undisclosed at all times. Besides, you don’t need to showcase creditworthiness to anyone on a DeFi lending platform. Simply provide the collateral, mostly in ETH, that is greater than the borrowed sum, and you are good to go. And while locking up more money than you actually borrow might seem impractical at first, but it all makes sense if you think of it as a hedge against the high volatility that is inherent to the cryptocurrency market and the way to cash out on your crypto without actually selling it.

In addition, one can borrow nearly as many tokens as he desires as long as the chosen liquidity pool is large enough, and the amount to be borrowed corresponds to the following formula: the price of collateral multiplied by the collateral factor, which is the quality of collateral (for instance, ETH has the collateral factor of over 70% on most lending platforms). However, you should be aware of the risk when taking a DeFi loan because if the price of the collateral (ETH) drops sharply, to the extent that the loan becomes under-collateralized, the protocol will liquidate the loan that you’d have to eat up the losses. Therefore, make sure to consider such loans only if you are certain that the asset that you are going to use as collateral won’t tank while the loan holds.

But it’s yield farming that is the biggest attraction of decentralized finance and one of the biggest threats to the traditional banking system. This process is also called liquidity mining, and it implies obtaining rewards, similar to deposit interest in banking, for providing liquidity to the aforementioned pools. The rewards are usually paid in DeFi tokens that might then be either sold, exchanged, or deposited to another liquidity pool. The liquidity providers or yield farmers often utilize complex strategies to multiply the “farmed” tokens, while being constantly on the lookout for better offers from different platforms. For example, a strategy might include depositing a stablecoin like DAI to a liquidity pool, say Curve, then re-depositing the received reward in the LP tokens into Synthetix contract. It can be complicated for an unsavvy person, but the annual percentage yield (APY) in DeFi tokens can range from 20% to 100% - you definitely won’t get the deposit rate even remotely close to these yields at any bank on the planet.

The story of banks and decentralized finance bears resemblance with that of David and Goliath, though a throw of a stone won’t be enough for the underdog to send the giant crumbling. However, given that DeFi already offers viable solutions to the problems that are inherent to traditional financial institutions, such as centralized control, limited access to banking services (according to the statistics, nearly 2 billion people still remain unbanked), the lack of transparency and operability, over-bureaucratization accompanied by inefficiency, we might see the blockchain-based ecosystem becoming a tough opponent to banking powerhouses because, at the end of the day, people deserve financial freedom, which is something that banks will never give them. DeFi still battles a lot of problems, like bugs in smart contracts that could lock up the funds permanently, the governance risks, troubles regarding scaling, and regulatory scrutiny, but Rome wasn’t built in a day, and given that DeFi is people-oriented and already much more efficient, the banking system will start showing big cracks sooner rather than later.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 86% | 25 | $64 231.88 | 0.59% | -1.12% | $1 264 752 663 246 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 75.2% | 46 | $3 128.59 | 0.50% | 0.80% | $381 842 351 685 | |||

| 3 | Tether predictions | 94.4% | 1 | $0.999787 | 0.01% | -0.11% | $110 440 040 048 | |||

| 4 | Binance Coin predictions | 88.8% | 20 | $603.06 | -1.38% | 7.59% | $88 986 925 382 | |||

| 5 | Solana predictions | 67.6% | 71 | $143.05 | -1.27% | -1.16% | $63 966 485 069 | |||

| 6 | USD Coin predictions | 94.8% | 2 | $0.999971 | -0.01% | -0.02% | $33 398 974 144 | |||

| 7 | XRP predictions | 68.8% | 68 | $0.522722 | 0.56% | 4.09% | $28 817 198 575 | |||

| 8 | Dogecoin predictions | 69.2% | 65 | $0.149823 | -0.21% | -2.00% | $21 580 928 488 | |||

| 9 | Toncoin predictions | 69.2% | 65 | $5.41 | 3.57% | -22.18% | $18 772 115 764 | |||

| 10 | Cardano predictions | 62.4% | 77 | $0.468326 | -0.32% | 0.03% | $16 688 289 735 | |||

| 11 | SHIBA INU predictions | 64% | 82 | $0.000026 | 1.86% | 9.04% | $15 038 242 307 | |||

| 12 | Avalanche predictions | 65.2% | 75 | $35.19 | 0.02% | -0.70% | $13 309 079 073 | |||

| 13 | TRON predictions | 87.2% | 21 | $0.118474 | 2.76% | 8.47% | $10 374 441 886 | |||

| 14 | Wrapped TRON predictions | 89.6% | 18 | $0.118015 | 2.66% | 8.41% | $10 334 270 063 | |||

| 15 | Lido stETH predictions | 95.2% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |