Swipe (SPX): Gearing Up For Another Rally?

In our previous Swipe (SPX) price prediction article, we were able to correctly forecast the breakout from the ascending channel and the establishment of a new all-time high by the altcoin that represents the Swipe Network, a crypto payment outlet that also offers Visa cards, which has recently become a part of the Binance infrastructure.

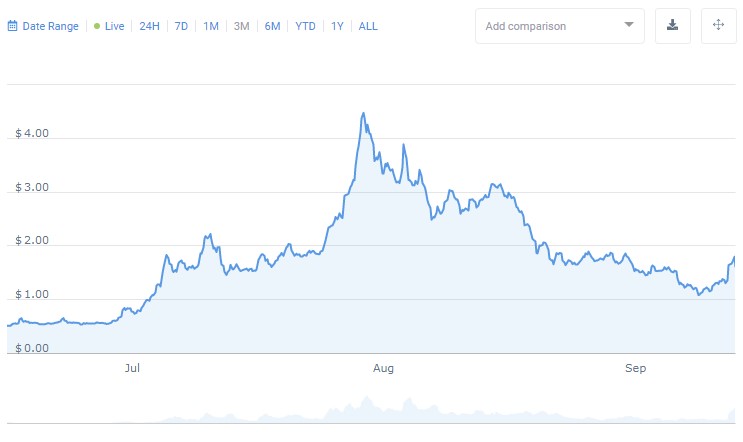

3-month SPX chart

Swipe appears to have bottomed out

Despite the expectations, the price didn’t encounter any resistance at $3.5 and went straight towards $5, a psychological price level that now serves as the historical high of SPX from which the price has already rolled back by 67% on the backdrop of the small crisis that hit the cryptocurrency market in the first days of September. But even such a considerable drop didn’t cause Swipe to go negative in terms of long-term gains against USD and BTC, as its yearly ROI stands at 44,5% and 8.2%, respectively. The all-time ROI is at 728%, a far better result than that of the neighboring altcoins.

At the moment, Swipe occupies the 85th position in global rankings, possessing a market capitalization of $124 million that took a sharp dive from $309 million, recorded in the middle of August. When it comes to the average trading volume, we noticed a significant drop in the past three weeks (from $160 million to $42 million), which coincided with the deepening of the correction. However, starting from September 27, we registered a substantial increase of volume from $47 million on September 26 to $198 million on the 27th and $415 million on the 28th. It could be a sign of the commencing reversal to the upside as SPX appears to have found the bottom of the correction near $1.1, evident from the daily chart.

1-day SPX/USDT chart

We have applied the Fibonacci retracement grid on the same time frame to figure out where the levels of support/resistance may lie during the anticipated rally. Our expectations regarding the rally are supported by the showings of key indicators:

- MACD has made a confirmed bullish crossover near the oversold extreme at -0.2, which usually results in a substantial push to the upside that could go at least to $2.5, the 0.382 Fibonacci level, given the upside potential that SPX holds after a prolonged bearish period;

- The Accumulation/Distribution indicator started to push off the bottom at - 12M, which means that the active distribution (selling) of Swipe tokens has run its course and the equally active accumulation should set in, which usually entails a nice price bump.

The Fibo grid also reveals that SPX tends to frequently interact with the round-number price levels, such as $5, $3, and $2, which is likely to become the first resistance area on the road to recovery and presumably a new ATH. Again, given how low MACD is in the oversold area, and how bullishly is looks at the moment, we expect the price to easily penetrate through the 0.236 ($2) Fibo level in the next two weeks and reach the point of resistance at 0.382 on Fibo or $2.5 price-wise. However, there is also a possibility that SPX will recover in one big upswing to, or even above, 0.5 on Fibo or $3.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 80% | 32 | $63 155.22 | 6.60% | 0.29% | $1 243 767 057 547 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 79.6% | 31 | $3 108.25 | 4.40% | -0.14% | $373 287 839 163 | |||

| 3 | Tether predictions | 96% | 1 | $1.000169 | 0% | 0.08% | $110 787 816 826 | |||

| 4 | Binance Coin predictions | 89.6% | 17 | $585.22 | 3.26% | -1.39% | $86 371 460 797 | |||

| 5 | Solana predictions | 68.8% | 67 | $144.99 | 5.24% | 6.47% | $64 858 047 574 | |||

| 6 | USD Coin predictions | 96% | 1 | $1.000003 | -0.01% | 0.01% | $33 451 018 744 | |||

| 7 | XRP predictions | 75.6% | 50 | $0.529651 | 1.71% | 2.90% | $29 255 735 341 | |||

| 8 | Dogecoin predictions | 66.8% | 62 | $0.151484 | 14.20% | 4.41% | $21 836 282 886 | |||

| 9 | Toncoin predictions | 67.6% | 64 | $5.79 | 7.65% | 9.86% | $20 121 267 128 | |||

| 10 | Cardano predictions | 66.4% | 70 | $0.467877 | 3.54% | 2.90% | $16 680 942 903 | |||

| 11 | SHIBA INU predictions | 70% | 58 | $0.000025 | 8.30% | 0.96% | $14 611 225 838 | |||

| 12 | Avalanche predictions | 67.2% | 73 | $35.64 | 5.83% | 4.72% | $13 526 598 789 | |||

| 13 | TRON predictions | 83.2% | 21 | $0.123145 | 0.80% | 2.71% | $10 778 382 006 | |||

| 14 | Wrapped TRON predictions | 88% | 21 | $0.123020 | 0.58% | 2.71% | $10 767 423 073 | |||

| 15 | Polkadot predictions | 67.6% | 66 | $7.17 | 1.77% | 7.82% | $10 305 295 024 |