Axie Infinity (AXS) Goes Parabolic: Would the Gaming Tokens be the First Ones to Overcome the Current Crisis?

When it comes to cryptocurrencies, most people are focused primarily on their adoption within the financial and banking sectors since the disruption of the contemporary global economic system has been the core idea behind the concept of blockchain. However, over the past couple of years, the application of blockchain technology has bifurcated to many other niches, like sports and gaming, which have little to do with today’s monetary system.

The interest in blockchain-based games has been booming lately, mostly due to the COVID-19 pandemic that forced many people to spend weeks, if not months loitering in the confines of their own homes, looking for ways to establish additional sources of income to sustain their families and lifestyles. And while crypto offers various means for making extra money, such as trading, staking, or lending, their complexity could be off-putting.

At the same time, nearly all owners of smartphones, laptops, and PCs are doing some recreational gaming to take their minds off the pressing issues of the day. There are also many inhabitants of the virtual world who devote hours to playing video games; some of them even compete at the professional level, earning a pretty penny in tournament rewards. But only a few were able to convert these largely pleasurable experiences into something more meaningful and profitable. However, the incorporation of blockchain technology into the industry of gaming has opened a window of opportunity for both professional and recreational gamers to earn actual money and for traders to make significant profits from the parabolic rise of gaming-related tokens.

Over the past three weeks, the market saw a mind-blowing rally of the gaming token called Axie infinity (AXS) that gained over 500% in this relatively short period of time, while the rest of the market remained stagnant. In doing so, AXS has covered all of the losses that it sustained in the aftermath of the recent market crash and went on to beat one ATH after another.

In this article, we will discover the reasons behind this meteoric rise of AXS and ruminate over the possibility of other gaming tokens following its suit in the near-term future. We will also give consideration to the pressing issues that the gaming industry is facing and speculate about the solutions that blockchain technology could provide to help monetize the gaming experience and boost the demand for the major gaming tokens like Decentraland (MANA), The Sandbox (SAND), and Enjin Coin (ENJ) that might drive their prices sky-high. Regardless of whether you are a gamer, who is eager to make some money from a favorite hobby, or a cryptocurrency trader on the lookout for the coins with the ticket to the Moon, these tokens must be on your radar for the time being because they might well be the first ones to overcome the ongoing market crisis and go on to establish new historical highs, following the example of AXS. There is no guarantee that all of these cryptocurrencies would follow in the footsteps of AXS and showcase explosive rallies, but the tendency is there, and we simply can’t ignore it, regardless of our attitude towards gaming.

Axie Infinity leaves Bitcoin and Ethereum biting the dust

Over the past three weeks, AXS has been inarguably the hottest altcoin across the entire cryptocurrency market. After it had found the bottom around the $4 mark, the gaming token has been pumping like crazy as it gained over 500%, which resulted in the market capitalization boost to $1.4 billion, as of the time of writing. Right now, the price of AXS hovers around the $22 area, and it still remains to be seen whether this price point would be the peak of the monstrous rally. Just check out this beauty of the price chart below: three huge weekly candles painted green left all market participants in total awe as the price kept disregarding all resistance points, going through them like a locomotive without breaks.

1-week AXS/USDT chart. Source: TradingView

Upon having gone in the price discovery mode, Axie Infinity has been ripping to the upside, and those who manage to jump on that money train, even at the later stages of the rally, must have made some nice profits, while the performance of heavyweights like Bitcoin (BTC) and Ethereum (ETH) was mostly underwhelming.

Before getting deeper into the analysis of AXS's price action and future prospects, we need to figure out the reasons behind this colossal pump: was it a fluke or a substantiated rally that would translate into a sustainable uptrend?

Those who are following the blockchain gaming sector must have read in various crypto news outlets that at the beginning of May, the Axie Infinity network had successfully migrated to the Ronin sidechain that resides on the Ethereum blockchain. It had been created exclusively for this blockchain game to solve the issues of scalability and multi-degree connections so that more people could join this small metaverse and breed virtual creatures. The move to the Ronin sidechain created the necessary conditions for performing ultra-quick transactions that are confirmed instantaneously by the network. In addition, it helped to resolve the issue of ungodly high gas fees that are still plaguing the Ethereum network. Lastly, the migration to that sidechain would eventually allow players to withdraw virtual assets in the form of non-fungible tokens (NFTs) to third-party platforms like OpenSea, where they could be traded for other NFTs or sold for cryptocurrencies, presumably ETH.

The rapid rise of AXS has also been facilitated by the involvement of a pseudonymous NFT whale, who goes by the name Flying Falcon, as well as the project's participation in the Yield Guild Games (YGG), a virtual organization that helps fledgling players to have a quick start in play-to-earn games through the Sponsor-A-Scholar program. Flying Falcon is by far the largest contributor to the program since he had sponsored as many as fifty Axie Infinity players to have a smooth start.

According to the reports, the whale owns $1.5 million worth of in-game virtual property, and he must have become even wealthier during the AXS rally. This program helped to create a positive image for this whole community, which resulted in a massive influx of new players during the past couple of months, which ultimately created an unprecedented demand for AXS that helped drive its price to incredible heights.

As per the data report provided by Delphi Digital and the Google Interest metric, the interest in the game began to rise significantly at the end of April and then drove through the roof, having gone from 10 on the Google Interest chart all the way to 100 in little over seven weeks. The majority of inquiries about the game came from the Philippines, Venezuela, Cuba, Qatar, and United Arab Emirates, the developing or downright backwater countries where people are looking for any means possible to make that extra buck. And instead of going to some mundane job, Axie Infinity offers a chance to make a decent income by playing a fun game, which has obviously become its main point of appeal.

Moreover, the migration to the Ronin sidechain, and the subsequent scalability improvement, resulted in a massive growth of the Axie community and the number of AXS holders. For instance, in April, the size of that community amounted to 50 thousand members - after the transition to the Ronin sidechain, these figures began to grow rapidly. By the end of June, the Axie Infinity community accounted for over 250 thousand daily active users, holders, and Discord members. Naturally, such exponential growth of the ecosystem led to a significant improvement in Axie's tokenomics and revenue. The latest report on NFT sales within that ecosystem has it that there are over 50 thousand NFTs being sold on that platform on a daily basis, which translates to the average trading volume of around $25 million. Axie Infinity has also become the most profitable protocol across the entire industry - $21.6 million a week, which is light years away from other popular blockchain protocols like PancakeSwap, Synthetix, MakerDAO, and even MetaMask.

Therefore, it's quite obvious that the AXS's super rally isn't a fluke by any means because it was substantiated by several critical fundamental factors, so it's highly unlikely that we would see a massive dump once it runs its course.

Judging from the price chart above, that rally is close to its completion because the market looks extremely overheated as it has stretched out the Bollinger Bands significantly, which usually results in a correction to an area close to the middle line of that indicator. The chart also displays the receding trading volume, which means that the AXS holders should brace themselves for the correction that might take the price down to the area between $12 and $14 in the next few weeks.

Those who don't have AXS in their portfolios should be extremely cautious when trying to enter this market: there is a good chance that you would manage to scoop up a nice 10% - 15% profit on an intraday move, but the bearish pressure is likely to start mounting very soon, so the most reasonable trading approach here would be scalping. But since play-to-earn is a new concept that holds the promise of getting an even larger traction thanks to the game's appealing design and great tokenomics that provide means for making real income, the anticipated correction could be followed by another rally that might end with AXS reaching $40 or even $50. Given that there are around 3 billion gamers across the world, who are looking for ways to monetize their skills and efforts, as well as over 2 billion under-employed people who are desperately looking for a hassle-free way to make money, there might well be the second wave of demand for AXS and its companion token, Small Love Portion (SLP) that has also been extremely bullish these past few weeks.

Small Love Portion (SLP), a younger sibling with the same bullish prowess

Small Love Portion (SLP) is the second ERC-20 token that exists in the Axie Infinity ecosystem. The SLP tokens serve as a substitute for experience points, found in practically all online games, but their main perk is that they are worth actual money. Players use SLP to enhance the breeding process of virtual creatures (Axies) that are used to track and loot in-game treasures that come in the form of non-fungible tokens. Gamers can either earn SLP by winning online battles or by purchasing them on cryptocurrency exchanges. Each creature has seven breeding stages that cost from 200 SLP to 2,100 SLP, with the value of each one increasing gradually with each breeding. Right now, the average price of an Axie that has been bred twice stands around $500 on the platform's proprietary marketplace - a good source of income for those who owe several of them.

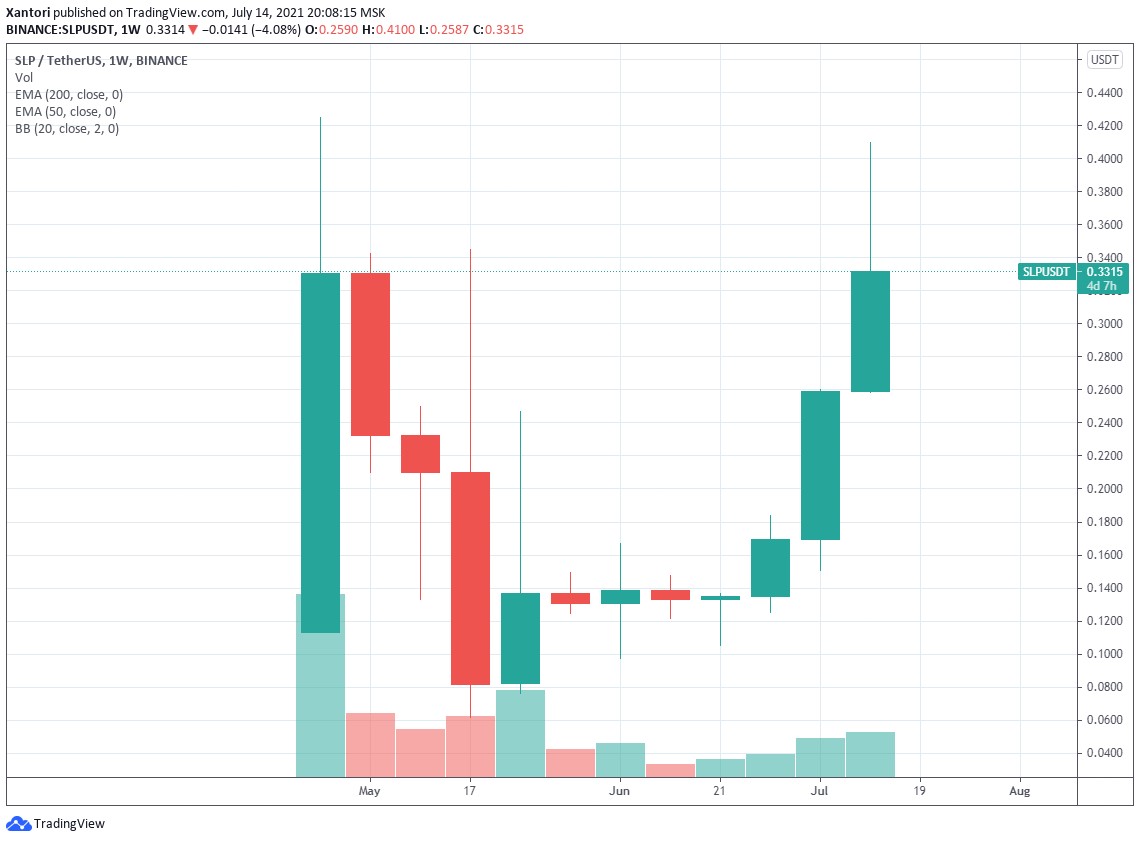

1-week SLP/USDT chart

Price-wise, Small Love Portion has followed in the footsteps of Axie Infinity with a slight delay, which offered a chance for those familiar with this entire ecosystem to grab the second scoop of profits over the course of token's recent three-week rally, during which its value has grown by nearly 300% and even came close to the previous all-time high at $0.42.

The price of SLP is currently above all moving averages, which signifies its incredible bullishness, but we also notice that the significant trading volume, similar to the one registered at the end of April, hasn't arrived in this market yet, though it has been rising steadily over the past four weeks. It could mean that the rally hasn't reached its climax yet, and more gains are still to come, especially given that the current value of SLP is only $0.34, compared to $22 of that of AXS. Certainly, SLP is meant to be much cheaper than the main in-game currency, but the discrepancy is evident, which means that this token has great potential for further gains, especially if the community of Axie Infinity gamers would keep growing at the same rate. The only thing that could stop SLP from going parabolic is the fact that this token has an infinite supply and is being burned quite frequently to balance out its inflation rate.

Even by the most modest SLP price prediction, it's bound to surpass the all-time high at $0.42 and test $0.5 eventually, so there is still room for considerable gains and profits for SLP traders and holders. However, keep in mind that the value of this token is inherently tied to that of AXS, and if the latter goes into a correction mode, which is highly likely, as explained above, Small Love Portion might follow its suit and slide to $0.26 or even $0.22.

But even if you don't trade cryptocurrencies, this amazing play-to-earn game offers a unique opportunity to make an additional income by simply farming SLP on that platform. According to player feedback, it takes roughly two to eight hours to farm 200 SLP, which is enough to perform the first breed. Multiply that by the token's current price of $0.34, and you get around $68 of daily income. Those who have enough time to do some grinding (non-stop gaming) might count on earning around $1,700 to $2,040 a month, a sum that constitutes an average salary in most European countries and way higher than the wages in South Asia or Africa. There is no need to explain what a marvelous financial opportunity this is for those who live in countries that struggle economically, where the unemployment and inflation rates are high. For example, the Ph.D. and Master's graduates in Malaysia make around $240 a month, while the average salary in Poland is $747, according to the OECD index.

Perhaps there has never been a better time to be the "natural born slacker" who can lie around on the couch all day playing video games while making a higher income than most of his or her peers. With AXS and SLP, that is certainly a possibility, though we don't encourage this type of lifestyle.

In any case, blockchain technology has opened a new gateway for underprivileged people to earn decent money in a fun way, without having to leave their families to travel abroad and encountering all kinds of difficulties. As for gamers, this and other blockchain games offer a splendid opportunity to monetize their playing time while also creating an interoperable metaverse, where in-game assets from one game can be transferred to an open marketplace and sold or exchanged as NFTs, something that the gaming world has never seen before.

Other gaming tokens that might rally any time soon

The Sandbox (SAND)

The Sandbox (SAND) is another gaming token that has already had a good rally from the interim bottom at $0.14 to its current price level at $0.52, a 260% gain in less than three weeks. Right now, it’s ranked by Coinmarketcap as the fourth largest gaming token by market capitalization, which presently stands at $360 million, surpassed only by Axie Infinity (AXS) that has the capitalization of $1.4 billion as a consequence of its parabolic rally; Decentraland (MANA) boasts the capitalization of $1.1 billion; the market value of SAND’s third rival, Enjin Coin (ENJ) stands at $1,08 billion.

But while SAND might be falling behind in terms of market capitalization, it’s certainly making headway when it comes to price gains. Over the past week, the token under review gained 28%, though we should take into account the fact that the market has been predominantly bearish during this time, which resulted in the price making a considerable pullback after encountering the resistance at $0.52.

1-week SAND/USDT chart

The chart above shows that after having a rather deep pullback to $0.38, SAND went back to its bullish ways and is now gearing up to test the $0.55 area. Similar to AXS, there has been a considerable buying volume coming into this market during the past three weeks, while the sellers have failed to send the price into a correction. After nearly a week of bearish price action, SAND seems to be mustering the bullish strength that might lead to a rally to $0.8 or even $0.91, the all-time high. Contrary to the situation on the AXS market, it’s not too late to take up a position in this market with prospects of solid 30% - 40% gains, or even more, depending on the market conditions in the next couple of weeks. In the best-case scenario, SAND would surpass the ATH and go on to test the psychological level at $1 in the next three to six weeks, thus repeating the path of AXS.

The Sandbox is a popular blockchain-based gaming franchise where players are given the means to build their own virtual assets or even worlds on the plots of virtual land. The app has been around since 2012 and was downloaded 70 million times, which speaks volumes about its popularity that is bound to increase as more people discover play-to-earn games. Moreover, according to the whitepaper, the team behind The Sandbox plans to transfer the control over this metaverse to users by 2023, thus making it a fully decentralized game that can offer its players a sizable income from selling those plots of land and virtual items on open marketplaces.

Decentraland (MANA)

The next gaming token that holds the prospects of substantial gains is Decentraland (MANA) that has also seen a decent period of bullish price action in the last three weeks, though now it seems to be struggling to recover after the recent pullback that didn’t allow it to break out of the descending channel.

1-week MANA/USDT chart

We don’t see a formidable trading volume in this market right now, compared to that on the AXS and SAND markets, but the analysis of the order book reveals a big cluster of buy orders (around 1,6 million tokens) at the price level near $0.6 - MANA’s current price stands at $0.68. If those buy orders get triggered, the market might react by breaking the said channel to the upside and testing the resistance at $1, after which traders could see the retracement back to $0.7 for the retest of that area. Should it be successful and the market conditions remain bullish, the rally to $1.2 or higher would be on the cards.

Decentraland is a community-owned virtual world that was built on the Ethereum blockchain. It comprises 90 thousand plots of land, with each plot being designed in the form of NFT. All pieces of land and in-game items are purchased using MANA tokens that also grant its holders the right to vote on different issues that impact the token economics. It’s one of the most popular virtual worlds within the blockchain community because it offers full ownership of virtual property that is likely to increase in value over time. Besides, one can trade parcels of land and estates on the decentralized marketplace for a nice profit.

Enjin Coin (ENJ)

ENJ is the native ERC-20 token of the Enjin blockchain ecosystem that is characterized by interoperability and accessibility to all users who are willing to try out that social gaming platform that has been around since 2018. Enjin’s main selling point is that it offers means for talented blockchain developers to create their own gaming projects. Also, Enjin positions itself as the next-generation blockchain for NFTs that makes the creation of these unique tokens much cheaper, faster, and without any particular technical knowledge, thus facilitating their mass adoption.

1-week ENJ/USDT chart

On the weekly chart, ENJ has also been struggling to maintain the bullish rally as the sellers pushed back when the price reached $1.58 and subsequently dropped it to $1.1, though the buyers managed to defend that area and keep ENJ above the 50-period moving average. This market also can’t boast a significant trading volume, but it might arrive there soon enough because it seems that the NFT space is getting a second wind, especially in the sports industry, which might bring back the increased demand for this type of tokens and bring more users to the Enjin platform is search of tools for more comprehensive and easier NFT development. We don’t expect any monstrous pumps on this market in the near future, but the $2 area could be in sight, offering the prospect of 55% gains.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 82% | 25 | $64 463.63 | 0.80% | -0.55% | $1 269 313 209 031 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 76% | 46 | $3 149.21 | 0.44% | 1.51% | $384 359 433 583 | |||

| 3 | Tether predictions | 93.6% | 1 | $0.999999 | 0.01% | -0.06% | $110 463 415 368 | |||

| 4 | Binance Coin predictions | 85.2% | 20 | $603.90 | -1.41% | 7.99% | $89 111 825 830 | |||

| 5 | Solana predictions | 66.4% | 71 | $143.96 | -1.56% | -0.05% | $64 372 777 006 | |||

| 6 | USD Coin predictions | 94.8% | 2 | $1.000017 | -0.01% | -0.01% | $33 379 420 163 | |||

| 7 | XRP predictions | 68% | 68 | $0.523893 | 0.14% | 5.05% | $28 881 748 060 | |||

| 8 | Dogecoin predictions | 69.2% | 65 | $0.151058 | 0.80% | -0.78% | $21 758 477 314 | |||

| 9 | Toncoin predictions | 68.4% | 65 | $5.43 | 2.50% | -23.18% | $18 850 103 346 | |||

| 10 | Cardano predictions | 63.2% | 77 | $0.468000 | -0.33% | 1.18% | $16 676 655 489 | |||

| 11 | SHIBA INU predictions | 62.8% | 82 | $0.000026 | 3.44% | 13.13% | $15 224 788 349 | |||

| 12 | Avalanche predictions | 63.6% | 75 | $35.44 | 0.47% | 0.19% | $13 401 949 645 | |||

| 13 | TRON predictions | 87.6% | 21 | $0.117913 | 2.81% | 8.09% | $10 325 417 304 | |||

| 14 | Wrapped TRON predictions | 88% | 18 | $0.117724 | 3.06% | 8.26% | $10 308 941 064 | |||

| 15 | Lido stETH predictions | 94.4% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |