Non-Fungible Tokens: What Stands Behind the Recent Crypto Mania?

Alex Paulson

Crypto and Forex professional trader, analyst, contributor.

“NFT” has become a very loud buzzword lately, thanks mostly to the eruption of the market for digital art and collectibles. In the past few weeks, we have seen all major cryptocurrency news outlets riddled with titles about people splashing out on non-fungible tokens that contain various forms of digital content, from sophisticated art to Internet memes. Some say that these tokens represent the next phase of the blockchain evolution, while others remain skeptical about the real value of these tokens that might be bloated from the enormous hype. We will dive deep into a very fascinating subject of non-fungible tokens to discover the nature of this class of digital assets, its history, and use cases.

Some of you may feel your jaw drop after finding out the sums for which some NFTs were sold at online auctions recently, while others might follow the suit of hundreds of collectors who have been stocking up on even the silliest-looking NFTs in the hope that their value will appreciate significantly in the future. Crypto traders will get insight into tradable currencies that represent the specific niche for non-fungible tokens, and some readers might feel the awakening of the artistic self and go on to create an NFT-backed product that is going to be sold for hundreds of ETHs.

In any case, it has become obvious that the blockchain ecosystem has bifurcated in a direction that is literally the opposite of finance and app development, its initial field of application. The people of the creative breed have finally discovered that blockchain holds vast opportunities for their careers and financial well-being and immediately began to exploit these newly opened markets.

But the question of whether NFTs and related cryptocurrencies are a good investment and trading instruments remains open because no one cancels the scenario of this market surge ending up being a bubble that would explode in everyone’s faces. Similar to what happened to tech stocks during the infamous DotCom bubble: the tech went on to change the world, but the stocks of countless tech companies had plummeted, never to rise again. In our opinion, the likelihood of that is quite low, and the NFT market will prove its sustainability, but please don’t take it as financial advice and regard this article as purely educational.

NFT is not a curse word

In order to understand the nature of NFTs, one has to grasp the concept of non-fungibility since NFT stands for non-fungible token. Fungibility is an economic term that describes the interchangeable nature of a commodity or a monetary unit, whether it's a dollar or a Bitcoin. It means that when a ten-dollar bill is equivalent to another ten-dollar bill and they are indistinguishable from one another. The same applies to all cryptocurrencies that are being traded on exchange platforms. Another important characteristic of fungible units is that they are divisible - a bill can be exchanged to ten one-dollar bills that will hold the same value, while Bitcoin can be broken down into millions of satoshis. In other words, not a single unit of fungible assets has the unique property that makes it irreplaceable and indivisible.

Source: Blockchain Simplified

As the name suggests, non-fungible tokens are a whole different kind of cryptographic asset. Each token that belongs to this class contains special identification codes and metadata that make it unique among other such tokens. It can't be replicated, fractionated, counterfeited, or used for financial transactions as if to be exchanged for another NFT at equivalency.

Non-fungible tokens are usually backed by a digital asset, whether it's a drawing, a musical composition, or an in-game virtual item, and act as means for their verification on the blockchain; hence they are provably owned and provably scarce. There are virtually no means to replicate non-fungible tokens because they are created using smart contracts, the self-executing computer protocols that can't be changed or otherwise amended once it’s launched on the blockchain.

Different tokens - different standards

NFTs usually contain the ownership data and some additional metadata that makes the tokens exclusive, for instance, a digital signature of an artist, like the ones we see in the bottom corner of real paintings. Another interesting feature of non-fungible tokens is that depending on the conditions of the smart contract, some of them can be extensible - two such tokens can be combined to create a third token that is going to have unique properties. Needless to say, one can't do that with fungible tokens: crossing BTC with ETH won't produce DOT, for instance. All these attributes make non-fungible tokens really fascinating in terms of their social and economic utility. The blockchain solutions that deal with the digital representation of assets and proof of ownership have been around for years, but it seems that non-fungible tokens would be the real game-changer. And it's not just a figure of speech because some of these tokens are set to revolutionize the realm of online gaming by putting a price tag on tons of in-game items that players had previously been grinding for without being able to monetize their efforts.

Despite the fact that non-fungible tokens can be created (minted) virtually on any blockchain that supports smarts contracts, like NEO, Cardano, NEM, and Hyperledger, the current NFT market is formed almost solely from the tokens of ERC-721 and ERC-1155 standards that are implemented on the Ethereum blockchain. Unlike the ERC-20 standard, which is a universal standard for creating fungible tokens on the Ethereum network, including stablecoins like USDT or the representative of the previous crypto craze, the DeFi tokens, ERC-721 allows for the creation of tokens with unique properties, which are also known as deeds. The standard allows for the same and transparent transfer of tokens that contain the ownership data over a certain physical (an item of real estate or other physical property, or a piece of artwork) or virtual items like digital collectibles. The ERC-721 standard is also used to generate assets that hold negative value, such as financial loans that are issued on DeFi platforms, which is one of many use cases of NFTs.

The ERC-1155 standard, on the other hand, is used to create and manage different token types. The use of this standard allows for the issuance of smart contracts that might include different types or even classes of Ethereum tokens. One can put together a contract that contains a mix of non-fungible, semi-fungible, and even fungible tokens. The ERC-20 standard would require the creation of a separate smart contract for each token class, but ERC-1155 allows to melt them together while letting each token retain its metadata and other unique features, if any are present. This standard was developed in collaboration with the team that stands behind the Enjin project and the ENJ coin, which is one of the most traded NFT-related cryptocurrencies with an average daily trading volume of $500 million.

A journey into the history of non-fungible tokens

The emergence of NFTs dates back to 2012 when the crypto world first saw the so-called Colored Coins, which was the solution for digitizing real-world assets with the help of the Bitcoin blockchain by storing some metadata that represents a certain asset. Basically, Colored Coins added unique attributes to specific BTC coins and were the first tokens that allowed for the decentralized verification and management of an underlying digital asset, which gave way to the creation of digital collectibles. But these coins didn’t get much traction, mainly because the Bitcoin blockchain is just far less suitable for minting and maintaining the vast amounts of such tokens than the Ethereum one.

But the non-fungible token enjoyed the first real popularity when the blockchain game called CryptoKitties was first introduced by Dapper Labs in 2017. The essence of this game is that a player is given a virtual kitten that has unique features written in the smart contract of the non-fungible token that represents each digital animal.

Examples of CryptoKitties for sale

One could easily buy, sell, and even breed those kitties, meaning that those were the extensible tokens. The first-ever CryptoKitty, which goes by the name Genesis, was sold at the time of issuance for 247 ETH. Interestingly enough, the game appeared almost a year before the introduction of the ERC-721 standard, though it has later been transferred to that standard. The popularity of CryptoKitties was so high that at one point, it had occupied 10% of the network traffic on the Ethereum blockchain and even caused it to clog up. In order to resolve this problem, Dapper Labs decided to move the game and all of its components from Ethereum to the FLOW blockchain, which has then turned into the center stage for nearly all NFT trading.

The popularity of this fascinating game had subsided with the commencement of the bear market in 2018, but it had definitely given a much-needed spark to the entire sector, which carried on through a couple of years until this market had really exploded. There were some interesting examples of NFT-based games like CryptoCelebrity, which saw the Donald Trump token being sold for 123 ETH, but this space had gone back to the creative and self-searching phase until the development studios like Dapper Labs, Rare Bits, and Lucid Sight caught the interest of venture capitalists and received the substantial financial injection.

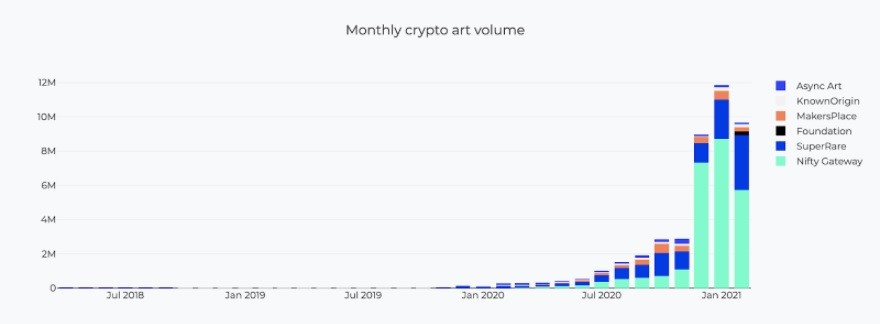

Monthly crypto art volume chart. Source: nonfungible.com

But it wasn’t until 2021, and the acquaintance of digital art and blockchain, when this market has really gone parabolic. As you can see on the chart above, the total trading volume of art-related non-fungible tokens shot to the Moon in 2021, right around the time when people, and especially celebrities, began to take notice of this digital phenomenon.

NFT market cap. Source: Statista

According to the data provided by Statista, the approximate market capitalization of all such tokens had skyrocketed from $141 million in 2019 to $338 million by the close of 2020, and these figures are likely to be much higher since the activities in different markets associated with non-fungible tokens have kicked into gear in the first quarter of 2021. Note that in 2017, the total market capitalization of NFTs was a mere $30 million, which showcases the real advancement that this sector has made in a relatively short period of time.

The most common use cases for non-fungible tokens

But before we get down to reviewing the amusing examples of how people are willing to pay small fortunes for something simple and familiar and the Nyan Cat meme, allow us to walk you through the most popular use cases for NFTs for the sake of a better understanding of this particular blockchain niche.

The first one concerns digital collectibles, the area that has really expanded since the NFT market has begun taking shape. CryptoKitties is one of the earliest and most prominent examples of such assets, accompanied by another set of Ethereum-based tokens called CryptoPunks, which comes in the form of an extensive collection of 10,000 unique characters, the very concept of which had that laid the foundation for the contemporary crypto art movement since it also appeared before the introduction of the ERC-721 standard.

A few of many CryptoPunks NFTs. Source: Dapp.com

As you can see, these are nothing more than pixelated images that are reminiscent of video games from the 90s. Interestingly enough, the developer of this digital collection, Larva Labs, had been given these NFTs away for free to anyone with the Ethereum wallet. That was, of course, before the commencement of the NFT mania, which helped put a considerable price tag on most of these digital images and bring the over trading volume to $30 million.

Those two series have undoubtedly played a key role in the establishment of the contemporary market for digital collectibles, which has recently been supplemented by sports trading cards. The UK-based blockchain project Socios was probably among the first to popularize sports-related digital collectibles on its proprietary Chiliz blockchain, though its range was limited to a few elite soccer clubs like Arsenal and Borussia Dortmund. But it was another Dapper Labs creation that has taken the NFT market by storm.

Most of you are probably familiar with the concept of sports trading cards: the physical versions of them usually include the player's image and stats. Even before the digital era, these cards could have been sold for a pretty penny, especially those licensed rare ones in mint condition. But as with almost everything in the real world, exchanging or purchasing those cards involves a lot of hassle, whereas their digitized versions that are embedded on the blockchain can be bought, sold, and exchanged in a matter of minutes.

NBA Top Shot LeBron James. Source: NBA.com

In a nutshell, NBA Top Shot is the marketplace where basketball fans can obtain the packages of officially licensed highlights from NBA games via buying or trading them online. The keyword here is "officially licensed" because the overwhelming majority of digital collectibles in circulation aren't endorsed by the major sports leagues and associations. But Dapper Labs managed to strike the official partnership deal with the National Basketball Association; therefore, all digital packages that are being offered to fans contain teams' logos, accurate stats, and high-definition video highlights picked and cut by the NBA employees before they get tokenized by Dapper Labs. And just like most other non-fungible tokens, the packages at NBA Top Shot have been selling like hotcakes. For instance, a rare package that showcases the highlight reels of LeBron James was sold for over $70,000. Some of the cards are being offered for more than $100,000. NBA Top Shot has been regularly making the news during the past few weeks thanks to the soaring daily trading volume, which exceeded $30 million at one point.

Professional players from other leagues, such as the National Football Association, have also been trying to jump on this hype wagon. Rob "Gronk" Gronkowski, the Super Bowl winner who plays for Tampa Bay Buccaneers, has recently released the personal Championship Series NFT collection that was sold for nearly $2 million. Patrick Mahomes, the quarterback for Kansas City Chiefs, has even launched a digital museum with NFT-ed versions of his helmet, boots, an autographed ball, etc.

The second largest use case for non-fungible tokens is certainly gaming and virtual worlds. The industry of esports has always been a perfect place for the adoption of cryptocurrencies and related products because one doesn't need to explain the concepts of virtual economy and currencies to an avid gamer. As we have mentioned earlier, the entrance of non-fungible tokens into the gaming space could be the game-changer because it offers means for tokenizing virtual items that were practically useless outside a specific game and couldn't be sold or traded at specialized marketplaces. The emergence of such marketplaces, along with minting platforms like Rarible, Cargo, and Digital Art Chain, provides an opportunity to realize the untapped potential of the market for virtual items from mainstream video games. But while the monetization of something like a rare knife from Assassin's Creed remains a distant prospect, the blockchain-based games and online universes (called metaverses) have been actively incorporating NFTs. The examples include:

- Axie Infinity (a game similar to CryptoKitties in a way that a play has to take care of his digital pet).

- Gods Unchained (a fantasy card game that gives players full ownership of the cards in the playing deck).

- My Crypto Heroes (a blockchain-based RPG where all rare and uncommon heroes are made into the ERC-721 tokens).

- Alien World (the players become a part of the NFT-based digital economy in intergalactic colonies).

The virtual worlds refer to the parcels of virtual land that can be traded and used for creating virtual assets that can then be sold, along with the land, to the highest bidder. The most shining examples of the virtual worlds blockchain projects include The Sandbox that has its native token SAND, and Decentraland that is fueled by the MANA token.

A part of the Sandbox metaverse. Source: Medium.

Above, you can see a part of the metaverse from The Sandbox game where one can buy a piece of land, mint their own NFTs that can be sold on the marketplace, and even create an own 3D game with the help of the visual scripting tool called the Sandbox Game Maker. The fact that all parcels of LAND, the pieces of metaverse, have been sold during several presale rounds in less than 5 hours speaks volumes about the popularity of this blockchain-based game. These are only a handful of games that utilize NFTs, and it's clear that it would be the most dynamically developing industry that employs non-fungible tokens and blockchain, even after the hype around these tokens die down.

Lastly, there is digital art, a niche that probably benefited the most from the NFT boom. One of the reasons why artists have populated the blockchain space so actively was, in fact, the coronavirus pandemic that caused practically all galleries and museums to close indefinitely, ultimately leaving the creators without means for showcasing their work. After finding out that tokenizing something isn't too complicated, the creative kind has swarmed into this space and proved that digital art could be as valuable and sought-after as the real-world one. Digital art auctions began selling NFT-ed pieces at an increased rate, with Picasso's Bull being the first work to have been sold for $55,000. The hype around digital art grew so large that the globally renowned auction house Christie's had even listed and sold the BTC-inspired NFT art collection dubbed "Portraits of Mind" by Ben Gentilli for $130,000.

The popularization of digital art on the blockchain has given rise to such platforms and marketplaces like Rarible and SuperRare. The former is a peculiar example of the platform that combines the NFT-minting properties with those of decentralized finance, such as yield farming as well as liquidity mining.

These are the most popular use cases for non-fungible tokens, though they are actively applied in such areas as fashion, licensing and certifications, and the acquisition of name services and crypto domains.

The biggest (and the craziest) NFT sales

The first NFT that was paid crazy money for is the 10-year-old pop-tart meme called Nyan Cat that depicts a pixelated cat that flies on a rainbow - you have probably come across this meme a lot, especially on platforms like Reddit. Chris Torres, the author of the original GIF image, had sold it in under 24 hours for the mind-blowing 300 ETH, while the biddings began from as low as 3 ETH.

Michael Winkelmann, who is better known as Beeple, is a digital artist and graphic designer who had made a name for himself in the crypto world after he began offering his works in the NFT format on the Nifty Gateway platform back in October 2020, when the hype had only begun to rise. His first big score was Crossroads, a piece of digital animation that depicted an image of a gigantic body that has "Loser" written all over it, lying on the lawn with people passing by it ignorantly. The artwork was dedicated to the recent presidential elections in the United States, and the NFT was programmed to change the shape of the body and head, depending on who was going to lose the race. Well, we all know the result, and that's why the loser has a distinctive blond hairdo. That piece of art was sold for $6.6 million, though its original price had barely exceeded $66 thousand. But Beeple's biggest payday occurred on March 11 when he sold a collage of images from his iconic Everydays: the First 5000 Days series for the whopping $69.3 million at the Christie's auction. The buyer was Vignesh Sundaresan, a founder of Metapurse, who splashed out 42,329 ETH for the artwork. Winkelmann himself admitted that he was quick to convert the crypto to fiat and cash in on the hype because, in his words, NFTs are definitely in the "bubble" stage.

- Jack Dorsey, the founder of Twitter and the well-known proponent of cryptocurrencies, had sold his first tweet, which said, "Just setting up my twttr," dated back to March 2006 for 1630 ETH ($2.9 million) to the user nicknamed @sinaEstavi. Being a multi-billionaire and not needing those couple of millions, Dorsey had promised that all proceeds from NFT sales would go to his charity.

- The Canadian singer, and Elon Musk's partner, Grimes had issued the NFT collection that features a number of unreleased tracks for the hefty sum of $6 million. Musk had also tried to play around with non-fungible tokens - he announced the release on the NFT-ed song about NFTs - but then changed his mind. There is no doubt that the song would have found a very generous buyer.

- Kevin Roose, a technology columnist for the New York Times, has written an article about non-fungible tokens - the article itself has the capability to turn into an NFT - for nearly $560 thousand and then gave away the money to The Times's Neediest Cases Fund.

The Forbes Magazine sold the NFT version of the front page that featured the Winklevoss brothers and titled "Merchants of the Metaverse" for $333 thousand. The Pokemon card that depicts a weird combination of Homer Simpson and Pepe the Frog, also a famous Internet meme, for $320 thousand, while the previous owner bought it in 2018 for just $38 thousand.

Those are the few significant examples of how the hype and the celebrity status that blow the price of a seemingly ordinary thing out of all proportions. So while the underlying technology is definitely here to stay, the buying craziness will subside very soon, and many of those who poured tons of money into such NFTs would be left holding the bags. But then again, the world of crypto is so unpredictable that the hype could keep on going for many months, giving an opportunity to flip the NFTs for a handsome profit.

Top cryptocurrencies associated with NFT’s

Axie Infinity (AXS)

AXS is the name of the coin that backs the Pokemon-inspired game called Axie Infinity, where players can participate in online battles and develop a virtual kingdom for cartoonish pets. The game is still in early access, but the player inflow looks very promising - it has the most active users among all games based on the Ethereum blockchain. Once the game goes fully live, the value of the underlying AXS token will surely rise along with the demand.

1-day AXS/USDT chart. Source: Tradingview

The 240-ranked AXS is currently priced at $7.69, with a market capitalization of $332 million. The chart shows that the price is now in the consolidation mode after a shallow correction. The price of the coin has the potential to rise above $15 in the coming month.

Decentraland (MANA)

The MANA coin represents one of the first virtual worlds that is in complete possession of players. On this platform, users can buy plots of virtual land that can be used to build virtual property, minting NFTs, create artworks, and even develop social games and decentralized applications.

1-day MANA/USDT chart

MANA is a fungible ERC-20 token that needs to be burned in order to acquire the NFT called LAND, which grants the ownership right to the said areas of the metaverse. The price of MANA now stands at $1.24, and it appears that it’s in the process of making the upswing, so expect it to land near $1.8 in the next few weeks.

The Sandbox (SAND)

We have already provided a sufficient description of SAND’s fundamentals, so let’s just say that this project has attracted the biggest interest from well-known game development studios like Atari that had bought vast expanses of virtual land in that metaverse for a good reason.

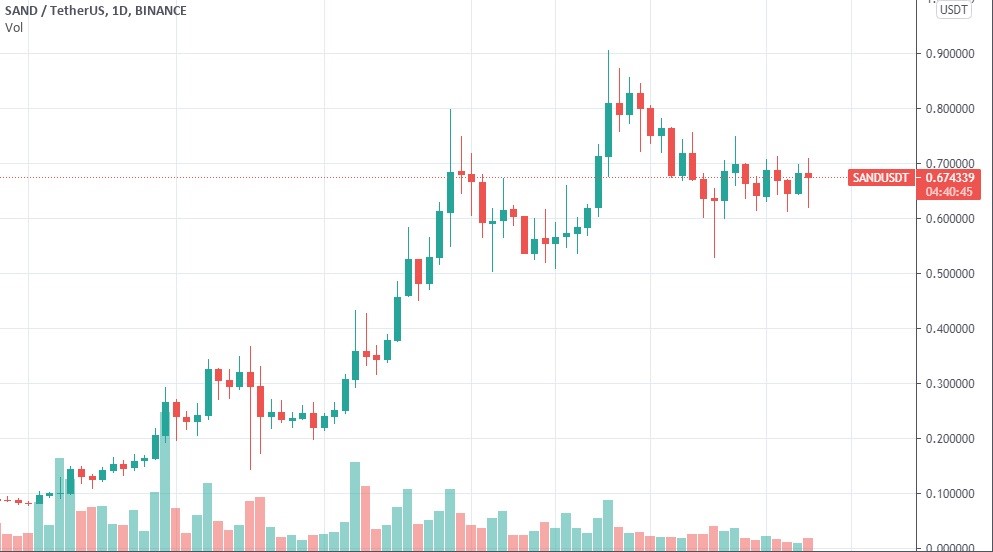

1-day SAND/USDT chart

The price of SAND has been sitting at $0.67 for a while, though the buyers have been successfully protecting the support level at $0.6, while the momentum has already turned bullish. Therefore, we expect SAND to establish a new higher high close to $1 in the next three to four weeks.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 87.2% | 23 | $64 837.84 | 1.21% | 2.14% | $1 276 667 564 847 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 72.4% | 51 | $3 174.86 | 1.45% | 3.51% | $387 485 564 544 | |||

| 3 | Tether predictions | 94% | 1 | $0.999855 | 0.06% | -0.07% | $110 447 532 693 | |||

| 4 | Binance Coin predictions | 85.2% | 20 | $616.92 | 1.30% | 12.17% | $91 050 425 745 | |||

| 5 | Solana predictions | 63.2% | 71 | $147.40 | -1.03% | 5.06% | $65 893 071 142 | |||

| 6 | USD Coin predictions | 90.8% | 2 | $1.000092 | 0% | 0% | $33 248 320 251 | |||

| 7 | XRP predictions | 68.8% | 62 | $0.530614 | -0.21% | 5.70% | $29 252 294 419 | |||

| 8 | Dogecoin predictions | 68% | 60 | $0.153019 | 0.23% | 1.26% | $22 039 903 315 | |||

| 9 | Toncoin predictions | 69.6% | 66 | $5.51 | -0.96% | -15.70% | $19 140 730 708 | |||

| 10 | Cardano predictions | 66% | 72 | $0.475569 | -0.48% | 4.39% | $16 946 387 500 | |||

| 11 | SHIBA INU predictions | 61.2% | 82 | $0.000026 | 1.40% | 15.15% | $15 461 237 537 | |||

| 12 | Avalanche predictions | 66.8% | 68 | $35.96 | -2.25% | 2.96% | $13 600 508 101 | |||

| 13 | TRON predictions | 86% | 21 | $0.117297 | 3.22% | 7.59% | $10 271 669 223 | |||

| 14 | Lido stETH predictions | 94.8% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 15 | Wrapped TRON predictions | 88% | 19 | $0.116953 | 2.88% | 7.58% | $10 241 543 166 |