Cryptocurrencies shake off the fears

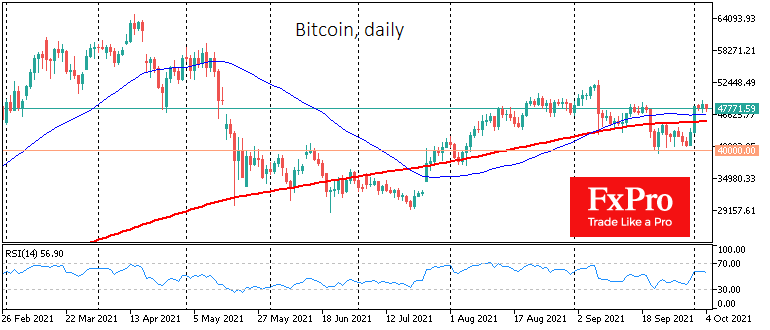

Bitcoin starts the week at $48K, maintaining a positive outlook after a spike over the weekend. The price momentum pushed the first cryptocurrency up to $49K over the weekend, with other coins following Bitcoin upward. After reaching local highs, a cautious sell-off began. However, judging by current high prices, optimism in the market prevails over pessimism. The total capitalization of cryptocurrencies has once again surpassed the $2 trillion thresholds, amounting to $2.1 trillion as of this writing. The first cryptocurrency capitalization is approaching $900 billion. The Crypto Fear & Greed Index for Bitcoin and major cryptocurrencies jumped from last week to 54, which corresponds to a “neutral” mode, fully reflecting what is happening in the crypto market. As recently as last week, the sector was in “fear” mode.

Bitcoin remains the locomotive of the crypto market, and now all crypto market participants will be watching the prospects of overcoming the circular level of $50K very closely. Even an unsuccessful attempt to overcome it will be very positively perceived by all market participants. If the coin manages to consolidate higher, we can count on the appearance of a new impulse of demand. In this situation, even a sideways price trend can be positive, as investors increasingly see that the absence of price fluctuations does not always mean that a sale is coming.

The neutral position of US regulators can make a significant contribution to the growth of crypto. Head of the Federal Reserve, Jerome Powell, said that there are no plans to ban cryptocurrencies, but some coins need regulation. In this case, we are likely talking about stable cryptocurrencies, which “parasitize” on the US dollar. Bitcoin’s volatility and relatively small capitalization size (compared to the traditional market) so far give it protection from regulatory pressure.

China, meanwhile, bans access to crypto information resources, including CoinMarketCap and CoinGecko. Beijing has consistently restricted its citizens’ access to cryptocurrencies. In this case, though, it is worth noting that the Chinese firewall will only keep the laziest away from this information. The VPN in the digital age is becoming one of the paramount applications on any device. In addition, not all crypto-exchanges and other resources are KYC compliant, so the Chinese may well continue to use cryptocurrencies. The Chinese government’s actions could make it more difficult, expensive, and dangerous for its citizens to use cryptocurrencies.

The authorities of Western countries probably understand the reality, so we will not see similar bans from the US and the EU. However, there is no doubt that the authorities of developed economies have several main tasks in the crypto sector: maximum tax collection and avoiding competition with the dollar or euro. Now the cryptocurrency market is entering its most active phase right up to Christmas and the New Year. If digital currencies continue to grow, we can see how much patience regulators have. Cryptocurrencies are not a priority for regulators right now, so investors will likely have time to make the most of the sector.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 74.4% | 54 | $68 162.88 | 1.29% | 2.42% | $1 344 973 357 845 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 76.8% | 47 | $3 274.54 | 0.99% | -6.14% | $393 691 858 423 | |||

| 3 | Tether predictions | 95.6% | 1 | $1.000152 | 0.03% | -0.03% | $114 346 541 734 | |||

| 4 | Solana predictions | 64.4% | 70 | $185.46 | 3.95% | 9.94% | $86 186 508 174 | |||

| 5 | Binance Coin predictions | 77.6% | 42 | $587.73 | 2.03% | -0.70% | $85 766 608 554 | |||

| 6 | USD Coin predictions | 90.8% | 1 | $1.000037 | 0% | 0.02% | $34 143 589 887 | |||

| 7 | XRP predictions | 62.4% | 86 | $0.600180 | 0.16% | 1.41% | $33 586 578 872 | |||

| 8 | Dogecoin predictions | 72% | 55 | $0.135374 | 4.80% | 6.83% | $19 667 998 553 | |||

| 9 | Toncoin predictions | 83.6% | 31 | $6.73 | 0.11% | -8.06% | $16 947 147 195 | |||

| 10 | Cardano predictions | 72.4% | 49 | $0.417243 | 1.33% | -4.43% | $14 980 752 444 | |||

| 11 | TRON predictions | 86.4% | 18 | $0.137318 | 0.34% | 2.05% | $11 955 029 826 | |||

| 12 | Avalanche predictions | 77.6% | 38 | $28.63 | 2.71% | 1.70% | $11 305 031 034 | |||

| 13 | Lido stETH predictions | 93.2% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | Wrapped TRON predictions | 90.8% | 1 | $0.116354 | -0.46% | 0.23% | $10 171 995 609 | |||

| 15 | SHIBA INU predictions | 84.4% | 30 | $0.000017 | 2.42% | -3.03% | $10 139 614 509 |