Bugatti Sports Car for 1 BTC: a Pipe Dream or Reality?

Among the many questions that concern the crypto community, two main ones can probably be distinguished: 1) Who is Satoshi Nakamoto? and 2) How much will bitcoin be worth? The first of them will be answered by White Paper Films, which announced the start of work on a documentary film dedicated to the personality and mysterious disappearance of the creator of the first cryptocurrency. (By the way, you can find a lot of interesting information on this subject on the NordFX broker website). As for the second question, as usual, we will look for answers to it in this weekly review.

- First, there is good news for those who are waiting for the major cryptocurrency to surge upwards. A new study by Glassnode has shown that despite the fall in the crypto market, the use of the bitcoin network continues to grow: the number of unique addresses has now peaked at over 1 billion. (For comparison: the main competitor of BTC, ethereum with 158 million addresses is far behind on this indicator).

- Good news No.2. According to Arcane Research, miners sold 6,500 BTC in July. This is 60% less than in June, when 14,600 coins were sold. The fall of the crypto market has created a lot of serious problems for public mining companies that have increased their production capacity with borrowed funds. Faced with the crisis, they are forced to dump the mined coins at low prices in order to pay off their debt obligations. Some, in the end, had enough margin of safety and managed to survive, while others turned out to be bankrupt. The July data gives a timid hope that the industry is recovering, the pressure of miners is weakening. They hold onto their coins in the hope that they will rise. However, Arcane Research notes that 6,500 bitcoins is still more than in May, when miners shocked the market by selling more coins than they mined.

- Good news No.3. A number of technical indicators signal the increasing likelihood of bitcoin reversing towards sustainable growth. Thus, the Spent Output Profit Ratio (SOPR) indicator recorded a minimum on June 18, 2022. This indicator had lower values only in December 2018 and March 2020. Another indicator, RHODL indicates a significant predominance of long-term investors on the market over short-term ones. This means that the holders do not plan to sell their coins and are guided by the growth of the market in the future.

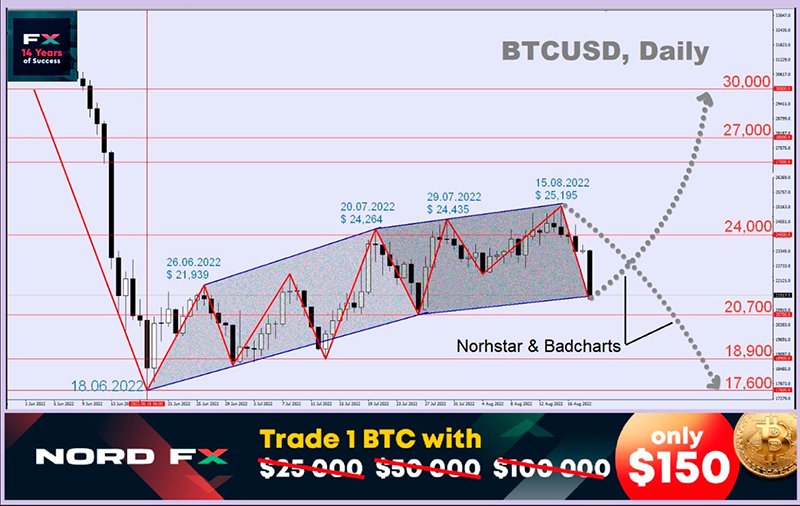

This is the end of the good news this week. Recall that the price of bitcoin fell to $17,597 on June 18, in line with December 2020 levels and almost 75% below its all-time high of $68,918. If we measure from the beginning of 2022, the main cryptocurrency started at $47,572 on January 01, and its fall was 63% by June 18. However, as the chart shows, bearish resistance sharply increased above $24,000 and the upward momentum began to fade rapidly. So, the weekly high was at a height of $24,264 on July 20, $24,435 on July 29, $24,891 on August 11, and, finally, $25,195 on August 15. That is, the uptrend seems to have continued, but the increase in highs was less than 4% over the past 4 weeks. And the past week has generally brought investors a complete disappointment.

As of this writing, Friday evening, August 19, the total crypto market capitalization is $1.028 trillion ($1.155 trillion a week ago). The Crypto Fear & Greed Index fell 9 points in seven days from 42 to 33 and came close to the Extreme Fear zone. BTC/USD has gone down sharply again and is trading at $21.095. There are several reasons for this fall. First, the intention of the Fed to continue raising rates, which became clear from the minutes of its last meeting. Secondly, there is strong downward pressure from the fever in the stablecoin market. First, aUSD was compromised, and HUSD, the token of the Huobi crypto exchange, lost its peg to the dollar last week. If we add to this the bankruptcy of a number of cryptocurrency funds, the pessimism that reigns in the market becomes clear.

Well-known analyst and DataDash founder Nicholas Merten noted that bitcoin and ethereum are showing signs of weakness despite their rising prices in recent weeks. According to Merten, the fact that the recovery of the stock market is ahead of the recovery of crypto assets suggests that the latter may not have much strength left to continue the rally. If cryptocurrencies sell out faster than stocks during a downtrend, then they should have recovered faster. But there is no such recovery at the moment.

Another crypto strategist, nicknamed Capo, believes that “there is a chance to see another attempt by the main cryptocurrency to storm the $25,400-$25,500 range.” However, according to his colleagues at Norhstar & Badcharts, there is a possibility that bitcoin could start to drop sharply to $10,000-$12,000. They explained their assumption in an interview with Kitco News as follows: “According to the chart, the price of bitcoin is in an inverted arc, opposite to the Cup pattern… There are a number of technical analysis methods that increase to 70-80% the probability that the price of bitcoin will make new lows of $10,000 -$12,000 and there's about a 20% to 30% chance it will go up." In the event that the bitcoin rate goes up, according to Norhstar & Badcharts, it could reach $29,000-$30,000. According to them, this is the maximum level that the value of BTC can rise to before it starts to fall. “We are either already at local peaks or very close to them,” Norhstar & Badcharts says.

As usual, influencers who have invested heavily in bitcoin are trying to knock down the wave of pessimism. They continue to convince everyone and everywhere of the fantastic prospects of the flagship cryptocurrency. For example, Anthony Scaramucci, former director of communications at the White House and now head of the investment company SkyBridge Capital, recalled in an interview with CNBC the limited issue of bitcoin of 21 million coins, which will lead to “shock demand with little supply.” Scaramucci believes that the first cryptocurrency can show unprecedented growth within six years. “If we're right, if bitcoin goes to $300,000 it won't matter if you bought it at $20,000 or $60,000. The future is ours. And it will happen sooner than I thought,” he says.

The former director of the White House is echoed by the former head of MicroStrategy Michael Saylor. Recall that this company acquired 129,698 BTC under his management. Despite the current unrealized huge losses on these trades, Michael Saylor is confident that the purchase of bitcoin as a reserve asset was justified, and the asset will prove to be reliable in the future. “We […] got into the lifeboat of the first cryptocurrency with the understanding that we would be tossed in the ocean, but we would not drown and would appreciate this step over time,” said Saylor. According to him, the volatility of cryptocurrencies will only affect short-term investors and public companies, so bitcoin is not for everyone. “The investment should be for a period of at least four years. Ideally, this is the transfer of wealth from generation to generation. The metric that confirms this is the four-year moving average,” he explains.

And at the end of the review, here is the statement of another bitcoin maximalist. “I still hope to buy a Bugatti for 1 BTC,” said Jesse Powell, CEO of the Kraken crypto exchange. Given that the cost of one Bugatti sports car can exceed $5 million, it takes very little to fulfill this dream: “just” to wait for bitcoin to rise in price by 250 times.

NordFX Analytical Group

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 84% | 26 | $64 058.80 | -1.06% | -0.50% | $1 261 356 169 861 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 76.8% | 45 | $3 150.15 | -0.70% | 1.66% | $384 474 185 184 | |||

| 3 | Tether predictions | 95.2% | 1 | $0.999665 | -0.05% | -0.09% | $110 388 739 706 | |||

| 4 | Binance Coin predictions | 87.6% | 20 | $602.35 | -1.82% | 7.50% | $88 900 328 804 | |||

| 5 | Solana predictions | 65.2% | 71 | $142.74 | -3.06% | -1.11% | $63 826 251 302 | |||

| 6 | USD Coin predictions | 96% | 2 | $0.999979 | -0.01% | -0.02% | $33 388 524 718 | |||

| 7 | XRP predictions | 68.8% | 68 | $0.528456 | -0.16% | 4.08% | $29 133 309 574 | |||

| 8 | Dogecoin predictions | 66.8% | 67 | $0.149390 | -2.47% | -3.38% | $21 519 306 721 | |||

| 9 | Toncoin predictions | 68% | 65 | $5.41 | -1.75% | -12.02% | $18 771 773 200 | |||

| 10 | Cardano predictions | 63.2% | 77 | $0.467534 | -1.99% | -1.06% | $16 660 038 368 | |||

| 11 | SHIBA INU predictions | 62.8% | 82 | $0.000026 | -2.37% | 11.44% | $15 056 263 325 | |||

| 12 | Avalanche predictions | 65.2% | 75 | $34.97 | -3.20% | -0.73% | $13 226 302 572 | |||

| 13 | TRON predictions | 83.6% | 21 | $0.120392 | 2.68% | 8.90% | $10 541 923 533 | |||

| 14 | Wrapped TRON predictions | 86.8% | 18 | $0.120290 | 2.70% | 8.93% | $10 532 992 976 | |||

| 15 | Lido stETH predictions | 96% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |