Bitcoin's fall under $48K will open the way to $41K or $30K

The crypto market has lost 4.2% of its capitalisation in the past 24 hours and now stands at $2.27 trillion. From the peak levels reached a month ago, capitalisation has dropped by 23%, allowing us to speak of the start of a bear market for the sector, at least like the one we saw in April-July. The cryptocurrency fear and greed index dropped from 29 to 24, slipping into the extreme fear territory.

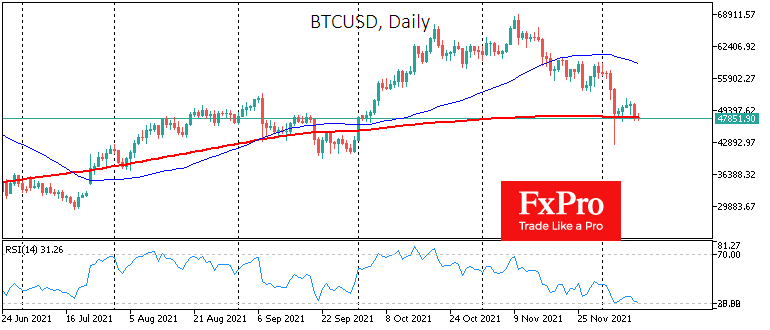

Alarmingly, the overall capitalisation this time was pulled down by altcoins. The first cryptocurrency lost around 3% over the day, returning to $48.3, where the 200-day moving average runs and touched the oversold area again.

A significant short-term indicator for the market promises to be the 200-day average for Bitcoin. An ability to bounce back above that line would indicate bullish sentiment prevails and promises new attempts to climb above $50K or $60K this month. A sharp fall would formally clear the way for a deeper correction to $41K or even $30K.

BTC/USD Daily Chart

ETHUSD has been losing 6% over the last 24 hours and is dangerously close to the psychologically significant $4000 level. The latest momentum of the decline pushed the first altcoin away from the 50-day moving average, and a deeper correction may follow. Ether fell out of the bullish uptrend from the end of September and went into a prolonged consolidation. The declines yesterday and this morning brought the coin back to the lower end of the consolidation range, and a dip under $4000 would open a straight road down with a potential target at $3300 or further to $2700.

Bitcoin’s share of the crypto market has started to rise again, reaching 40.3%. We see this growth in a falling market as an additional sign of fear of the crypto market.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 84.4% | 17 | $66 973.37 | 2.06% | 10.30% | $1 319 362 648 741 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 83.6% | 20 | $3 116.39 | 5.62% | 7.05% | $374 347 422 952 | |||

| 3 | Tether predictions | 96% | 1 | $1.000378 | 0.02% | 0.05% | $111 377 355 823 | |||

| 4 | Binance Coin predictions | 86.8% | 13 | $581.89 | 1.75% | -0.28% | $85 878 733 803 | |||

| 5 | Solana predictions | 78.8% | 37 | $173.35 | 6.73% | 20.32% | $77 801 682 538 | |||

| 6 | USD Coin predictions | 93.6% | 1 | $1.000100 | 0.01% | 0% | $33 434 358 660 | |||

| 7 | XRP predictions | 87.2% | 11 | $0.524400 | 1.52% | 4.19% | $28 993 528 492 | |||

| 8 | Toncoin predictions | 64.8% | 67 | $6.50 | -3.31% | -4.51% | $22 586 355 403 | |||

| 9 | Dogecoin predictions | 83.6% | 32 | $0.156364 | 3.77% | 8.62% | $22 568 858 150 | |||

| 10 | Cardano predictions | 82% | 23 | $0.484536 | 5.30% | 8.49% | $17 285 751 149 | |||

| 11 | SHIBA INU predictions | 79.2% | 42 | $0.000025 | 2.06% | 10.94% | $14 729 792 073 | |||

| 12 | Avalanche predictions | 80.8% | 35 | $37.63 | 8.17% | 12.09% | $14 391 830 995 | |||

| 13 | TRON predictions | 83.2% | 34 | $0.124487 | -0.02% | -1.82% | $10 886 096 402 | |||

| 14 | Wrapped TRON predictions | 77.6% | 34 | $0.124371 | -0.33% | -2.17% | $10 875 987 156 | |||

| 15 | Wrapped Bitcoin predictions | 84.8% | 17 | $66 968.59 | 1.96% | 10.20% | $10 413 386 260 |