Bitcoin will fall until the bulls capitulate

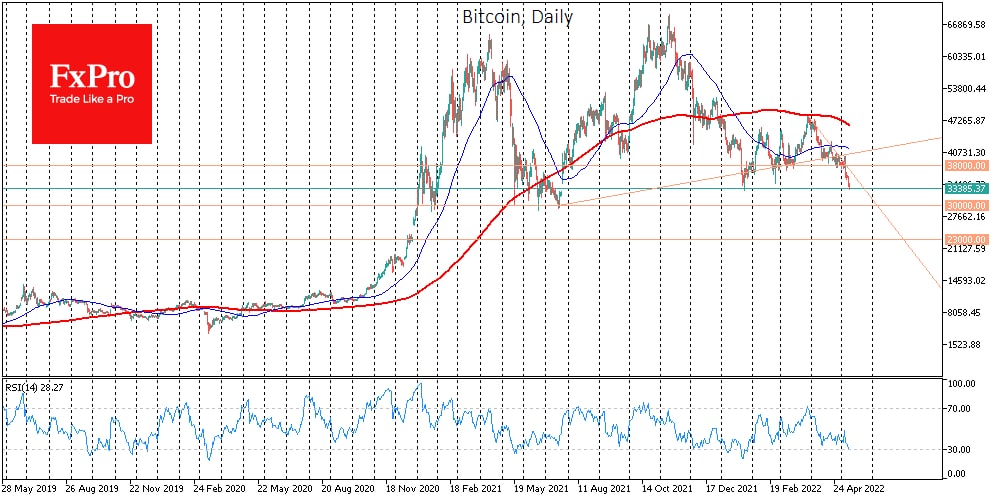

Bitcoin is trading near $33.5K on Monday morning, declining for the fifth consecutive day. Over the past 24 hours, losses are 2.3%, and are approaching 14% over the past seven days. Ether loses 3.5% in 24 hours and 14.3% for the week, settling near $2450. Altcoins from the top ten are down between 0.8% (XRP) and 4.3% (Cardano).

Total crypto market capitalisation, according to CoinMarketCap, is down 2.3% overnight to $1.54 trillion. More worryingly, volumes are rising along with falling prices. This situation points to an increasingly rapid exit from cryptocurrencies, even though the process takes place without sharp dips. We see an orderly exit – a sure sign that downward sentiment may prevail.

The optimists, however, have something to hang on to. The Cryptocurrency Fear and Greed Index has collapsed to 11. Over the past year, the index has been at the current or lower level six times, and on each occasion, we have seen either consolidation or the start of a rally and a rebound.

In March 2020, when the index similarly reached single digits, we saw an influx of long-term buyers. The current extreme fear may attract buyers who have been waiting for extreme oversold conditions to buy cryptocurrencies long term.

However, we note that the amplitude of crypto market fluctuations does not resemble either a capitulation of enthusiasts or a wave of stop orders triggering. Typically, a trend reversal is preceded by a sharp increase in momentum with the eventual resignation of those who stood against the trend.

In our case with Bitcoin, this could translate into a sharp acceleration of the sell-off after falling below $30K, all the way to the $23K or even the $20K area. It is only from this level that major long-term buyers can be expected to emerge.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 84.4% | 25 | $64 305.78 | 0.51% | -0.51% | $1 266 205 194 648 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 76.4% | 46 | $3 136.36 | -0.08% | 1.65% | $382 791 564 210 | |||

| 3 | Tether predictions | 92.4% | 1 | $1.000262 | 0.05% | -0.02% | $110 492 500 823 | |||

| 4 | Binance Coin predictions | 84.4% | 20 | $608.91 | 0.18% | 9.71% | $89 850 983 761 | |||

| 5 | Solana predictions | 65.2% | 71 | $143.70 | -1.79% | 0.16% | $64 256 267 194 | |||

| 6 | USD Coin predictions | 92.4% | 2 | $1.000169 | 0.01% | 0.01% | $33 384 489 252 | |||

| 7 | XRP predictions | 66% | 68 | $0.526307 | 0.48% | 6.17% | $29 014 837 163 | |||

| 8 | Dogecoin predictions | 66.4% | 65 | $0.150308 | 0.03% | -1.22% | $21 650 492 983 | |||

| 9 | Toncoin predictions | 66.4% | 65 | $5.37 | -1.88% | -22.37% | $18 631 438 062 | |||

| 10 | Cardano predictions | 65.2% | 77 | $0.470062 | -0.71% | 3.14% | $16 750 133 824 | |||

| 11 | SHIBA INU predictions | 60.4% | 82 | $0.000025 | 2.07% | 12.54% | $14 981 054 544 | |||

| 12 | Avalanche predictions | 66% | 75 | $35.39 | -0.09% | 0.44% | $13 382 737 153 | |||

| 13 | Lido stETH predictions | 93.6% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | TRON predictions | 86.8% | 21 | $0.116933 | 2.56% | 7.95% | $10 239 603 506 | |||

| 15 | Wrapped TRON predictions | 84% | 18 | $0.116766 | 2.51% | 7.71% | $10 225 018 140 |