Bitcoin is unlikely to bottom so early and high

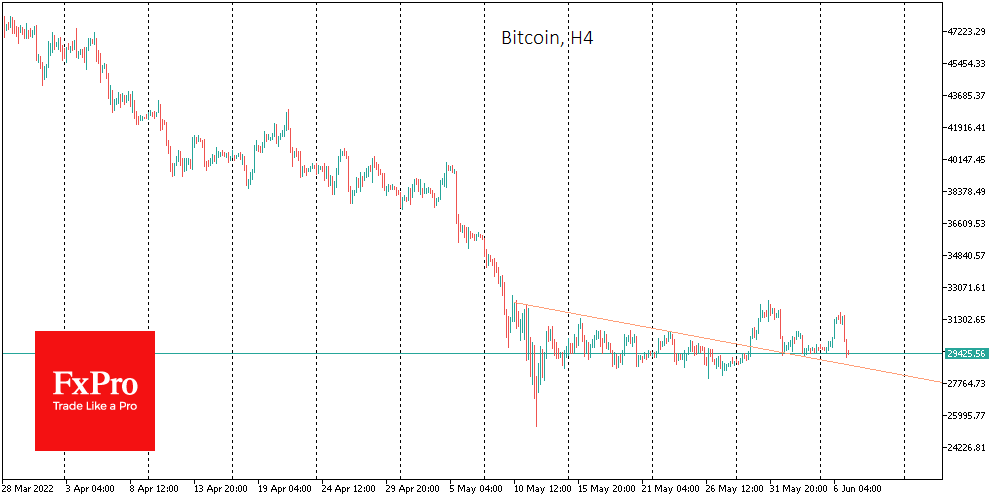

Bitcoin rose 4.9% on Monday, ending at around $31.5K. However, on Tuesday morning, the first cryptocurrency collapsed 7% to $29.5K, the second such bear attack in the past seven days. Both were of similar magnitude, but the latter should have a more considerable negative effect. It more than offset Monday's gains and temporarily brought the price back to levels from May 30. The BTCUSD consolidation has been going on for more than a month.

Earlier it was formed as a triangle with decreasing amplitude of fluctuations, but since the end of last month, it became more like a sideways pattern, from which it makes several failed attempts to break upwards.

The market dynamics this Tuesday morning are a reminder that the market cannot now rally again as it did in 2020. Bitcoin's prolonged sideways slide is turning current prices into the norm, although current levels seemed like a good buy for the long term two months ago. 2018 and 2019 teach us that such consolidations can last for months and often lead to new selloffs from frustrated fast earners. In our view, the bitcoin bear market is not over yet, although it has made a significant part of its way down.

The market is full of rumours that short-term buyers have already capitulated, backed up by Kathy Wood. But the whole bear market rarely ends at this phase. Far more often, a bull market begins when medium-term investors and even some long-term investors capitulate, bringing stressed market professionals into play. It is unlikely to reach this point before the price returns to the highs of 2017. Bitcoin's short-term volatility is irrelevant, MicroStrategy CEO Michael Saylor said. He said BTC is the surest thing in a very volatile world and is more suited to long-term investment rather than trading.

According to a survey by The Economist, 37% of respondents in the world's leading economies are interested in having their governments adopt cryptocurrencies as legal tender.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 75.2% | 54 | $67 706.14 | 1.90% | 2.01% | $1 335 948 390 898 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 74% | 47 | $3 251.05 | 2.03% | -6.72% | $390 867 892 707 | |||

| 3 | Tether predictions | 95.6% | 1 | $1.000129 | 0.02% | -0.04% | $114 343 982 006 | |||

| 4 | Solana predictions | 68% | 71 | $181.98 | 4.78% | 7.02% | $84 550 065 137 | |||

| 5 | Binance Coin predictions | 78% | 41 | $579.05 | 1.11% | -1.52% | $84 500 124 655 | |||

| 6 | USD Coin predictions | 92% | 1 | $1.000181 | 0.02% | 0.02% | $34 131 195 324 | |||

| 7 | XRP predictions | 60% | 86 | $0.603888 | 0.68% | 5.26% | $33 794 079 216 | |||

| 8 | Dogecoin predictions | 71.6% | 55 | $0.134321 | 7.26% | 7.04% | $19 514 149 036 | |||

| 9 | Toncoin predictions | 82% | 30 | $6.68 | 0.78% | -8.51% | $16 800 802 508 | |||

| 10 | Cardano predictions | 76.8% | 49 | $0.414814 | 3.90% | -4.75% | $14 893 010 858 | |||

| 11 | TRON predictions | 88% | 18 | $0.137564 | 1.55% | 2.08% | $11 976 532 574 | |||

| 12 | Avalanche predictions | 75.2% | 40 | $28.71 | 5.33% | 1.85% | $11 334 689 323 | |||

| 13 | Lido stETH predictions | 92.8% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | Wrapped TRON predictions | 93.2% | 1 | $0.116354 | -0.46% | 0.23% | $10 171 995 609 | |||

| 15 | Wrapped Bitcoin predictions | 92.8% | 1 | $65 806.83 | 0.78% | -2.68% | $10 083 957 608 |