Technical Analysis in Cryptocurrency Trading

How to effectively apply technical analysis to cryptocurrency trading

In 2019, cryptocurrencies can be called the most popular financial instrument. High volatility of tokens creates a good potential for obtaining super-profits. The decentralized nature and lack of regulation of the digital financial industry allows market makers to effectively apply the well-known strategy of Wall Street - "Pump & Dump".

In other words, a significant turnover of capital allows large bidders to manipulate quotes in order to make profit. Such activity is illegal when it comes to the stock and commodity markets, but market makers constantly apply such strategies on decentralized platforms. This is possible due to ineffective regulation or its absence.

Among other things, high volatility creates the potential for high profits in the cryptocurrency market. The cost of cryptocurrencies can vary during the day up to 50%, so everyone can significantly increase capital. For stable earnings on altcoin pricing, it is not enough to register on a specialized exchange and deposit funds. Successful token trading, like any other derivative asset, requires an effective strategy.

This article discusses the proven system of making money on the pricing of altcoins and provides practical recommendations based on personal experience. Even novice traders can start putting them into practice immediately!

How to succeed in trading altcoins?

Trading cryptocurrencies is significantly different from managing capital in the OTC market. When working with charts of currency pairs, traders use tools of technical and computer analysis — methods which are hardly helpful when trading altcoins. Cryptocurrency pricing is extremely difficult to analyze with standard analytical methods; however, there are still ways to earn consistent profit by trading coins.

Before we study them in great detail, you should understand some major characteristic features of the dynamics of altcoin pricing:

Cryptocurrency charts are characterized by pulses of a wide range, that is, the price can instantly change by dozens of points.

Price corrections are not typical for altcoins. There are quite effective trading systems based on corrective movements. If the chart of a currency pair or stock asset travels a considerable distance in one direction, then the probability of a short-term movement against the main trend is close to 90%. This is confirmed by statistical data.

The screenshot shows a segment of the chart of the GBP / USD pair with a period of H1, on which 2 price impulses of a significant range are formed. Please note that each price spike is followed by a correction, the maximum value of which can reach 50% of the impulse. There is one important condition for the formation of the correction — the jump range should not be less than the average daily volatility of the asset (for the pair GBP / USD this value is 120 points).

As for cryptocurrencies, the formation of a correction is not peculiar. Pay attention to the segment of the chart of the BTC / USD pair, on which 2 price impulses are formed:

The likelihood of a correction after a jump in prices on cryptocurrency charts is approximately 50/50. Consequently, an effective strategy for making money on kickbacks, which can be successfully applied when trading Forex, is useless when working with altcoins.

- When trading cryptocurrencies, it is unacceptable to use oscillators due to the high percentage of false signals. To analyze such assets, it is much more efficient to use standard, trend indicators (Bollinger envelope, moving averages and others).

- When analyzing token charts, it is useless to use the Price Action candlestick analysis system.

- Watch out for wide spreads, the range of which can reach 100 points, especially in conditions of increased liquidity.

- Change of trading sessions does not have any effect on the dynamics of altcoin pricing.

The decentralized nature of the cryptocurrency market and the lack of regulation create all the conditions for large bidders to apply the Pump & Dump strategy. As practice shows, this mainly affects new and little-known tokens.

A Proven Successful Altcoin Trading Method

The most important cryptocurrency pricing feature that everyone can effectively use in trading is the frequent formation of price impulses. In order to capitalize on this, it is important to timely issue trading orders in the direction of the leap. To do this, it is recommended to use pending orders Buy Stop and Sell Stop.

To place orders, wait until the formation of at least 5 candles formed in the same price range. Similar “patterns” are displayed on the BTC / USD chart almost daily.

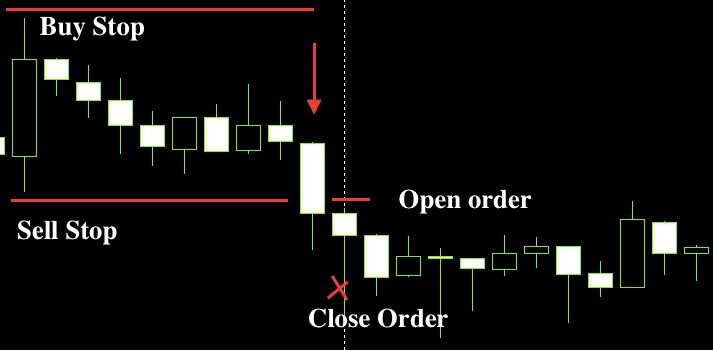

In the screenshot, 2 signals for placing pending orders are marked.

Price impulse and 100% correction. In this case, it is required to mark the opening / closing points of the pulse candle in the terminal, and in the case of 100% correction, place pending orders 1600 points below / above the boundaries of the formed price corridor. In the situation presented in the screenshot, the trading plan will look something like this:

At the borders of the formed channel, it will be necessary to establish pending Sell Stop and Buy Stop orders and wait for the opening of one of them, after which the second will need to be deleted. Placing safety orders is also obligatory.

Stop Loss for each order will correspond to the opening point of the opposite. Take Profit should be fixed and make up 5% of the asset value at the time of opening the transaction (only for the pair BTC / USD). For example, if at the moment of opening an order the BTC price is 10 000 USD, then the Take Profit value for Buy orders will be 10 500, and when opening a Sell transaction - 9 500 USD. In the transaction considered in the screenshot, a Sell Stop order was activated, which was subsequently closed automatically with profit taking.

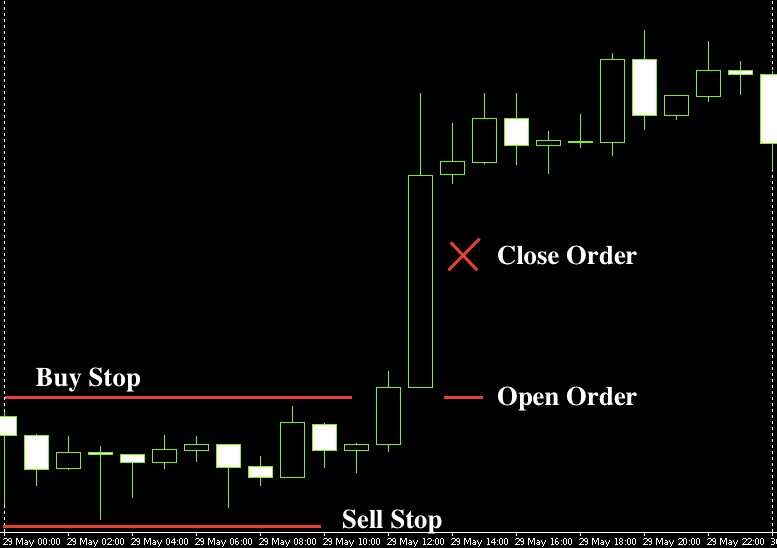

Flat. When forming a local lateral trend, the trading principle is similar:

To identify a trading signal, it is important to pay attention to the number of candles, which should be at least 5. All price elements must be formed within the same range. In the presented example, it is clear that a Buy Stop order was opened, after which the transaction was closed by Take Profit.

The presented strategy is tested on personal experience. With its help, even a novice trader will be able to earn up to 40% of the deposit every month, while observing the rules of money management (the risk for each transaction is no more than 10% of the capital).

Attention! The application of the considered method in practice is possible only when trading cryptocurrencies on specialized exchanges. When working with CFD contracts for altcoin pricing through Forex brokers, the use of this strategy is unsafe. The fact is that in the user agreements of some companies there is a special clause, the conditions of which may deprive the trader of profit:

“The company reserves the right to annul a customer’s financial result if the value of a derivative financial instrument has changed by more than 10% within 1 hour.”

As mentioned earlier, the cryptocurrency pricing is not regulated, which ensures high volatility of these assets. There were cases when the cost of tokens changed by 80% during the day. The trading condition mentioned earlier, some brokers are trying to protect themselves from possible losses.

It is important to remember that conflict of interest is an integral part of working with CFDs. Therefore, to minimize non-trading risks, it is recommended to trade in altcoins through specialized exchanges.

An alternative cryptocurrency trading method

To increase the profit potential, you can use a more complex strategy based on the Fibonacci grid. It is important to wait for the formation of 4-7 price elements in a narrow price range and determine the local trend. Trading will be carried out by pending orders and only in the direction of the trend.

The screenshot shows a group of price elements, based on which it is possible to draw up a trading plan. Please note that the local trend in this example is upward, therefore, you only need to place a Buy Stop order. Fibonacci levels are required to accurately determine the values of safety orders.

Important! If the local trend is upward, then the Fibonacci grid will need to be stretched from top to bottom, and with a downward trend, from bottom to top.

The grid should be stretched so that the local minimum corresponds to the level of 23.6, and the maximum - to 61.8. Stop Loss order will need to be set slightly below the level of 23.6, and Take Profit should correspond to the value of 100.0. The opening point of the order corresponds to the level of 61.8. It is worth saying that such trading signals on the charts of the BTC / USD pair are generated almost daily, and the accuracy of orders reaches 90%.

Let’s review one more example:

A circle marks a segment of the graph, the minimum / maximum of which were taken as the basis for plotting Fibonacci levels. Please note that this time the local trend is downward, so stretch the grid from the bottom up.

Trading rules are similar to those previously considered. Since the local trend is downward, it will only be necessary to place a Sell Stop order at the level of 61.8. As you can see, the deal closed with profit taking. Closing an order at a loss is also possible under the influence of market noise, but this happens quite rarely.

Conclusion

The methods for trading altcoins considered in the article are effective and tested on personal experience, however, novice traders are strongly recommended to familiarize themselves with the strategies presented on a demo account in order to obtain the experience necessary for successful trading. It is also recommended to analyze the history of quotes for a period of at least 6 months. This will allow you to confirm the effectiveness of the considered methods and evaluate the profit potential.

Important! The use of Martingale and averaging methods in combination with the strategies presented is not recommended.

The mentioned strategies are recommended to be used only on the BTC / USD pair, as this is the leading cryptocurrency with high capitalization. It is not possible for large bidders to use the Pump & Dump strategy on such assets.

Author: Kate Solano for Сrypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 83.2% | 27 | $62 972.40 | -2.03% | -1.61% | $1 239 978 587 556 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 74.8% | 43 | $3 118.44 | -0.57% | 1.84% | $380 609 699 237 | |||

| 3 | Tether predictions | 90.8% | 1 | $0.999422 | -0.08% | -0.10% | $110 497 963 154 | |||

| 4 | Binance Coin predictions | 83.6% | 21 | $593.68 | -2.48% | 5.90% | $87 620 793 697 | |||

| 5 | Solana predictions | 65.6% | 70 | $136.21 | -5.15% | -5.19% | $60 907 793 026 | |||

| 6 | USD Coin predictions | 95.2% | 2 | $0.999917 | -0.02% | -0.02% | $33 467 180 350 | |||

| 7 | XRP predictions | 68.8% | 70 | $0.514684 | -2.11% | 0.03% | $28 429 038 149 | |||

| 8 | Dogecoin predictions | 68.8% | 68 | $0.145068 | -3.45% | -6.17% | $20 897 662 930 | |||

| 9 | Toncoin predictions | 65.2% | 65 | $5.24 | -2.24% | -15.45% | $18 200 614 305 | |||

| 10 | Cardano predictions | 61.6% | 80 | $0.454959 | -3.17% | -8.37% | $16 212 412 070 | |||

| 11 | SHIBA INU predictions | 62% | 82 | $0.000025 | -3.14% | 6.46% | $14 513 545 562 | |||

| 12 | Avalanche predictions | 61.6% | 78 | $34.08 | -3.65% | -5.06% | $12 890 821 570 | |||

| 13 | TRON predictions | 83.2% | 21 | $0.120533 | 3.08% | 10.20% | $10 554 243 957 | |||

| 14 | Wrapped TRON predictions | 87.2% | 18 | $0.120395 | 3.10% | 9.83% | $10 542 158 285 | |||

| 15 | Lido stETH predictions | 96% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |