Bitcoin Reaches New Annual Peak as Federal Reserve Halts Interest Rate Increases

Kate Solano

Accomplished fintech journalist and analyst.

The cryptocurrency market received a buoyant lift as Bitcoin (BTC) vaulted past its prior annual zenith of $35,500, surging to a fresh high of $36,000. This surge came on the heels of the Federal Reserve's decision to hold interest rates steady, marking a departure from its aggressive rate-hiking policy that had been in place for 16 months. Investors, interpreting the pause as a sign of easing monetary policy, responded with enthusiasm, propelling Bitcoin to heights it hadn't explored since the previous year.

The wave of optimism in the crypto sector didn't crest with Bitcoin's price alone. The financial markets observed a remarkable event when the Depository Trust & Clearing Corporation (DTCC) expanded its list to include a new spot Bitcoin Exchange-Traded Fund (ETF), courtesy of Invesco & Galaxy. This move came after BlackRock and Ark Invest had already made similar introductions, sparking speculation and hope that the approval of multiple spot BTC ETFs could be imminent.

In a further vote of confidence for the sector, MicroStrategy Incorporated, a major corporate proponent of Bitcoin, disclosed the acquisition of an additional 155 BTC for $5.3 million in October. This increased their already substantial holdings to an impressive 158,400 BTC, underscoring the firm's bullish stance on the digital asset. Investment inflows into crypto funds experienced a strong recovery, reminiscent of the vigor seen in July 2022. Digital asset investment products welcomed inflows totaling $326 million, with a dominant 90% directed toward Bitcoin amid growing expectations of a spot ETF. In the altcoin realm, Solana (SOL) outshone its peers with a significant inflow of $24 million.

The escalating excitement around cryptocurrencies and the relentless surge in prices for numerous altcoins ignited a fear of missing out (FOMO) among retail investors, causing a noticeable uptick in funding rates midweek. However, the space soon witnessed a tempering of this ascent as many cryptocurrencies touched new annual highs but failed to sustain their rapid price growth. Interestingly, the levels of liquidations did not spike dramatically, indicating that despite the price rallies, market leverage remained modest. The mid-week retracement was thus perceived as a healthy market correction from a short-term overextended state, rather than a symptom of deep market stress.

The trading week also brought to light the sale of a basket of cryptocurrencies by FTX, valued at roughly $200 million. While the amount was relatively small in the context of the broader market, the news possibly swayed some traders to initiate sales or short positions, contributing to the market's pullback. Yet, the consensus was that FTX's actions would likely have only a transient impact, given the underlying strengths supporting the market's advance.

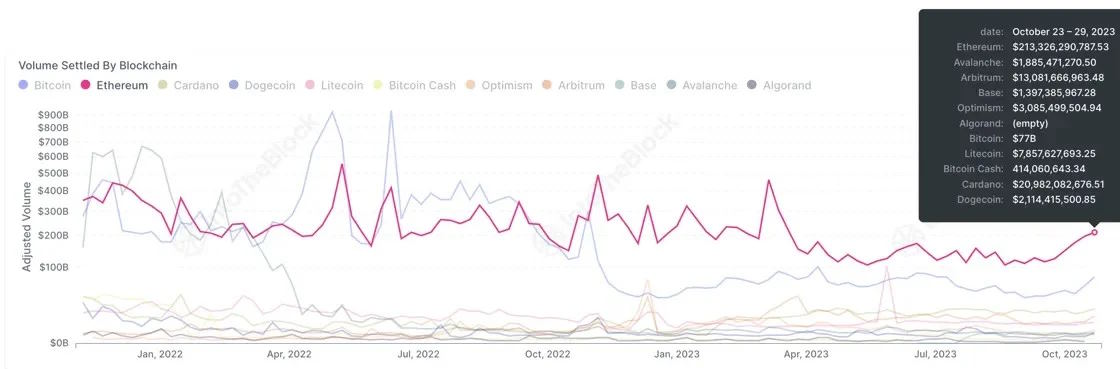

An analysis of Bitcoin's open interest relative to its market cap (OI/MC) revealed that the latest rally was principally driven by spot transactions rather than leveraged bets. This implies that the current upswing has a solid foundation, with potential for further growth. Amid Bitcoin's consolidation phase, the altcoin sector captured the limelight, with several tokens, including Thorchain (RUNE), Solana (SOL), and NEAR Protocol (NEAR), posting remarkable gains. This "alt season" might persist as trading momentum appears to be rotating through various coins. Ethereum (ETH), despite lagging behind in recent weeks, is showing signs of a potential resurgence. As overbought conditions begin to manifest in other coins, ETH's on-chain metrics indicate significant improvement, particularly in terms of network usage and settlement volumes, suggesting that it may be primed for a bullish phase.

In the broader financial landscape, US stocks celebrated their best week in over a year following the Fed's decision to pause rate hikes. Key labor market indicators pointed to a cooling economy, with the ADP private sector jobs report and non-farm payrolls both falling short of expectations. The resulting shift in investor sentiment led to a rally in the stock market, with indices like the Dow Jones, S&P 500, and Nasdaq posting impressive gains.

The bond market responded accordingly, with yields on US Treasury notes declining, reflective of the changed outlook on the Fed's interest rate policy. The US dollar experienced one of its sharpest declines in recent months, providing a boost to other currencies and commodities, although gold saw a slight dip amid geopolitical tensions.

Looking ahead, the global financial markets are expected to navigate through a relatively quiet economic calendar, with the Australian central bank's meeting and speeches from Fed Chair Powell on the horizon. As trading commenced in Asia, a risk-on sentiment prevailed, although the sustainability of this trend will depend on how markets in Europe and the Americas respond in the forthcoming sessions.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 86% | 27 | $62 764.78 | -2.10% | -1.31% | $1 235 893 879 804 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 77.2% | 43 | $3 111.97 | -0.38% | 2.34% | $379 819 713 548 | |||

| 3 | Tether predictions | 95.6% | 1 | $0.999494 | -0.05% | -0.10% | $110 506 000 076 | |||

| 4 | Binance Coin predictions | 84% | 21 | $590.77 | -2.06% | 6.34% | $87 189 889 810 | |||

| 5 | Solana predictions | 66.8% | 70 | $135.84 | -4.69% | -3.94% | $60 740 771 527 | |||

| 6 | USD Coin predictions | 90.8% | 2 | $1.000110 | 0.01% | 0% | $33 480 747 438 | |||

| 7 | XRP predictions | 66% | 70 | $0.513345 | -1.64% | -1.70% | $28 355 089 485 | |||

| 8 | Dogecoin predictions | 67.2% | 66 | $0.143954 | -3.94% | -5.35% | $20 737 446 091 | |||

| 9 | Toncoin predictions | 70.8% | 65 | $5.22 | -2.93% | -15.98% | $18 107 119 337 | |||

| 10 | Cardano predictions | 60.4% | 80 | $0.453093 | -2.93% | -6.41% | $16 145 977 936 | |||

| 11 | SHIBA INU predictions | 64% | 82 | $0.000024 | -5.15% | 6.51% | $14 290 077 656 | |||

| 12 | Avalanche predictions | 63.2% | 78 | $33.85 | -3.51% | -4.35% | $12 802 269 096 | |||

| 13 | Wrapped TRON predictions | 87.6% | 18 | $0.119961 | 1.88% | 9.63% | $10 504 018 012 | |||

| 14 | TRON predictions | 83.6% | 21 | $0.119919 | 1.53% | 9.70% | $10 500 371 925 | |||

| 15 | Lido stETH predictions | 94.8% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |