Bitcoin Breaks Free: A Renewed Surge Amidst Market Climbs

Kate Solano

Accomplished fintech journalist and analyst.

In the dynamic landscape of the crypto market, a recent upswing of 3.4% has propelled the total valuation to an impressive $1.38 trillion within the last 24 hours. Spearheading this surge is Bitcoin, contributing a substantial 3.8%, while altcoins exhibit varying but positive movements, ranging from 1.7% (BNB) to an impressive 7.7% (Polygon).

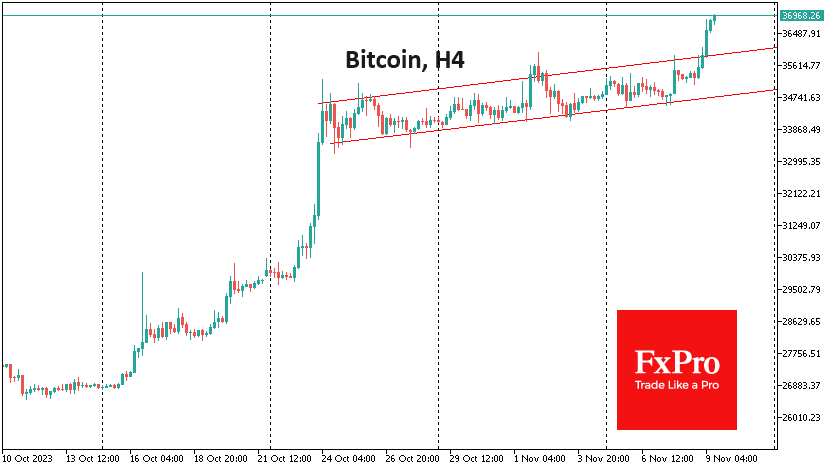

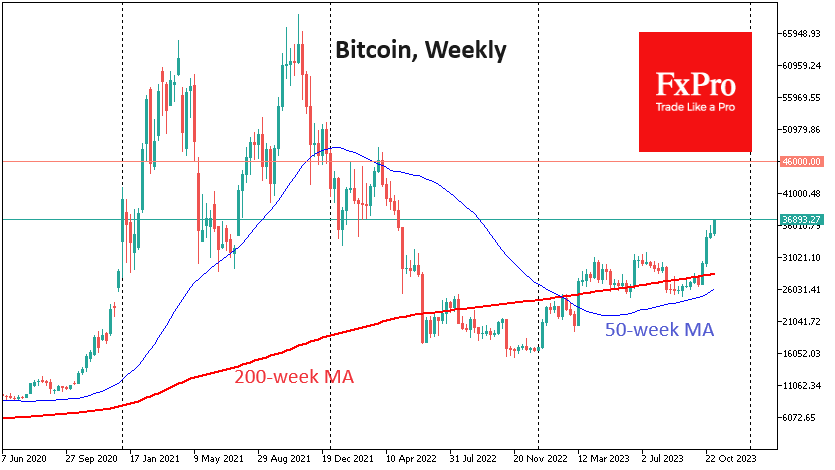

Bitcoin, often seen as the bellwether of the crypto space, has decisively broken free from a prolonged consolidation range, now approaching the significant threshold of $37,000. A meticulous technical analysis of this pattern indicates a potential upward trajectory to the range of $41,000 to $45,000, contingent on the chosen starting point of the last significant impulse. The upper limit emerges as a compelling target, aligning with a pivotal point in April 2022 where a corrective rebound concluded, marking the inception of a robust selling phase.

Despite Bitcoin's resilient recovery since the year's commencement, a unique challenge persists—the scarcity of available coins, intensified by the strategic actions of long-term holders. Notably, metrics indicative of "bitcoin inactivity" have achieved historical peaks, as highlighted by Glassnode, underlining the increasing prevalence of hodling behavior.

Key Developments Shaping Bitcoin's Trajectory

The surge in Open Interest in bitcoin futures is identified as a catalyst for the continued ascent of digital gold's price, as suggested by CredibleCrypto, a prominent analyst on YouTube. This development underscores the growing interest and engagement of institutional players in the bitcoin derivatives market. On the regulatory front, the European Banking Authority has initiated a public consultation, focusing on establishing capital and liquidity requirements for issuers of stablecoins and other digital tokens. This signals a broader effort to create a regulatory framework that addresses the evolving challenges posed by digital assets.

In the realm of stablecoins, Circle Internet Financial, the issuer of USDC stablecoin, is reportedly contemplating an initial public offering (IPO) in early 2024, as reported by Bloomberg. This move signifies the maturation of stablecoins and their pivotal role in the broader financial landscape.

Swiss cryptocurrency bank SEBA has achieved a significant milestone by obtaining a license from the Hong Kong Securities and Futures Commission. This regulatory green light empowers SEBA to provide a spectrum of digital asset-related services to residents, solidifying its position in the emerging crypto banking sector.

On the technological front, the renowned cryptocurrency exchange Binance has unveiled its Web3 Wallet. Accessible through the platform's mobile app, this wallet leverages Multi-Party Computing technology. By dividing private keys into three parts and distributing them across different servers, Binance enhances security and usability for its users, aligning with the evolving landscape of decentralized technologies.

As Bitcoin sheds the shackles of consolidation and the broader crypto market experiences buoyancy, these developments underscore the multifaceted dynamics shaping the trajectory of digital assets. The interplay between technical patterns, regulatory initiatives, and technological innovations collectively propels the crypto space into new realms of growth and sophistication.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 72.4% | 54 | $68 221.63 | 1.27% | 2.38% | $1 346 132 518 889 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 77.6% | 47 | $3 277.70 | 0.62% | -6.01% | $394 072 124 681 | |||

| 3 | Tether predictions | 93.6% | 1 | $1.000294 | 0.04% | -0.03% | $114 362 869 613 | |||

| 4 | Solana predictions | 64.4% | 70 | $186.46 | 3.76% | 10.05% | $86 651 629 563 | |||

| 5 | Binance Coin predictions | 79.2% | 42 | $588.60 | 1.71% | -0.56% | $85 893 706 101 | |||

| 6 | USD Coin predictions | 90.8% | 1 | $1.000218 | 0.01% | 0.02% | $34 165 068 764 | |||

| 7 | XRP predictions | 60.4% | 86 | $0.601322 | 0.08% | 1.60% | $33 650 519 304 | |||

| 8 | Dogecoin predictions | 74% | 55 | $0.135778 | 4.40% | 6.72% | $19 726 589 838 | |||

| 9 | Toncoin predictions | 84.8% | 29 | $6.74 | -0.27% | -8.09% | $16 954 582 289 | |||

| 10 | Cardano predictions | 75.2% | 49 | $0.417851 | 0.74% | -4.48% | $15 002 527 040 | |||

| 11 | TRON predictions | 86.4% | 18 | $0.137290 | 0.44% | 2.02% | $11 952 578 512 | |||

| 12 | Avalanche predictions | 77.6% | 38 | $28.70 | 1.64% | 1.95% | $11 330 467 420 | |||

| 13 | Lido stETH predictions | 93.2% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | SHIBA INU predictions | 80.8% | 30 | $0.000017 | 2.35% | -3.05% | $10 173 129 198 | |||

| 15 | Wrapped TRON predictions | 90.8% | 1 | $0.116354 | -0.46% | 0.23% | $10 171 995 609 |