Cardano (ADA) Price Prediction for 2025 and 2030: Will Hoskinson's Creation Become the Real Ethereum Killer?

Alex Paulson

Crypto and Forex professional trader, analyst, contributor.

While Bitcoin (BTC) dictates the undisputed dominance in the cryptocurrency space, the contest for the second spot is getting hotter by the year. And while Ethereum has had an immense price appreciation since the March crisis, thanks largely to the hype around the launch of Ethereum 2.0, its competitors have been staying idle.

If you are familiar with the Cardano ecosystem, then you should know that this project has long been posing serious competition to Ethereum. And this competition is going to get only tougher over the next five to ten years, as Cardano has many fundamental factors aligned to propel the price of ADA in 2025 and through to 2030 to new heights and past the Cardano’s highest price at $1.33 that is still 87% away from the current value of ADA that stands at $0.17.

Fundamentals are key to understanding and foreseeing ADA’s price movement. Therefore, this Cardano price prediction for 2025 and 2030 will feature an in-depth analysis of recent improvements in that area, and how they can impact the price of ADA in five and ten years’ time.

Cardano starts laying the foundation for future achievements

We’ll offer a profound analysis of Cardano’s achievements in 2020 in the area of fundamentals, which will surely have an immense effect on the price of ADA in the next 5 years, but for now, let’s focus on the current situation on the market and see how it can affect the price action over the coming year.

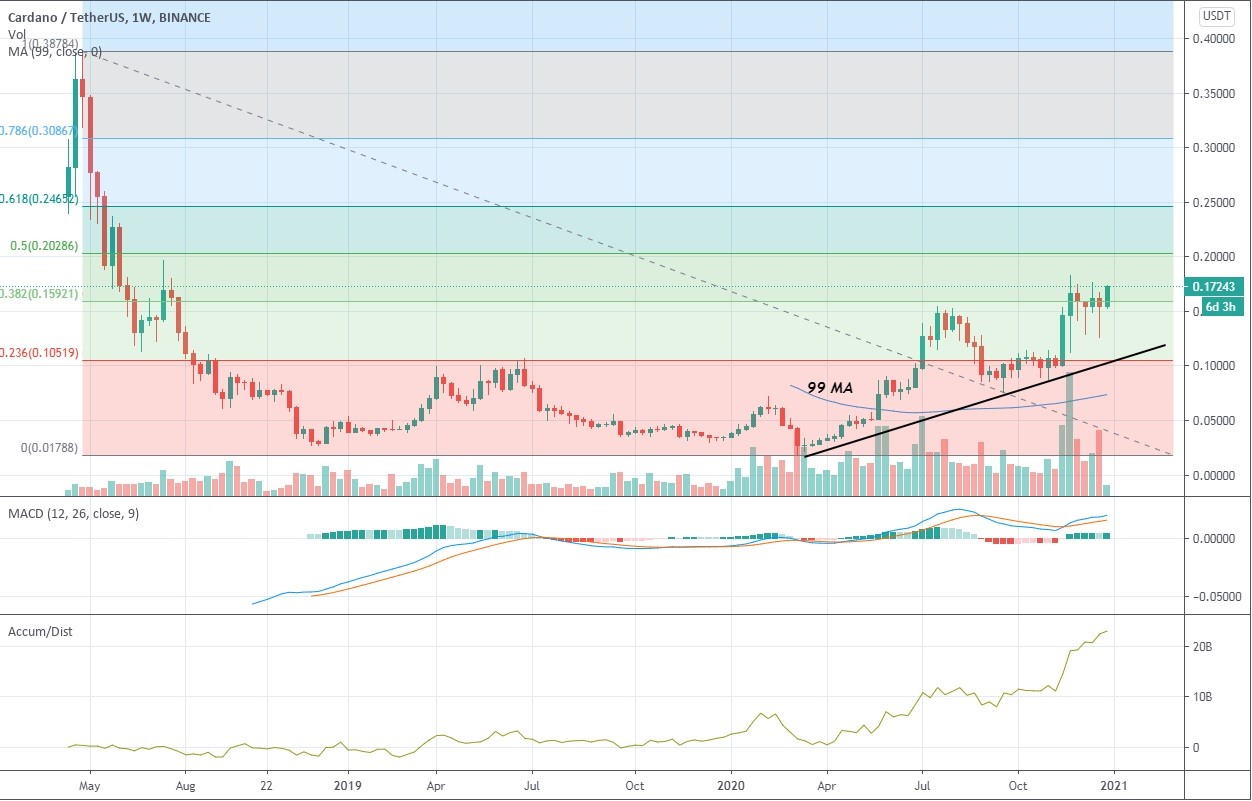

1-week ADA/USDT chart

The weekly ADA price chart shows that the coin is clearly gearing up for the bull run that can potentially last for the next five to eight years, depending on how well the process of adoption of cryptocurrencies, including the one under review, would go over the said period of time. But as our proprietary price prediction model suggests, everything is lining up for ADA to have another multi-week swing to the upside that will land the Cardano price in USD 42,9% above the current level in the next 30 days and reach $0,25, while the price appreciation in 2021 will peak at $0.41, which is 140% to the upside.

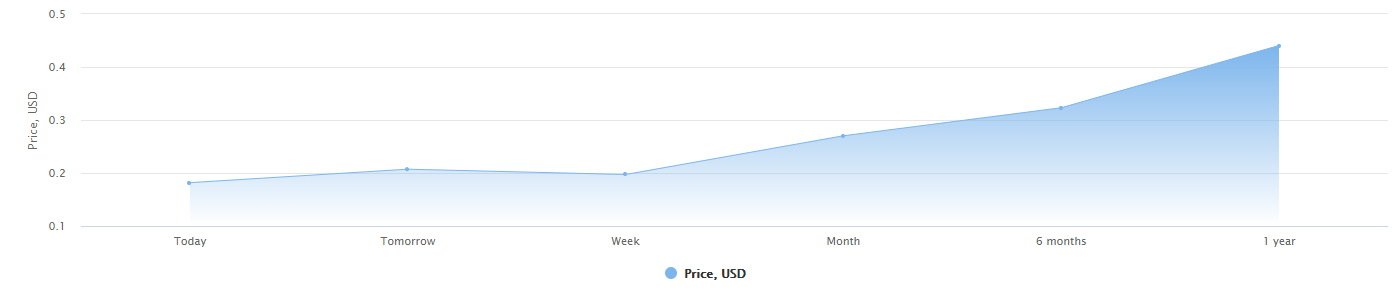

1-year ADA price prediction chart

As you can see on the chart, the price of ADA is now finalizing the consolidation after the second serious burst to the upside that has been put to a halt right near the 38.2% retracement level on the Fibonacci grid. Cardano’s historical price action reveals that the area between the Fibonacci levels 8.2% and 50% contains serious resistance that the price had failed to overcome during the early stages of the bear market of 2018.

But now, ADA is in a clear-cut uptrend, being stationed safely above the 99-period moving average and above the diagonal support. For the past five weeks, the Cardano price has been forming a shallow retracement that’s already started to resolve to the upside. However, we are yet to see sufficient volume to accompany this move, but the Accumulation/Distribution indicator hints that it would arrive soon. MACD here is in the bullish control zone, with both MAs looking north, thus adding to the overall bullish bias.

ADA addresses vs. capitalization chart. Source: Coinmetrics

The on-chain analysis reveals a steady rise of active addresses on the Cardano blockchain, though this metric did experience a sharp drop after the peak in August, which was probably the result of a dying hype around the Shelley upgrade. Nevertheless, the address count had restored its growth right around the time when the staking was introduced - a subject which we will touch upon below - accompanied by the rise of market capitalization and the actual price of ADA in USD.

All in all, the current situation on the market shows a significant bullish bias concerning Cardano, which is supported by the on-chain metrics. So, the answer to the question, “Is ADA a good investment?” would surely be affirmative because this altcoin basically has the full package for the prolonged bull run: great fundamentals, sufficient media attention, tons of new blockchain solutions that are going to be implemented with the next five years, and a low price along with the high position in global rankings - ADA currently sits at 8th, with the market capitalization of $5.4 billion.

All this means that once the retail investors start to flood the market, incentivized by the hype around Bitcoin breaking one ATH after another, many will surely opt for ADA after realizing its potential and also being seduced by its cheapness. This brings us to the question of what Cardano will be worth in 5 years.

How ADA’s fundamentals will propel its price to new heights in 2025

As you have probably guessed, the success of ADA in the next five to ten years will largely depend on whether it would prove capable of becoming the infamous Ethereum killer. Just a quick reminder that the term “Ethereum killer” is used with regard to several blockchain projects that utilize smart contracts and pose a direct challenge to Ethereum that is rightfully considered as a current leader in that particular field.

EOS, Polkadot, TRON, Cardano, and several others - all have been branded with this rather dark name. But to be frank, all these projects, except for Cardano and Polkadot, are light years away from Ethereum in terms of the state of network development and the viability of their blockchain solutions. In fact, most of these so-called “killers” have actually admitted to being willing to cooperate, or even integrate, with Ethereum once the 2.0 version of its main network gets fully operational.

But when it comes to Cardano, the stance of its founder Charles Hoskinson, and his team of seasoned developers, has always been clear - Cardano was inherently designed to challenge Ethereum on all fronts. And given how splendid was the year 2020 for the project in terms of both fundamental improvements and price appreciation, we expect the period from 2021 to 2025 to be decisive in this battle for creating the most sophisticated blockchain solution for smart contracts and token staking.

Allow us to give you a quick recap of what Cardano, as a blockchain development company, has achieved over the passing year. At the tail end of July, its blockchain underwent a successful hardfork upgrade dubbed Shelley, named after the famous English poet Percy Shelley. This upgrade brought the project closer to the successful completion of the second stage of its development roadmap, though it should be said that there had been numerous delays due to various technical issues, which might also become a problem for the project's seamless development throughout 2021 - 2025.

In any case, Shelley is said to have significantly improved the network decentralization through the incorporation of a staking option. This alone has already put Cardano a step ahead of Ethereum since the transition from PoW to the staking model is one of the primary purposes of Ethereum 2.0. But Cardano’s first experience with staking has turned out to be a genuine success as more than 400 staking pools have emerged in the first months alone and attracted over $13 billion in staked ADA that arrived from 40,000 unique addresses. The first staking rewards turned out to be higher than many expected since nearly a million dollars (7 million tokens) had been distributed on the first day of rewards.

Given that Cardano’s staking is conceptually different from that of other blockchain projects, it might achieve even greater success over the next five years, consequently making Cardano a primary go-to place for such purposes.

The first advantage of staking ADA is that there is no lock-up period, meaning that an investor can unstake his tokens at any given time without repercussions. That is an amazing feat, especially compared to the staking conditions on Ethereum 2.0, where the coin could be locked for many months. Given that Ethereum still has a long way to go before the staking function is properly implemented, while Cardano already has it up and running, guessing who’s going to have the upper hand in this competition is a no-brainer, really.

In addition, Cardano allows for staking directly from either Daedalus or Yoroi wallets, meaning that the staked funds will be safe at all times, unlike the staking system offered by other projects. Also, one can freely switch between different pools or even use multiple pools for that purpose.

Finally, Cardano offers very reasonable staking rewards (approximately 5% per year), while they are also said to be designed to counteract inflation through the project’s anti-domination policy with regard to staking nodes. In a nutshell, once the amount of ADA staked in a pool reaches a certain threshold (the current one stands at 63 million ADA), the system starts to automatically lower the rewards up to a zero even to avoid the oversaturation of a node and the formation of a group of dominant nodes. With such a well-elaborated approach, it’s no wonder if Cardano would already be the most populated staking platform, which would have an immensely positive impact on the actual price of ADA.

Also, Charles Hoskinson has openly admitted to being extremely fond of decentralized finance (DeFi) to the extent that he announced that Input Output Hong Kong (IOHK), the company that Hoskinson had founded after leaving the Ethereum Foundation due to the dispute over the network’s governance structure, will be working on the algorithmic stablecoin, designed to pose direct competition to DAI, a stablecoin developed by the decentralized autonomous organization MakerDAO that utilizes Ethereum’s smart contracts. For this purpose, the company had launched Project Catalyst, a grant program aimed at attracting developers to start building products on the Cardano blockchain, one of which is the said stablecoin.

So, we already have a staking program, a stablecoin, and the plans for further decentralization of the network - Hoskinson has repeatedly said that he envisions Cardano as the most decentralized ecosystem in the crypto space - not a bad choice of arms for the confrontation with Ethereum over the next five years. Through the upcoming upgrades, Cardano strives to become as many as 50 times more decentralized than Bitcoin that could be achieved through the aforementioned anti-dominance policy concerning staking.

Also, In 2021, Cardano plans to introduce a range of blockchain solutions that might shift the balance of power in ADA’s favor. The list is truly impressive: over the coming year, the Cardano Foundation plans to roll out smart contracts on its proprietary third-generation blockchain, along with tokenized assets, and the converter of ERC-20 tokens, a piece of technology that can really sweep the rug from under Ethereum’s feet.

The company has already released the demo of the converter during the rollout of the program plan for the next system upgrade dubbed Goguen, named after a famous computer scientist Joseph Goguen. In essence, the converter will allow for seamless migration from Ethereum to Cardano, obviously, for the purpose of poaching promising blockchain projects and their tokens.

Speaking of the Goguen update, written in the Plutus programming language, it will introduce smart contracts on the Cardano blockchain and give it a real shot at beating Ethereum to the mark and competing with it for the second spot in global ranks. Also, with Gogen would come a multi-currency ledger that would offer means for creating new digital assets on the Cardano blockchain, including non-fungible tokens (NFTs) that are believed to be the next big thing after the DeFi movement. What’s great about this ledger is that it will allow for sending different types of tokens within a single transaction without the need to pay additional gas fees. According to Hoskinson, the tokens created on the Cardano blockchain will have an easier time getting listed on cryptocurrency exchanges since they will enjoy a greater autonomy compared to ERC-20 tokens.

All these fundamental factors put ADA in a great position for the ongoing bull run that may well transform into a bull market that might last until 2025, with Cardano being one of the primary candidates for becoming the third cryptocurrency by market capitalization, surpassing XRP that is likely to suffer immensely from the recently evoked lawsuit by SEC.

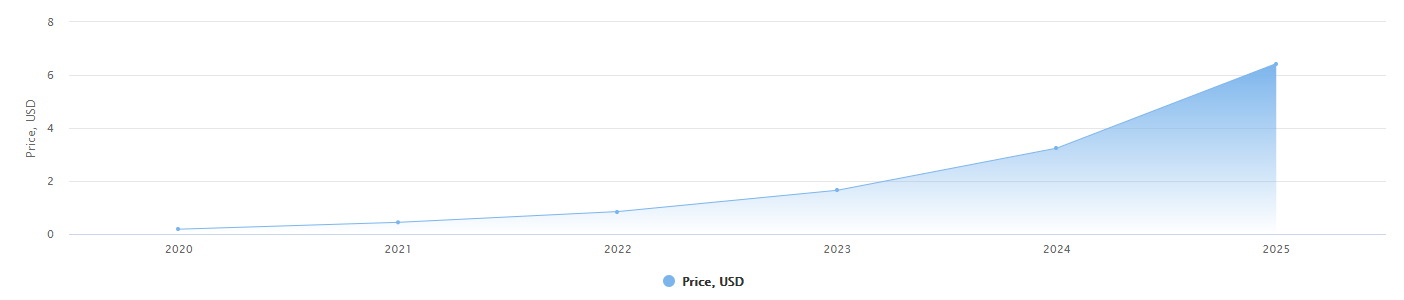

5-years ADA price prediction chart

As for the ADA price for the next five years, our price prediction algorithm suggests that within 3 years, the price of Cardano will go up by 785%, surpassing the ATH in the process and establishing itself at $1.5. The next two years after that will see the continuous growth of coin’s value - by 2024, the price of ADA in USD will reach the psychological point at $3 after another sharp rise that will amount to 1632%. The year 2025 will see ADA doubling in price once again and reaching yet another record high at $5.83 that would mark the 3343% rise from its current price level.

What awaits Cardano in 2030?

We have already described in detail how Cardano is going to thrive in the coming five years thanks to its amazing fundamentals. By 2030, it will become clear whether or not this project would live up to the expectations of becoming the Ethereum killer. In all candor, we reckon that all these speculations are nonsensical because, in reality, these two heavyweights will remain bitter competitors, but will also find a way to co-exist in the constantly expanding world of crypto. There is absolutely no doubt in our minds that ADA will climb at least to the 4th spot in the global ranking, surpassing the failing XRP and Bitcoin Cash in the process.

Our algorithm predicts that by 2030, Cardano will rise all the way to $10 per coin, but that would probably be its peak for years to come because the bear market has to happen eventually, and given that the crypto market will keep on maturing (and the bullish cycles getting longer), we expect the next episode of bearish dominance to begin right around 2027-2030; although by that time, Cardano will already be too big to fail.

FAQ

Is now the right time to invest in Cardano?

There probably wouldn’t be a better time to invest in ADA than now, because it is standing at the very beginning of the bull cycle, though its gains in 2020 have already been impressive.

What are the fundamental advantages of Cardano?

The Cardano blockchain ecosystem is one of the most versatile as it’s highly decentralized and features staking, with smart contracts, stablecoin, and token converter being on the menu.

What is the ADA price prediction for 2021?

By the end of 2021, ADA will be priced at $0.41.

What will Cardano be worth in 5 years?

In 2025, ADA is expected to rise to $6.

What will be the price of ADA in 10 years?

By 2030, Cardano will reach the peak of the bullish cycle and hit the $10 mark.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 84.4% | 25 | $64 271.38 | -3.73% | 5.15% | $1 265 496 450 332 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 76.4% | 49 | $3 157.43 | -3.05% | 6.22% | $385 358 557 927 | |||

| 3 | Tether predictions | 92% | 1 | $0.999852 | -0.02% | -0.04% | $110 447 216 461 | |||

| 4 | Binance Coin predictions | 85.6% | 18 | $606.93 | 0.03% | 10.61% | $89 575 802 259 | |||

| 5 | Solana predictions | 67.6% | 71 | $147.40 | -6.86% | 12.67% | $65 893 442 380 | |||

| 6 | USD Coin predictions | 96% | 2 | $1.000087 | 0.01% | 0.02% | $33 443 613 205 | |||

| 7 | XRP predictions | 72% | 62 | $0.527628 | -4.06% | 6.49% | $29 087 702 292 | |||

| 8 | Dogecoin predictions | 72.8% | 60 | $0.151351 | -6.56% | 2.44% | $21 798 428 537 | |||

| 9 | Toncoin predictions | 66% | 66 | $5.47 | -7.58% | -7.01% | $19 006 158 758 | |||

| 10 | Cardano predictions | 65.2% | 72 | $0.477013 | -6.07% | 7.91% | $16 997 831 280 | |||

| 11 | SHIBA INU predictions | 59.2% | 82 | $0.000025 | -7.12% | 14.30% | $14 877 091 584 | |||

| 12 | Avalanche predictions | 68% | 66 | $35.76 | -9.52% | 3.68% | $13 516 558 275 | |||

| 13 | Lido stETH predictions | 94.4% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | Polkadot predictions | 70.8% | 64 | $6.96 | -6.08% | 4.48% | $10 002 091 467 | |||

| 15 | Wrapped TRON predictions | 86.8% | 19 | $0.114186 | 0.76% | 4.40% | $9 999 796 730 |