Best Stablecoins for Trading and Investment in 2021

Stablecoins can be simply explained as a form of digital currency, the value of which is tied (pegged) to the price of real-world currencies like USD, EUR, JPY, etc. Basically, it’s a digital equivalent of foreign currency that crypto traders and investors use for safeguarding their capital against high volatility that is inherent to the cryptocurrency market, as well as making remittances and using it as a medium of exchange and unit of account when dealing with crypto.

Over the years, the market has seen the emergence of many stablecoins with different features, which might be confusing for nascent traders and investors. Therefore, we compiled the list of the best stablecoins to use in 2021, having taken into account the coins’ transparency, the proof of reserves, and the position in global ranks.

USDT

USD Tether (USDT) is inarguably the most widely used stablecoin and an immensely important cog in the constantly running crypto machine that has recently reached and surpassed the overall capitalization of $1 trillion. Back in the day, the crypto trading community desperately needed a stable digital asset to hedge against the notorious volatility. In 2014, Brock Pierce, Reeve Collins, and Craig Stellars found the company called Tether Limited, which is domiciled in Hong Kong, and began issuing the blockchain-based digital currency that had its value pegged to the US Dollar at a 1:1 ratio, meaning that each coin is backed by the equivalent sum in USD, EUR, and JPY. One of the best stablecoins was initially branded as RealCoin, but it was later changed to USD Tether. In five years, this stablecoin became the primary medium of exchange, the total market capitalization of which has been growing exponentially since the beginning of 2020.

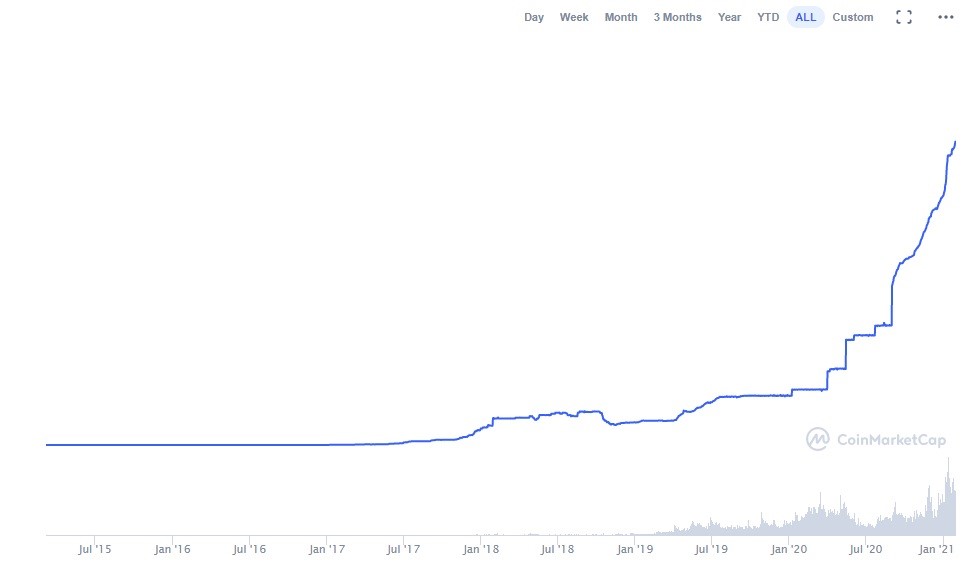

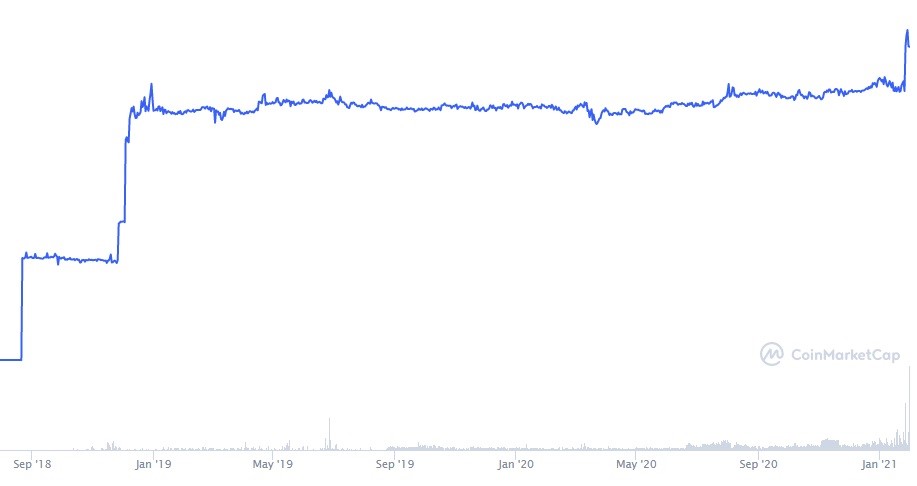

USDT market capitalization. Source: Coinmaketcap

Right now, USDT has a market capitalization of $25,3 billion, the largest among the rivaling stablecoins and all altcoins apart from Ethereum. Such an explosive capitalization growth led to USDT climbing up to the 3rd position in global cryptocurrency ranks, surpassing XRP and all other high-profile altcoins in the process, and becoming the foundation for most cryptocurrency trading pairs (80% of all BTC trades are done via USDT), as well as one of the biggest sources of liquidity for the market.

But even though USDT is an integral part of the biggest chunk of all crypto trading operations, this stablecoin remains surrounded by controversy that emerged from the alleged company’s inability to back every single coin with real-world assets, and accusations of uncontrolled token minting that may have led to market manipulations.

In a way, Tether Limited is not much different from the Federal Reserve that went on a money-printing spree after the COVID-19 pandemic had knocked the global economy off her feet, aside from the fact that the American central bank is virtually untouchable, while Tether Limited began drawing the attention of regulators since January 2018, when the company had refused to carry out an independent audit that should have confirmed that each USDT is backed by a fiat currency, and that the issuer is not consorting with Bitfinex, for which Tether Limited got subpoenaed by the US Commodity Futures Trading Commission (CFTC). At the same time, the company was accused of deliberately manipulating the price of Bitcoin through intense coin minting during the crypto bubble of 2017.

Another instance of a conflict with the authorities happened in 2019 when the New York Attorney General’s office made a move against a parent company of Tether Limited for concealing the loss of around $850 million that turned out to be a part of an alleged scheme that involved Bitfinex and the Panama-based company Crypto Capital that handled the exchange’s withdrawal operations. As a result, the Tether representative Stuart Hoegner was forced to admit in the corresponding affidavit that only 74% of USDT in circulation is backed by USD, while the rest is backed by collateralized assets.

But despite the ongoing controversy, USD Tether remains the best stablecoin in terms of provision of the largest trading volume in countless markets, serves as a store of value, and a protective tool against market volatility. Every trader knows that having a large volume is essential for those big market swings, so, like it or not, USDT will remain at the top of the stablecoin list in the foreseeable future and the best stablecoin to use when trading cryptocurrencies. The rest of the bunch might be more transparent, fully backed by fiat or other assets, and be free of controversy, but they simply can’t compete with Tether stablecoin, whose market dominance is nearing 3%, in terms of liquidity and trading volume provision.

- Pros: The most popular stablecoin with a huge market cap.

- Cons: The company might have some legal issues.

True USD (TUSD)

True USD (TUSD) is no doubt one of the best stablecoins when it comes to transparency and legal compliance. The fiat-backed coin was released in January 2018 by TrustToken, the US-based blockchain company established by Rafael Cosman. The company itself is quite interesting as it’s composed of graduates from Stanford, UC Berkeley, and former Google employees. As the name suggests, TrustToken’s primary purpose is to issue asset-backed and totally transparent (trustworthy) stablecoins that can be easily included in the global cryptocurrency flow and used by traders, exchange platforms, retail users, lenders of funds, and their borrowers, as well as DeFi protocols.

Apart from TUSD, the company has already issued the digital pound sterling (TGBP), Australian dollar (AUD), Canadian dollar (TCAD), and Hong Kong dollar (THKD), all of which can be minted and redeemed directly on the TrustToken platform through the use of PrimeX and Silvergate Exchange Network.

The transparency of TUSD is ensured by the continuously updated Proof of Reserves that is carried out by Armanino, the digital accounting firm that had developed an audit and assurance platform on the basis of TrustExplorer. Therefore, users can rest assured that every token out of the declared circulating supply of $400 million TUSD is backed by a dollar or the other fiat currency from the list above, which makes it a fully collateralized stablecoin. In addition, the team claims that True USD is compliant with the legal framework concerning digital assets, adopted in over 100 countries.

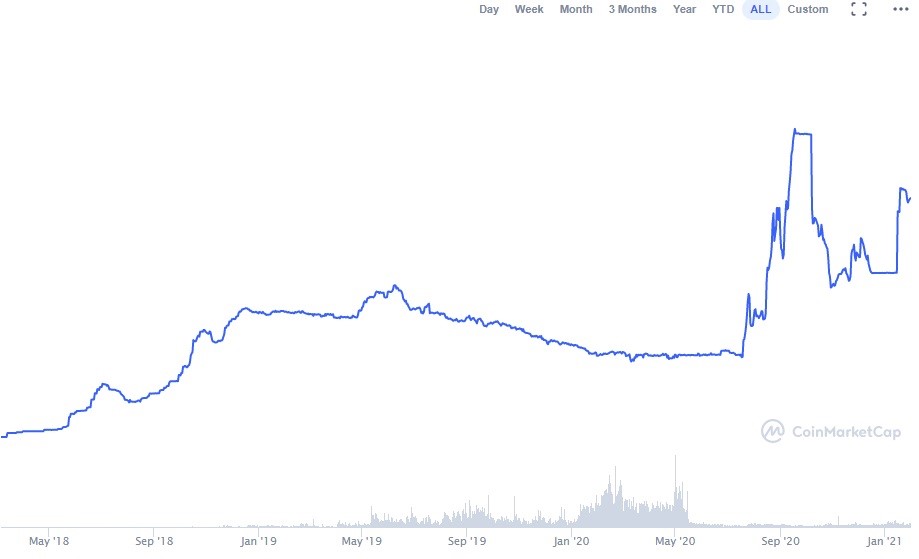

TUSD market capitalization chart

The chart above shows that the market capitalization of TUSD has been quite erratic over the course of the past year, peaking at $507 million last fall, then crashing hard and spiking again to the current level. These jumps, and the relatively small capitalization in general, didn’t allow the safe stablecoin to be placed in the global ranks higher than its present 77th position. TUSD has the widest presence on such cryptocurrency exchanges as Coinsbit (more than 30% of the entire trading volume) and Binance (around 20% of the total trading volume). HitBTC and Bittrex also feature the TUSD markets, but the trading volume there barely exceeds $4 million per day.

The other drawdown of this truly reliable stablecoin is that it’s featured in a limited number of trading pairs, being placed mostly against BTC, ETH, and USDT. So, if you’d like to trade some exotic altcoin against TUSD, the choice of the markets will be poor. Besides, the on-chain analysis tells us that more than 86% of the entire TUSD supply is concentrated in the wallets of large holders, meaning that retail traders tend to give preference to other stablecoins, which explains why the average daily trading volume that involves this stablecoin rarely goes above $200 million.

All in all, True USD is among the best stablecoins when it comes to safely parking your capital while waiting for the opportune moment to re-enter the BTC or the ETH market, without worrying that some regulator might shut down the whole enterprise one day, like it might happen to USDT.

- Pros: Full transparency, legal compliance.

- Cons: Average market capitalization, small number of trading pairs, overwhelming percentage of coins is concentrated in the hands of large holders.

Paxos Standard (PAX)

Paxos Standard (PAX) is another stablecoin that runs on the Ethereum blockchain and complies with the ERC-20 standard. The first PAX token was issued in 2018 by Paxos Trust Company (PTC), which made sure that the stablecoin falls in line with the regulatory framework of the New York State Department of Financial Services, which granted the company the Trust Charter. Being a trust business entity, PTC doesn’t use the funds devoted by users to mint PAX to run its operations. Instead, it acts as a fiduciary that offers custody to all deposits, which are held at all times in the vaults of the FDIC-insured US banks and collateralized by the government treasuries.

In our experience, Paxos Standard has one of the fastest token redeeming procedures among its competitors, probably because the company doesn’t rely on intermediaries in that matter. The official website promises that the coin can be redeemed within a single business day, but in practice, the freshly-minted coins arrive in the Ethereum wallet in an hour or two, depending on the amount requested.

Paxos Trust Company has its proprietary cryptocurrency exchange called itBit that allows for Over-the-Counter trading with PAX, which is a trading method preferred by large institutional investors.

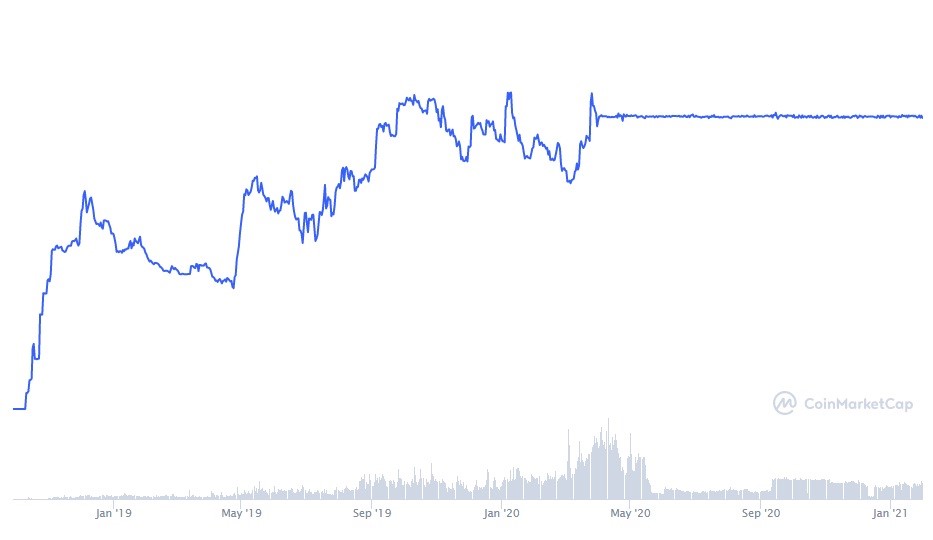

PAX market capitalization chart

Despite all these obvious advantages, Paxos Standard doesn’t have an overly impressive market capitalization - after a couple of years of continuous growth from $20 million to the peak at $264 million, upon which the market cap has flatlined at $244 million and has been staying at this level for the past several months.

Similar to TUSD, the largest activity involving PAX falls on two cryptocurrency exchanges: Coinsbit and Binance that collectively accommodate over 40% of the entire trading volume. The choice of tradable pairs that include PAX is also relatively narrow as this coin is most often traded against Bitcoin, Ethereum, and USD Tether. There are some altcoin markets for PAX, but the majority of them are either located on small-time exchange platforms or have a relatively small average trading volume.

Speaking of the average daily trading volume with regard to PAX, it stably fluctuates between $150 million and $300 million, most of which occur between Paxos Standard and the two dominant cryptocurrencies, whereas the altcoin pairs often lack liquidity. Also, the fact that 89% of the total circulating supply of $244 million, which puts PAX in the 95th spot in global rankings, is being concentrated by large holders, 62% of which refrain from moving the coins for more than a year, doesn’t add to the fluidity of this otherwise good stablecoin. But if you choose Paxos Standard as a long-term store of value, you can rest assured that the funds will be safe, and the company won’t get involved in any feuds with regulators.

- Pros: Regulated by US authorities; easy to redeem.

- Cons: Small number of tradable pairs; most coins are lying still in holders’ wallets.

Binance USD (BUSD)

Binance USD (BUSD) is placed right after Paxos Standard (PAX) because this popular stablecoin has been developed in collaboration with Paxos Trust Company, thus making BUSD a joint venture that shares similar traits. It is obvious that being one of the largest cryptocurrency exchange platforms, Binance needs its own stablecoin that would facilitate the ecosystem development. Apparently, Binance’s chief executives didn’t want to jump numerous bureaucratic ropes to get the necessary approval by the authorities and opted to go under Paxo’s wing, which was probably the right decision, given the general hostility of US authorities towards cryptocurrencies, especially those provided by foreign companies.

The partnership with Paxos allowed Binance to receive the approval from the New York State Department of Financial Services, which means a great deal for its constantly expanding customer base in the United States. In addition, Binance was allowed to store the vast amounts of USD used for the collateralization of BUSD in FDIC-insured banks, thus making it one of the safest stablecoins around. Paxos Trust Company also acts as a custodian of all BUSD coins. Binance also claims that the availability of the funds to back BUSD at 1:1 ratio is being regularly checked and verified by an independent auditing firm.

BUSD market capitalization and price chart

Naturally, Binance is the trading platform that hosts the overwhelming majority of all currency pairs, with BTC/BUSD being the largest market that takes up 33% of the entire trading volume. But unlike PAX, Binance’s stablecoin is included in a vast number of trading pairs, being placed against many interesting altcoins as well as fiat currencies. But thanks to the popularity of Binance, there is a much higher demand for this stablecoin compared to that of PAX, which explains its respectable market capitalization of $1,5 billion and the constantly growing number of large transactions in BUSD (over $100K per transaction), the total weekly volume of which often surpasses $5 million.

Binance USD is also characterized by high average daily trading volume that can fluctuate from $1.5 billion to $5 billion during times of increased market activity. All these factors allowed BUSD to be placed at the 30th spot in global rankings, making it one of the highest-ranked stablecoins on the market. Lastly, you can create and redeem BUSD on a no-fee basis.

- Pros: Highly regulated; associated with a dominant exchange platform; lots of trading pairs; easily redeemable.

- Cons: The average trading volume is still light years away from that of USDT.

Dai (DAI)

Just like any other currency included in this list of the best stablecoins of 2021, the value of Dai (DAI) is pegged to the US Dollar at 1:1 ratio. However, the underlying structure is a bit more complicated. The thing is that unlike most other stablecoins, DAI is actually decentralized in nature, and also has its value collateralized by the debt in Ethereum (ETH). It means the absence of central authority over this particular stablecoin, which, in turn, provides for the resilience to regulatory scrutiny, such as confiscation and taxation, something that the likes of PAX, BUSD, and TUSD are vulnerable towards because they are being closely monitored by the authorities. Besides, the fact that Dai is built on the Ethereum blockchain and utilizes its smart contracts eliminates the possibility of occurrence of human error that can put the users’ holdings at risk.

In 2019, the team organized the system transition from the Single Collateral Dai (SCD) o the Multi-Collateral Dai (MCD) that introduced some very interesting features, such as the additional CDP collateral, along with the Dai Savings Rate (DSR) that has further differentiated this stablecoin from the rest. Basically, the holders of Dai were given the opportunity to earn interest of up to 6% per year.

The minting of DAI is also different from that of other stablecoins, and more complicated. Dais are generated through the proprietary decentralized application, created by the Maker team, that needs to have access to the user’s ETH holdings, thus turning Dai into a crypto loan taken against the available Ethereum to create the collateralized debt position (CDP). Smart cryptocurrency traders can use this Dai creation method to their advantage when trading ETH by increasing the size of CDP by purchasing ETH with newly minted DAI during the rallies.

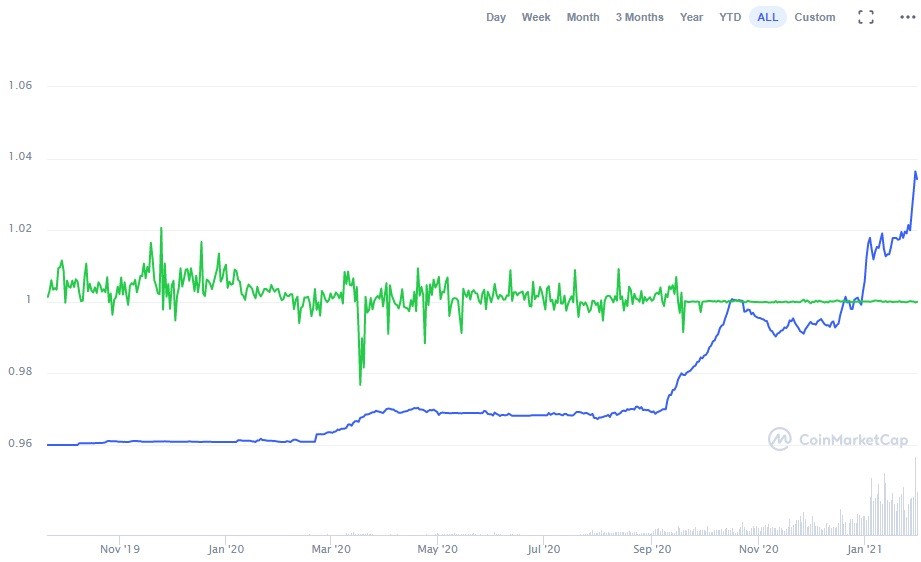

Another interesting thing about Dai is how it maintains the peg to USD. As you can see on the chart below, the price of Dai stablecoin isn’t firmly tied to $1 and tends to fluctuate quite a bit. For instance, if the price drops below $1, the user who has a CDP can cover the collateralized debt in ETH at a discount, upon which the extra Dai are burned and the price strives back to $1.

Dai price and market capitalization chart

Apart from that, DAI is probably the only stablecoin that has become an active part of the decentralized finance (DeFi) movement since 14% of the total trading volume comes from Uniswap, the popular decentralized liquidity protocol, where Dai is traded against Wrapped Ethereum (WETH).

This interesting stablecoin is also featured on such DeFi platforms as Compound, Curve Finance, and 1inch Exchange, with Binance being the only centralized exchange platform that puts up a decent trading volume in ETH/DAI and BTC/DAI pairs.

What’s also good about Dai is that the concentration by large holders doesn’t exceed 74% of the total circulating supply of $1,64 billion, with the same percentage being held for over a year, which speaks positively of the coin’s fluidity. The coin’s average trading volume rarely exceeds $900 million, which means that the majority of funds are locked in CDP or elsewhere. But if you are into the whole DeFi movement, Dai is definitely the way to go in terms of the choice of tradable stablecoin.

- Pros: Decentralized; active part of DeFi movement; interesting incentive scheme.

- Cons: Complicated minting process.

USD Coin (USDC)

A stablecoin named USD Coin (USDC) was created within the framework of a partnership between Circle, a peer-to-peer payments technology company that was established in 2013 by Jeremy Allaire, and Coinbase, one of the biggest cryptocurrency exchange platforms by liquidity, which is tailored to serve the needs of the US-based traders. Like most other stablecoins, USDC is built on the foundation of the Ethereum blockchain and uses its smart contract to eliminate the possibility of human error and automate all transactions and conversion operations.

The use of the unique open-source technology allows the developers to integrate fiat currencies in decentralized applications and make them interact with Ethereum smart contracts. The transparency of all operations and the presence of sufficient reserves to back the circulating supply of USDC, which currently stands at 5.8 billion coins, is ensured by regular audits, conducted by Grant Thornton LLP, the Chicago-based audit, tax, and advisory firm that has been offering its services for almost a century, so its reputation is beyond reproach.

The firm releases reports on the state of the network and reserves on a monthly basis - all reports are downloadable from the official website. Add to that the fact that both Circle and Coinbase are now fully compliant with the regulatory framework concerning digital assets that exist in the United States, and you get arguably the safest stablecoin with confirmed reserves and strong backing from top-tier crypto companies.

USDC market capitalization and price chart

Right now, USDC is integrated into numerous ERC-20 compatible wallets (BitGo, Exodus, Ledger), all major cryptocurrency exchanges, blockchain platforms (Bitpay, Kyber Network, Loopring, Wyre), application providers (BlockFi, Compound, Celsius Network), and service providers (Chainalysis, Coinfirm, Consensys). It comes to show that the team is tirelessly expanding the USDC ecosystem, which is one of the reasons why this stablecoin is placed as high as the 12th spot in global ranks, with the market capitalization of $5,8 billion that has been growing exponentially over the past year, as shown on the chart above. Apart from being an integral part of trading on centralized platforms, USDC also showcases a relatively large trading volume of DeFi platforms like Uniswap and Curve Finance. So far, USDC has the smallest percentage of coins (70%) owned by large holders, whereas the total amount of transactions greater than $100K often exceeds $18 billion per week. There is probably no need to mention that USDC is paired against all major altcoins, and many exotic ones, across all cryptocurrency exchanges that list this stablecoin.

- Pros: Secure and transparent; vast ecosystem.

- Cons: None, apart from the smaller trading volume, compared to USDT.

Gemini Dollar (GUSD)

The Gemini Dollar (GUSD) emerged on the cryptocurrency market in 2018, around the same time as the other two of the best USD stablecoins featured on our list - Paxos Standard (PAX) and TrueUSD (TUSD), thus instantly becoming their direct competitors. This stablecoin is issued by the eponymous cryptocurrency exchange that operates in New York and is registered as the limited liability trust that is regulated by the New York State Department of Financial Services (NYSDFS). It also comes as a subject to the New York Banking Law. The exchange was established by the Winklevoss twins, the famous cryptocurrency proponents and celebrities in the respective global community. Needless to say that the Gemini exchange, and its stablecoin, is more focused on traders from the United States, though the platform serves users from 45 countries.

GUSD also uses the Ethereum blockchain as its foundation, and its value is pegged to the US Dollar at the familiar 1:1 ratio. Like all other respectable issuers of USD-backed stablecoins, Gemini demonstrates the so-called proof-of-solvency by allowing the trusted third party, mostly BPM Accounting and Consulting, to carry out audits and verify the presence of the underlying USD balance held by the US State Street Bank that backs the 1:1 peg ratio.

Gemini Dollar is also characterized by the unique issuance and redemption process that involves the creation of the corresponding amount of GUSD upon its withdrawal from the exchange. If the user redeems these stablecoins or deposits the sum back to Gemini, the equal amount of GUSD gets burned.

GUSD market capitalization chart

Despite being among the best USD stablecoins for 2021 in terms of technical characteristics, Gemini Dollar can boast the same popularity as other coins on our list, mainly because of tough competition from other stablecoins that are backed by larger exchange platforms. The rise and fall of GUSD is clearly depicted on the market capitalization chart above. With a total market capitalization of $16,1 million and an average daily trading volume of $10 million, GUSD rightfully occupies the 490th spot in global ranks and showcases small trading volumes across all exchange platforms, except Gemini and BitMart. To summarize, GUSD is definitely one of the best stablecoins to use for making payments and storing value, but isn’t very suitable for swing trading and scalping.

- Pros: Compliant with the US regulations; verified reserves.

- Cons: Low popularity among traders.

Hot USD (HUSD)

Hot USD (HUSD) is the USD-backed stablecoin that is issued by Stable Universal, the financial services company domiciled in Hong Kong but also operating in the United States. It was launched in 2019 in cooperation with Paxos Trust Company and Huobi, the cryptocurrency exchange with one of the largest liquidity on the market. Naturally, the stablecoin is pegged to USD at a 1:1 ratio, with reserves held across several US banks. Just like Paxos Standard, HUSD is regulated by the NYDFS and complies with the legal framework regarding digital assets adopted in that particular state. Stable Universal undergoes a regular examination by Withum, the highly ranked advisory, tax, and audit services firm that operates in the United States and India.

HUSD market capitalization and price chart

As you might have guessed, the HUSD stablecoin is designed to serve the needs of the Huobi Global Exchange that accommodates the overwhelming majority of trading volume (nearly 90% across all markets) and trading pairs, mainly because the platform offers substantial fee cuts when paying them in the native token. HUSD is featured in many trading pairs, the most popular of which being USDT/HUSD that accounts for 57% of the entire trading volume. But if you like trading mid-ranked altcoins like Kusama (KSM) or VeChain (VET), Huobi will offer the corresponding pair with HUSD.

The chart above shows that the market capitalization of this stablecoin has been rising substantially since May 2020, having gone from $148 million to the current $451 million over this period of time, allowing the stablecoin to rise in ranks to the 74th place.

- Pros: Backed by Paxos; good market cap and a lot of trading pairs.

- Cons: Concentrated on one exchange platform.

Statis Euro (EURS)

Statis Euro (EURS) is the only currency on our stablecoin list that is backed by Euro. It was developed by the Statis Foundation, a European company that operates within the EU Nation - Malta regulatory framework. Presently, the company’s reserves amount to 37,5 million EUR, which is verified by the law firm BDO Malta that conducts monthly verifications, quarterly audits, issues daily account statements, as well as on-demand verification of available funds. Like any other stablecoin, EURS is pegged to Euro at a 1:1 ratio.

EURS market capitalization chart

The EURS team members claim that their primary goal is to bridge the gap between the real-world and off-chain markets with blockchain solutions and the industry of decentralized finance. The chart above shows that the market capitalization of EURS doesn’t fluctuate a lot and has reached the $43 million level only recently, which explains why it is ranked 315th. Status Euro features on a small number of exchanges, the most notable of which is Uniswap, where it is actively traded against USDC and USDT.

- Pros: Verified reserves and transparency.

- Cons: Low trading activity with this stablecoin.

EOSDT (EOSDT)

EOSDT is a unique but largely underappreciated stablecoin that not only has its value pegged to USD, but also uses the EOS and BTC reserves as collateral, with the collateralization ratio of 370%. The stablecoin is designed on the EOS blockchain and exploits the corresponding smart contracts. The safety of EOSDT is ensured by the presence of funds allocated in the special Equilibrium Stability Fund that currently amount to $14 million, though the stablecoin’s market capitalization rarely exceeds $2,6 million, which places it deep in the global ranks at the 1009th spot.

EOSDT market capitalization chart

Such a minuscule market capitalization can be explained by the fact that only 2,6 million EOSDT out of the maximum supply of 170 million coins is now in circulation, which is around 2%. Otherwise, the capitalization of this stablecoin would have reached $169 million. EOSDT is most actively traded on HitBTC and Bitcoin.com Exchange, though the average trading volume rarely goes above $500,000.

- Pros: Stablecoin based on an interesting technology;

- Cons: Small market cap; low trading volume; lack of general interest from traders.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 85.6% | 21 | $62 425.77 | -2.75% | -9.04% | $1 228 814 294 642 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 79.2% | 31 | $3 045.08 | -3.16% | -13.05% | $365 624 192 313 | |||

| 3 | Tether predictions | 94% | 1 | $1.000610 | 0.02% | 0.08% | $108 166 111 258 | |||

| 4 | Binance Coin predictions | 86.8% | 16 | $531.76 | -5.43% | -7.74% | $79 516 436 813 | |||

| 5 | Solana predictions | 75.6% | 41 | $131.62 | -6.67% | -24.35% | $58 780 933 010 | |||

| 6 | USD Coin predictions | 95.2% | 2 | $1.000157 | 0.02% | 0.02% | $32 451 655 106 | |||

| 7 | XRP predictions | 83.2% | 31 | $0.492222 | -0.49% | -20.05% | $27 131 217 183 | |||

| 8 | Dogecoin predictions | 72% | 60 | $0.151891 | -1.24% | -19.46% | $21 858 818 982 | |||

| 9 | Toncoin predictions | 74.8% | 54 | $6.18 | -8.48% | -6.65% | $21 435 081 226 | |||

| 10 | Cardano predictions | 76.4% | 49 | $0.449778 | -2.75% | -25.07% | $16 019 019 570 | |||

| 11 | SHIBA INU predictions | 57.6% | 85 | $0.000022 | 1.58% | -18.57% | $13 152 402 203 | |||

| 12 | Avalanche predictions | 72% | 62 | $33.91 | -6.22% | -28.07% | $12 815 191 018 | |||

| 13 | Lido stETH predictions | 92% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | Wrapped Bitcoin predictions | 88.8% | 20 | $62 395.25 | -2.89% | -9.32% | $9 687 988 113 | |||

| 15 | TRON predictions | 87.2% | 13 | $0.109811 | -1.94% | -9.19% | $9 622 459 361 |