Is it a Buy-the-dip moment for crypto?

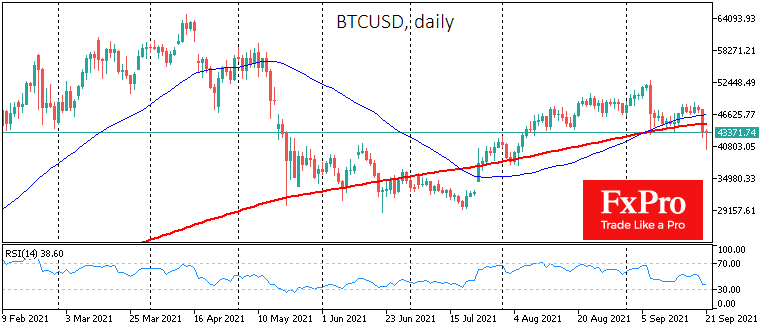

On Monday, Bitcoin lost up to 10%, dropping at some point to $42.4K. This happened against the backdrop of selling pressure on global stock exchanges. Early on Tuesday morning, an avalanche of stop orders had already driven the price to $40.2K and back. These are the lows since the beginning of August. If the market repeats the May correction, it might not be over on the RSI yet. At the same time, it cannot be said that the situation is now completely out of the control of the bulls. The losses of major cryptocurrencies do not exceed 10%, and buyers have clearly appeared in the markets. It is difficult to say now how strong the support will be at current levels.

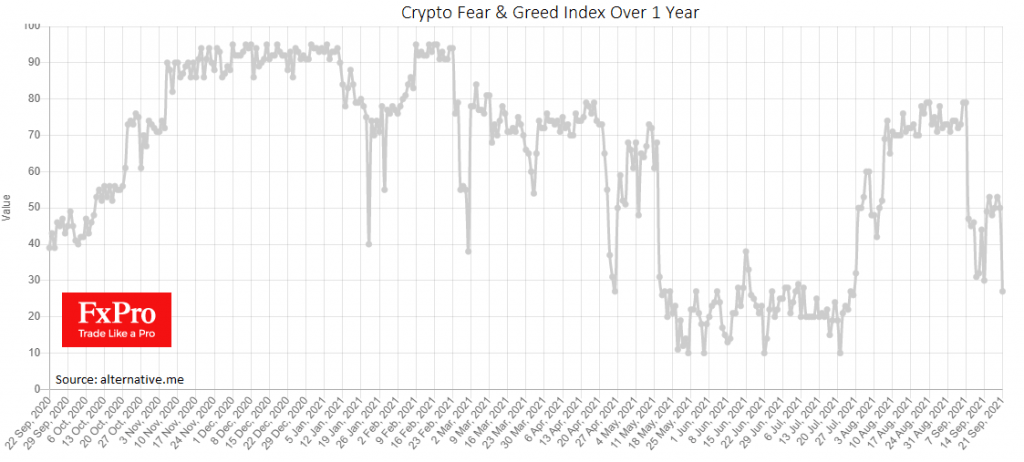

With the arrival of European capital markets on Tuesday, buyers were clearly activated, which allowed Bitcoin to regain its fall from the beginning of the day and gives a chance to fight for a close in the green zone. The cryptocurrency index of fear and greed has now dropped into the fear area at the level of 27, losing 23 points in a day. These are the lows since July 24, when downturn buying intensified in the market.

Bitcoin traders should keep their eye on the $45K level. The ability to quickly recover and go above this mark will indicate the beginning of purchases in the downturn. Anchoring below this line for a week could trigger a significant surrender of bullish crypto enthusiasts. The BTC chart is now below the 200 daily MA ($45K) and has already tested the area under the 21-week MA at $42K with a candle shadow. Both lines are formal signs of a bull market if the chart is above them. Maintaining the second level of support is an extremely important factor in preserving the prospects for further growth.

Many analysts have named the fall in shares of the Chinese developer China Evergrande Group and the sharp drop in the S&P500 as the reasons for yesterday’s collapse of the crypto market. However, for the price to rise, investors need to start buying. At the same time, the dynamics of altcoins and trading volumes before and after yesterday’s fall show that crypto investors continue to buy coins.

If we consider specifically the news about the experimental corporate use of bitcoin in companies in Laos, then the market reacted to this news with extreme restraint. Instead, it didn’t even take them into account. Laos maintains a strong economic and political relationship with China. The PRC, as we know, is categorically against any legalization of cryptocurrencies. Investors understand this and do not believe that Bitcoin can get widespread circulation in this Republic. Still, they are unlikely to want to spoil relations with a key partner in Laos.

Yesterday, as is typical for them, cryptocurrencies lost value with two or three times the amplitude against the background of a decline in US indices. The downgrade had such a large scale, not necessarily because of the strength of the mentioned news, but because of the lack of liquidity during the holidays in China and Japan.

This created an increased demand for liquidity among institutional investors, which led to much more pressure than the situation deserved. On Tuesday morning, the downtrend continued solely due to the automatic triggering of stop orders for long positions. A positive factor that should be considered is that bitcoin and altcoins have been decreasing approximately the same over the last 24 hours. Usually, during serious sales, small coins lose many times more than bitcoin.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 87.2% | 23 | $64 837.84 | 1.21% | 2.14% | $1 276 667 564 847 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 72.4% | 51 | $3 174.86 | 1.45% | 3.51% | $387 485 564 544 | |||

| 3 | Tether predictions | 94% | 1 | $0.999855 | 0.06% | -0.07% | $110 447 532 693 | |||

| 4 | Binance Coin predictions | 85.2% | 20 | $616.92 | 1.30% | 12.17% | $91 050 425 745 | |||

| 5 | Solana predictions | 63.2% | 71 | $147.40 | -1.03% | 5.06% | $65 893 071 142 | |||

| 6 | USD Coin predictions | 90.8% | 2 | $1.000092 | 0% | 0% | $33 248 320 251 | |||

| 7 | XRP predictions | 68.8% | 62 | $0.530614 | -0.21% | 5.70% | $29 252 294 419 | |||

| 8 | Dogecoin predictions | 68% | 60 | $0.153019 | 0.23% | 1.26% | $22 039 903 315 | |||

| 9 | Toncoin predictions | 69.6% | 66 | $5.51 | -0.96% | -15.70% | $19 140 730 708 | |||

| 10 | Cardano predictions | 66% | 72 | $0.475569 | -0.48% | 4.39% | $16 946 387 500 | |||

| 11 | SHIBA INU predictions | 61.2% | 82 | $0.000026 | 1.40% | 15.15% | $15 461 237 537 | |||

| 12 | Avalanche predictions | 66% | 68 | $35.96 | -2.25% | 2.96% | $13 600 508 101 | |||

| 13 | TRON predictions | 86% | 21 | $0.117297 | 3.22% | 7.59% | $10 271 669 223 | |||

| 14 | Lido stETH predictions | 91.2% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 15 | Wrapped TRON predictions | 85.2% | 19 | $0.116953 | 2.88% | 7.58% | $10 241 543 166 |