Monero Price Prediction for 2025 and 2030: Privacy as the Main Driver and the Main Obstacle for Price Appreciation

Alex Paulson

Crypto and Forex professional trader, analyst, contributor.

If you are looking for an altcoin that still has a lot of untapped upside potential, then look no further than Monero (XMR), a privacy coin that has been around since 2014 and went through a lot of trials and tribulations but still remains under a lot of scrutiny from financial law enforcement agencies. But despite the largely unjustified persecution, the price of XMR remains the hot topic among cryptocurrency traders, especially after it had the show of strength last year.

It leaves many traders and investors wondering, what would be the price of Monero in five years? Or ten years? Is XMR a good investment, or will it eventually go under the boot of the regulators? We used our proprietary price prediction algorithm that gauges the market sentiment through the Cryptocurrency Volatility Index (CVIX), projected market capitalization, and extensive market data to deliver the most accurate cryptocurrency price predictions for the next five to ten years. Stick around to find out what will be Monero’s price in the next five to ten years.

2021 started badly for XMR, but things start to brighten up

Monero, and privacy coins in general, are being constantly accused of nearly all mortal sins of the financial world, such as facilitating money laundering, drug trafficking, hacker attacks, the list goes on and on. In all candor, a certain percentage of criminals do utilize XMR for their malicious purposes because of its anonymity properties, but it goes beyond comparison with all those atrocities that are being paid for in fiat. But those who are aware of the benefits that Monero has in store for its users tend to disregard the anti-crypto propaganda and maintain their trust in the most private cryptocurrency that currently exists across the industry.

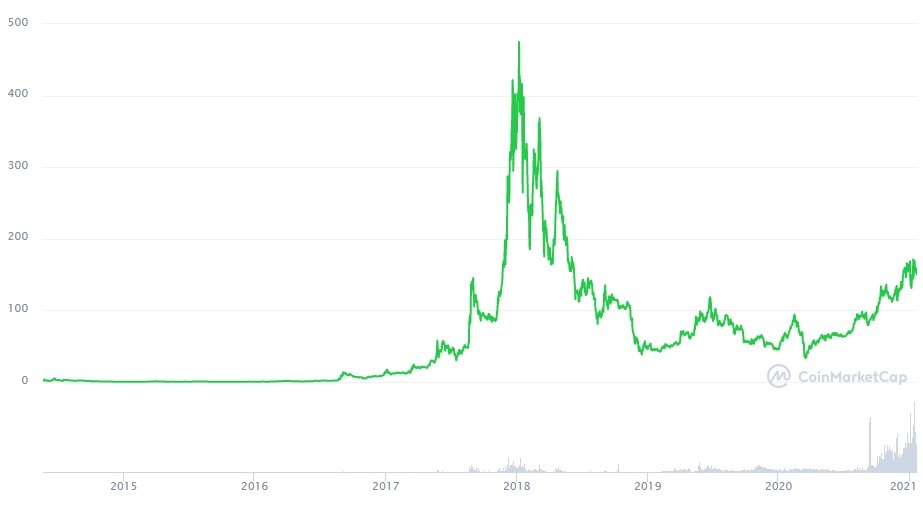

XMR all-time chart. Source: Coinmarketcap

Firstly, let’s check out Monero’s historical chart to have a better understanding of what’s going on in this market on the macro level through XMR’s price history. It’s clear that while a big part of the altcoin market is going through yet another altseason phase - some of the DeFi coins and ETH has already surpassed the respective all-time highs and went on a price-searching trip - the bulls still have a lot of pushing to do before the price of XMR in USD reaches the all-time high that was set at $593.4 back in 2018 when the crypto bubble was on the brink of explosion.

Right now, the price is hanging at $151 that was established after a relatively swift recovery that XMR has made after the popular cryptocurrency exchange Bittrex announced a number of privacy coins, including Monero, were to be delisted for undisclosed reasons.

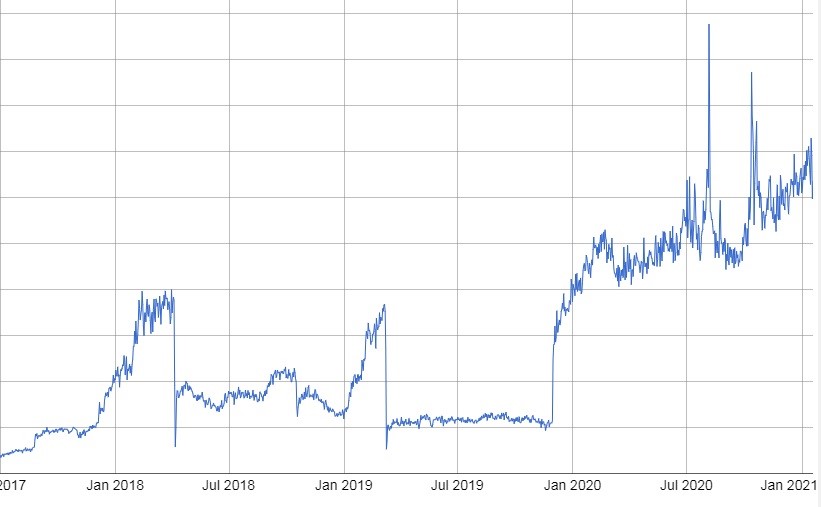

90-day XMR/USDT chart. Source: CoinCodex

It led to a sharp 27% drop of the Monero price at the tail end of the year, which you can clearly see on the 90-day chart above that almost caused a panic sell on the market, but the bulls had managed to keep the support at $130 intact. Upon that, the price had consolidated for a short while only to explode to $190 and establish a new higher high within the framework of the major emerging uptrend.

By the way, last year left us with mixed feelings concerning Monero and its ability to make gains when traded against top cryptocurrencies. Over the past 365 days, the price of XMR in USD has risen significantly - 127%, whereas its performance against BTC (-43%) and Ethereum (-71%) left traders feeling somewhat underwhelmed.

The fact that the price of Monero is lagging behind that of other top cryptocurrencies could speak either of the unrealized upside potential or the inherent weakness of that coin that keeps it from initiating a more powerful rally to cover the 75% distance to the all-time high. In order to understand that, let’s resort to the on-chain analysis.

XMR hashrate chart. Source: BitInfoCharts

The chart above demonstrates that Monero had experienced the explosive growth in her hashrate over the course of 2020, the trend that holds to that day. The exponential growth of the hashrate to the all-time highs was caused by the execution of a hardfork and the introduction of fundamental changes to the consensus algorithm. The soaring hashrate also signifies the increased mining activity, which is nearly always good for the price in the short and mid-term run. Should the hashrate persist in rising in 2021, we might well see the price of Monero covering that 75% distance to the ATH in frog leaps.

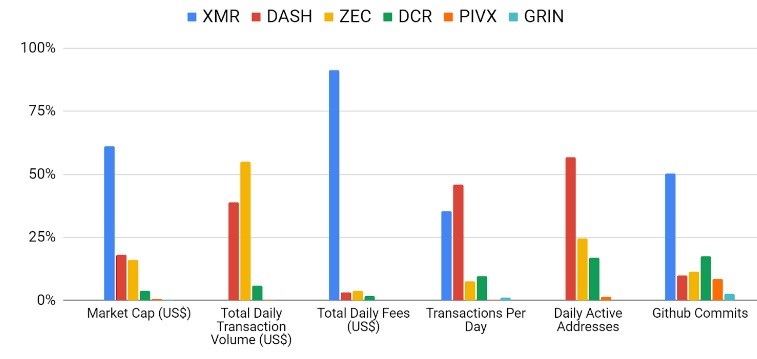

Another chart that compares the stats of different privacy coins with that of XMR shows that the latter dominates in terms of the overall market capitalization, daily fees, and development proposals on GitHub.

XMR/DASH/ZEC/DRC/PIVX/GRIN comparison chart. Source: Coinmetrics

Unfortunately, we couldn’t derive data regarding Monero’s total daily transactions and daily active addresses due to the use of MLSAG signatures that hide such information from the prying eyes, hence making the coin private. But it’s obvious that such a steep rise in daily fees couldn’t have happened without an equally drastic increase in the network activity and the demand for XMR, all of which substantiate the ongoing uptrend and hold the promise of future price appreciation.

But, as we already mentioned, the evolution of privacy coins, and the associated price of XMR, are being held back by ceaseless attacks from regulators. For instance, the US Financial Crime Enforcement Network, an agency that operates under the auspices of the Treasury Department, proposed to further tighten the running knot of the coin’s throat by toughening up the regulatory framework, whereas the US Internal Revenue Service (IRS) has even announced the reward of over $600,000 for those who’d manage to crack the Monero’s privacy setting mechanism. Therefore, traders shouldn’t expect the astronomic growth on the part of XMR in the coming months, especially to the extent showcased by many DeFi coins. The price of Monero in USD will keep on growing, but more slowly and erratically than that of its non-private peers.

1-year XMR price prediction chart

When applied to the Monero market, our price prediction model suggests that the altcoin will encounter some bearish pressure in the next seven to ten days that will lead to a price drop of up to 5%. But after some sideways action that should last for about a month, XMR will resume its journey to the upside, though at a snail’s pace, especially compared to other top altcoins that are booming right now. This assumption is dictated by the showing of our Cryptocurrency Volatility Index (CVIX) that currently stands at 48, meaning that the price swings are likely to be modest, though it also tells us that the majority of market participants aren’t fearful of XMR crashing any time soon.

Our algorithm predicts that in a month, the price of Monero will jump up by 20% and retest the $180 mark. The remainder of the year promises to have the bullish bias to it, as XMR will start going to the upside more decisively, and would presumably end up the year above $330 that would constitute a 123% price appreciation.

1-week XMR/USDT chart. Source: TradingView

This price forecast falls in line with the technical analysis of XMR price action on the weekly chart. We see that the price is now being locked inside the channel that has its support established at $138 and resistance at $190. The fact that the bears couldn’t pressurize the price below the said support on the backdrop of an enormous selling volume that emerged on two occasions over the past four months speaks in favor of the continuation of the existing uptrend in 2021.

But before that, Monero has to break through the resistance that happens to converge with the 38.2% retracement level on the Fibonacci grid. We also see that the price is likely to have a very tough time beating the resistance near $300 that also coincides with the Fibonacci level of 61.8%. But given that MACD is clearly in the bullish stance above the zero line, which hints that the momentum favors the buyers, and is yet to cross even the level at 25, we believe that Monero has enough firepower to maintain the uptrend and finish the year in the zone between 61.8% and 78.6% on Fibonacci, just like our price prediction algorithm suggests.

1-year XMR market cap prediction chart

Similarly to the price action, the market capitalization of Monero will see some substantial growth over the course of the year and end this period at the level of $5.9 billion that might allow the altcoin to climb a few stairs higher in the global cryptocurrency ranks.

Where will Monero find itself by the end of 2025?

Despite the fact that Monero is an underappreciated and persecuted cryptocurrency, we firmly believe that there is a bright future ahead of it, mainly because the people themselves are realizing the value of privacy of not only their sensitive data but also their financial activities. The global coronavirus crisis has shown that the governments are looking for the slightest opportunity to establish control over people’s lives, so those who appreciate personal freedom will surely opt for Monero and other privacy coins. But that isn’t the only fundamental advantage of XMR, but before we proceed with the fundamental analysis, let’s take a look at what our algorithm has to say about the price expectations regarding Monero for the next five years.

5-year XMR price prediction

- XMR will stay on the bullish path in 2022 as its price will increase by 306% and achieve the price level at $611, effectively surpassing the current all-time high, which will put it in the price-seeking mode and open up a window of possibilities for even more significant price appreciation;

- Over the course of 2023, Monero will keep on striving to the upside on the back of the increased demand from retail users and, of course, those who want to evade taxes or otherwise hide their financial activity, which, in turn, will boost the demand for the cryptocurrency under review that already has a substantial amount of its total supply already in circulation. The growing demand will push the price of Monero up by 673% and catapult it to $1164 that might allow the coin to enter the top 10 ranks;

- By the end of 2024, XMR will see its value doubled from that of the previous year - the coin will be traded at $2236 that will mark the 1384% price increase from its current standings;

- Finally, as the year 2025 will draw to its close, Monero will be light years away from where it’s now, floating comfortably above $4000.

From the fundamental standpoint, in five years, Monero might well be one of the few ecosystems that are truly decentralized in nature, something that its team has constantly been striving for and achieving good results through the implementation of such anti-censorship and mining-facilitating solutions as RandomX, a recently implemented PoW consensus that made the network much more secure and private.

Besides, the XMR team is also dedicated to improving the efficiency and the usability of their network, like they did with the Bulletproof Tech that had radically reduced the size of transactions, hence made them significantly faster and cheaper. The improvement in tokenomics and XMR’s efficiency will draw a much larger user base and drive the price to the designated price levels. In addition, XMR will reach its total supply in March 2022 and establish the block reward at 0.6 XMR per block - this mechanism is called “tail emission” - which will make the supply of Monero infinite.

Some might consider it a bad thing since the capped supply (like 21 million in the case of Bitcoin) will make a digital asset more scarce that might have a positive effect on the price. But on the other hand, once the block reward in the BTC network goes down to zero, there will be little to no incentive for miners to sustain the network while being rewarded only through transaction fees, which then will skyrocket. That might cause a great security problem for BTC and the likes, whereas Monero will keep the incentive - even the minimum one - intact and keep the user base, and the demand for XMR, growing.

This comes to show the far-sightedness of Monero developers who make the decentralization and censorship resistance their top priority and have never tried to circumvent it, and who genuinely care about the security of their network. But once again, privacy will be the main driver behind XMR’s price appreciation in the next five years as more people will come to realize that it stands to safeguard every person’s inherent right to privacy in personal life, communication, and finance. The much talked about central bank digital currencies (CBDCs) will only increase the control that the governments will have over the financial activity of their citizens - that will undoubtedly force people to explore the options and Monero will come up as the finest solution there is.

What would be the price of XMR in 2030?

We don’t have the slightest doubt that in the next ten years, Monero will face numerous obstacles set by the regulators who are petrified of having the rapidly growing privacy solution that can take control over the digital money out of their hands. But did you hear of anyone making a remotely successful attempt to crack the Monero code and scoop that juicy reward from the IRS? No, and that’s the point. With all the resources that the US government, the main financial watchdog, has in its possession, the attempts to bring down Monero has proven to be futile. And with the blockchain community being always one step ahead of the hulking but hard-hitting bureaucratic machine, it will surely think of ways to help XMR pull through and enter 2030 stronger than ever. Once the devs implement the atomic swaps feature, the threat of delisting from cryptocurrency exchanges, and the resulting price drops, will be resolved for good.

All in all, we predict that by 2030, Monero will be among the most widely used cryptocurrencies for peer-to-peer transactions, which will effectively put its price above $6000 - a fair price for such a feature-packed coin - where it will stay for the next couple of years.

FAQ

Is now the right time to invest in XMR?

It would be better to buy XMR after a short pullback that is expected to occur soon.

What are the fundamental advantages of Monero?

The answer is quite obvious - privacy.

What is the XMR price prediction for 2021?

By the end of 2021, Monero will be traded at $336.

What will XMR be worth in 5 years?

In 2025, the price of Monero will stand at $4421.

What will be the price of Monero in ten years?

By 2030, XMR will surpass the $6000 price range.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 87.2% | 23 | $64 628.67 | 0.98% | 1.82% | $1 272 549 046 711 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 72.8% | 51 | $3 159.06 | 0.71% | 3.24% | $385 557 858 196 | |||

| 3 | Tether predictions | 92.8% | 1 | $0.999642 | 0.02% | -0.08% | $110 423 991 962 | |||

| 4 | Binance Coin predictions | 84% | 20 | $616.20 | 2.01% | 12.14% | $90 944 101 922 | |||

| 5 | Solana predictions | 64.4% | 71 | $146.66 | -2.12% | 4.60% | $65 562 976 868 | |||

| 6 | USD Coin predictions | 94% | 2 | $1.000055 | 0% | 0.02% | $33 247 081 720 | |||

| 7 | XRP predictions | 67.6% | 62 | $0.529978 | -1.38% | 5.39% | $29 217 248 301 | |||

| 8 | Dogecoin predictions | 70.4% | 60 | $0.152266 | -0.82% | 1.05% | $21 931 506 577 | |||

| 9 | Toncoin predictions | 64.8% | 66 | $5.52 | -1.85% | -14.48% | $19 156 571 239 | |||

| 10 | Cardano predictions | 64.4% | 72 | $0.473390 | -1.24% | 4.30% | $16 868 730 809 | |||

| 11 | SHIBA INU predictions | 60% | 82 | $0.000026 | -0.37% | 14.49% | $15 274 775 352 | |||

| 12 | Avalanche predictions | 67.6% | 68 | $35.87 | -3.04% | 2.84% | $13 565 953 763 | |||

| 13 | Lido stETH predictions | 94.8% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | TRON predictions | 83.6% | 21 | $0.117105 | 2.77% | 7.54% | $10 254 777 324 | |||

| 15 | Wrapped TRON predictions | 84.4% | 19 | $0.116747 | 2.69% | 7.49% | $10 223 468 554 |