Markets have a high fever, Bitcoin doesn’t care

The global economy is watching the spread of the COVID-19 pandemic with bated breath. No one was ready for an invisible coronavirus that throws firewood into the fire of economic instability. Governments around the world began to fight the biological problem through fiscal measures from surprise; it has become the biggest theater of the absurd, and each of us has a ticket in the front row.

Now that China, which seems to have come out of a steep peak and is trying to restart its own economy, is faced with a new problem. At the same time, the demand for physical gold is growing, and Bitcoin is behaving as if it doesn’t give a damn. We offer a look at this situation closer.

Before we begin to dive into the topic, we would like to warn that this article and everything that is discussed below are considerations purely from an economic point of view. We are not epidemiologists, we don’t want to get into politics, we like to collect information, listen to others, watch the performances of much smarter people, put it all together and share with you, dear reader. Despite the fact that everything in this world is interconnected and the economy does not exist in a vacuum, we ask you to understand that all the conclusions presented below put economic processes at the forefront and consider problems from an appropriate perspective.

But what if we initially had made the best decision?

As an investigative experiment, we analyze the following example. No matter how plausible it is, no matter how, if at all possible, this can be done, just imagine: The most painless way from an economic point of view would be to somehow close all the houses for several weeks, and then check everyone for infection, isolate them for further treatment, and let the rest return to their normal working pace.

Even if this unlikely approach was successful, and in the event that there were so few cases of illness that after two weeks the economy fell into place and everything worked, as if nothing had happened, these two weeks would have caused a significant blow to the global economy. The global economy would freeze for two weeks. Losses would reach 4% of global GDP. Do not forget that we considered the most painless option.

But while the market got used to the different behavior of the crisis catalysts, we wrote about why we call COVID19 the catalyst earlier, COVID19 behaves as if it analyzed previous economic downturns and developed immunity to government measures.

COVID19 flows from one country to another. By the time China began to show signs of recovery, the epicenter of the virus was already in the largest economic city in the western hemisphere. Unfortunately, many countries have yet to feel the influence of the virus on their own skin. The essence of the problem is that this behavior of the coronavirus slows down world trade and destroys logistics and trade routes. And if money is the blood of the world economy, then goods are useful substances that this blood carries to the most remote corners of the body, while nourishing every organ. And now we are seeing how the body ceases to receive vital nutrients.

Given the above, it is logical to assume that this situation will not stop in the next couple of months, which, it would seem, most government measures would bet on. World economies do not seem to be “bottomed out” soon, let alone stabilization. A huge role is played by the psychological factor. Remember any other recession in modern history. Their reasons were either a lack of credit or a lack of income. As soon as the government or central banks resolved the issue, the economy began the path to recovery, people went to work, to the park, to the cinema, etc. It is unlikely this time everything can change overnight.

China is back in service, right?

Today, China, as a “pioneer,” can provide important behavioral information. They are trying to restart the economy, they have launched production facilities, catering establishments and cinemas have opened in China, everything seems to be on its way, but here's the interesting thing:

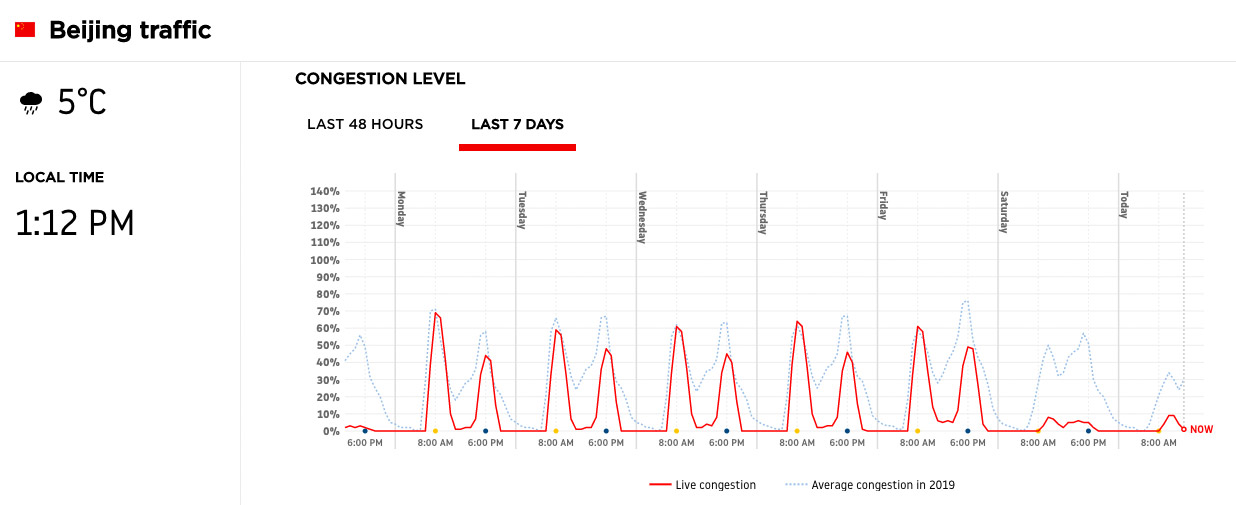

Red line - indicators for this week, Blue dotted line - indicators for the same period in 2019

It is clearly seen that the traffic in Beijing is not too far behind last year on weekdays, when the government forces citizens to go to work. But the streets of Beijing become empty again on weekends.

The psychological factor is a serious obstacle in the struggle of the government against the recession of the economy. In one of the previous articles, we have already said that even “helicopter money” will not bring the expected result. And now we see it with our own eyes. People do not want to leave home unnecessarily and even if the government gives each person one, two, or even ten thousand dollars, they will spend this money on closing holes in the family budget, and not on going to a restaurant or buying a new car.

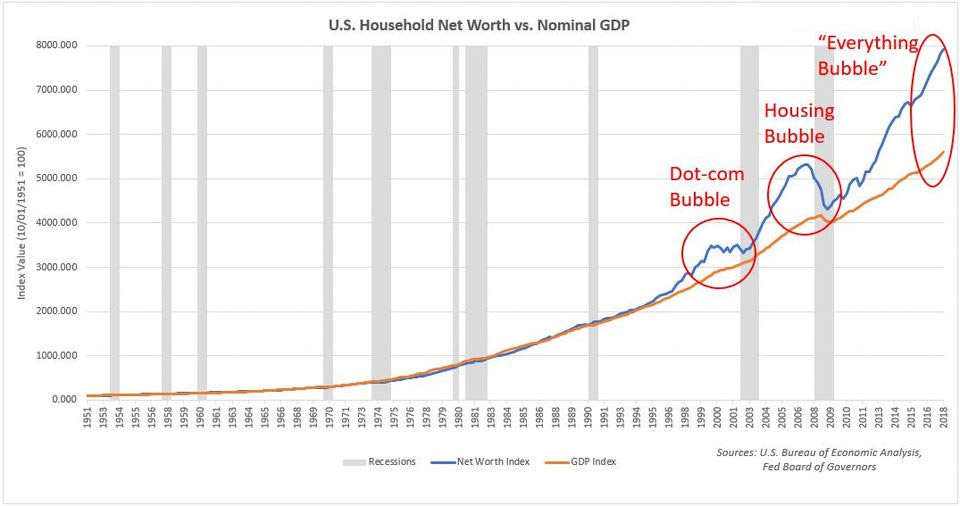

The graph clearly shows the gap between the value of assets (blue line) and US GDP (orange line) and that each peak is followed by a recession.

The problem is that the actions of various ministries are surprisingly not coordinated. Governments are taking some measures, scientists are developing a vaccine, and doctors, as usual, are working overtime. And everything seems to look logical, but coordination not only between different departments, but between colleagues at the international level, is not traced.

And at this time, central banks continue to fight the biological threat with economic instruments.

FED pillow is not so soft

Some graphs clearly show how much more room Fed, and other Central Banks, had for the maneuver and during the previous crisis compared to the current situation. And this is not even mentioning that this time the situation is many times more serious than any economic collapse in modern history.

What's next? And then, the dependence on borrowed funds will inflate to an unprecedented size in all its glory. Every time the government steps on the same rake, only this time this rake is many times larger. In addition, the multiplication of this dependence by the economic problems associated with global quarantine does not paint the most picturesque picture.

Does hard money have immunity to COVID19?

The most proven hard money is gold. It has facilitated trade for about five thousand years. Not surprisingly, following a similar path, this asset is considered a “safe haven” by default.

The derivatives market, securities allegedly backed by physical gold in vaults around the world, all this is nothing more than another mirage. Only physical gold ultimately matters. Everything else will sprinkle like a house of cards.

Physical gold, in turn, carries much less speculative load. It can rightfully speak of itself as a defensive asset. Gold, like a precious metal, has other lines of demand, such as jewelry and industry.

Obviously, physical gold and market instruments based on it have completely different dynamics of supply and demand. And now the demand for a defensive asset naturally outweighs the demand for a speculative one. In a situation where the global economy is collapsing, people need insurance, not a place at the poker table.

Now, as in 2008, there is an increased demand for physical gold. This, of course, is one of the factors causing price increases for this product. Under normal conditions, this arbitration will quickly close due to an injection of capital. Everyone who wants to buy cheaper and sell more expensive will gradually stabilize prices due to competition, but in a liquidity crisis, such a gap can exist for a long time.

Bitcoin is an alternative to gold in terms of hard money, however, it behaved not in the best way in March of this year. We have already discussed the reasons that could lead to a significant drop in bitcoin prices, but maybe the answer is buried somewhere deeper?

Bitcoin doesn’t cate

If you look at the situation through a fairly wide lens, you can see that there is no correlation between bitcoin and macroeconomic indicators. Yes, bitcoin fell, let’s not even talk about the PlusToken drain and the suddenly found thousand bitcoins that have not been moving for 10 years, in unison with the S & P500 indicators, but what didn’t fall?

Bitcoin dynamics compared to gold and S&P500

The wider you look at the situation, the more informed decisions you can make. The bottom line is that when the dust settles, the correlation also evaporates; and while traditional markets worth trillions of dollars will require an unpredictable amount of time to recover due to the unprecedented magnitude of this crisis, Bitcoin feels quite normal. The fundamental properties of the network have not changed, Bitcoin, as it was the hardest money in history, has remained relatively stable. All the same, every 10 minutes a new block appears, and the value of each coin is still determined by the decision of the free market. According to some estimates, at the moment only about 25 million, 0.32% of the world's population, people possess at least some part of bitcoin. What do you think, what will the May Bitcoin-halving, when the bitcoin flow will be halved and new network users will continue to join, lead to in the long term?

It would not be desirable to formulate the thesis as follows, but the crisis even played on Bitcoin’s behalf. More and more people are turning their attention to the first cryptocurrency, and money transfers in bitcoin from the USA to Mexico have already reached 5% of the total. We observe the manifestation of the Bitcoin’s anti-fragility in real time. And the more people pay attention to it, the less of them will lose their savings.

Conclusion

But the bottom line here is not that someone can benefit from the behavior of an asset during crumbling markets. We don’t even want you to follow our “advice”, go and sell all your shares, dollars, gold, sell real estate and buy bitcoins “for everything”. No, we want to convey that Bitcoin, in fact, does not care much for what is happening globally. It does not care for the performance of stock markets, the central banks chairmen’s and major states presidents’ decisions, we are very sorry, but it doesn’t care even as much for you as it doesn’t for us, writing this article. And no matter how inhuman it may sound, in the end it's good. Markets are nothing more than information, and Bitcoin is a tool designed to facilitate trade. The task of Bitcoin is to reflect the value, correctly, impartially, regardless of external factors and in accordance with the information, a set of individual decisions of each market participant, provided. Bitcoin, of course, is not ready to take the place of the dollar or gold right now, but the fact that every day it becomes one step closer to this task is undeniable.

Author: Kate Solano for Сrypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 87.2% | 23 | $64 837.84 | 1.21% | 2.14% | $1 276 667 564 847 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 72.4% | 51 | $3 174.86 | 1.45% | 3.51% | $387 485 564 544 | |||

| 3 | Tether predictions | 94% | 1 | $0.999855 | 0.06% | -0.07% | $110 447 532 693 | |||

| 4 | Binance Coin predictions | 85.2% | 20 | $616.92 | 1.30% | 12.17% | $91 050 425 745 | |||

| 5 | Solana predictions | 63.2% | 71 | $147.40 | -1.03% | 5.06% | $65 893 071 142 | |||

| 6 | USD Coin predictions | 90.8% | 2 | $1.000092 | 0% | 0% | $33 248 320 251 | |||

| 7 | XRP predictions | 68.8% | 62 | $0.530614 | -0.21% | 5.70% | $29 252 294 419 | |||

| 8 | Dogecoin predictions | 68% | 60 | $0.153019 | 0.23% | 1.26% | $22 039 903 315 | |||

| 9 | Toncoin predictions | 69.6% | 66 | $5.51 | -0.96% | -15.70% | $19 140 730 708 | |||

| 10 | Cardano predictions | 66% | 72 | $0.475569 | -0.48% | 4.39% | $16 946 387 500 | |||

| 11 | SHIBA INU predictions | 61.2% | 82 | $0.000026 | 1.40% | 15.15% | $15 461 237 537 | |||

| 12 | Avalanche predictions | 66% | 68 | $35.96 | -2.25% | 2.96% | $13 600 508 101 | |||

| 13 | TRON predictions | 86% | 21 | $0.117297 | 3.22% | 7.59% | $10 271 669 223 | |||

| 14 | Lido stETH predictions | 91.2% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 15 | Wrapped TRON predictions | 85.2% | 19 | $0.116953 | 2.88% | 7.58% | $10 241 543 166 |