Bitcoin Blasts Off But the Shadow of Evergrande is Still Looming Over the Crypto Market

Alex Paulson

Crypto and Forex professional trader, analyst, contributor.

“China,” the word that makes a cryptocurrency investor - and Donald Trump - wake up covered in a cold sweat. Over the past decade, the PRC has been the cause of many turmoils on the cryptocurrency market. The crypto history has it that since 2009, the communist state had imposed draconian sanctions and caused the worldwide FUD on as many as 19 different occasions. As you might remember, the most recent ones involved a total crackdown on the cryptocurrency mining industry which resulted in the so-called “exodus” of miners from China and their migration to Mongolia, Kazakhstan, Canada, and the United States. On September 24, the People’s Bank of China declared that all business activities related to blockchain-based digital currencies are illegal and that all firms that will continue providing financial services involving cryptocurrencies will be investigated for criminal liability.

However, the veteran crypto investors weren’t overly concerned about that crackdown because it’s obvious that China’s days of being a crypto hegemon are numbered, and her attempts to undermine the adoption of the innovative tech solution were to no avail, though they had caused a lot of turmoil. These bans, in many respects, are favorable for the healthy development of the cryptocurrency industry because, in doing so, China is giving away control over the most progressive financial instrument of the past few decades and contributing to the further decentralization of mining. But as this authoritarian government was taking the poisonous bite with its last ounce of strength, something else was cooking in its backyard, a crisis of global magnitude that could potentially send the global economy crumbling while it has been making tiny steps towards recovery from the damage inflicted by the coronavirus pandemic.

Before the first weeks of September, only a few nerds from the entire crypto community heard the name “Evergrande” and understood that it constitutes a threat to the feeble global economy and the cryptocurrency market by association.

In this article, we offer a detailed analysis of the situation around Evergrande, the Chinese housing market, and the potentially harsh impact on the cryptocurrency market. Spoiler alert, the cryptocurrency that finds itself between a rock and a hard place is not Bitcoin (BTC) - although should a certain substance hit the fan, the entire crypto market would be affected - but a stablecoin with the largest market capitalization among its peers. Nevertheless, a thorough analysis of the occurrences on the BTC market is required here because it remains a guiding light for the entire industry, and should it start tanking, which remains a possibility despite the ongoing jolly rally, the entire market would follow its suit. But we have already gone a bit ahead of ourselves, so let’s start with the analysis of the current situation on the Bitcoin market with the transition to the matters related to Evergrande.

Bitcoin is back at $55,000: a usual Uptober rally or a burst before the collapse?

The price of Bitcoin (BTC) is now exhibiting the first major rally since September 6, when a confident thrust to the upside from the critical support level at $29,100 had been disrupted by yet another piece of bad news coming from China, which continues to be the bogey state for the crypto industry. But this time, the news had sent shockwaves throughout all financial markets and industries as it brought to light the emergence of the property debt crisis, the scale of which reminded many of the 2008 subprime mortgage crisis and the subsequent implosion of Lehman Brothers, the now-bankrupt investment banking company that was the fourth largest investment bank in the United States, that resulted in the biggest meltdown of the global economy in the modern history and the financial crisis from which the economy had just managed to recover before the coronavirus had arrived.

Obviously, the dismay of such magnitude has had a profound effect on the Bitcoin market as the price had experienced a cascading 25% correction below $40,000 and even threatened to go much lower as other financial markets began to look down the cliff after the once steady uptrend had been disrupted.

S&P 500 weekly chart. Source: Tradingview

You can see on the weekly S&P 500 chart above that the index that tracks the performance of the 500 biggest companies had dropped by 6.5% over the past five weeks, with the beginning of the decline occurring right when the news regarding Evergrande flamed up the headlines. This marked the largest price degradation since August 2020 that resulted in the disfigurement of a smooth uptrend.

The situation on the Bitcoin market has been unfolding in a totally different fashion, which also proves that the once strong correlation between these markets is no longer relevant as the dominant cryptocurrency has successfully defended the support level at $40,000 and posted a 36% rally over the past two weeks and negated the bearish forecasts. As a result, the market capitalization of BTC has once again passed the $1 trillion benchmark.

BTC/USDT weekly chart

Many analysts have been anticipating such a bullish behavior on the part of Bitcoin at the beginning of October because of BTC’s propensity for price hikes in this particular period, which is the reason why October has been nicknamed “Uptober” by the crypto community. The data related to historical monthly returns of Bitcoin shows that from 2013 until now, the first cryptocurrency had finished this period in the red only on two occasions: -14.94% in 2014 and -3.91% in 2018. On other occasions, Bitcoin had been nothing but bullish: 54.84% in 2013, 36.7% in 2015, 18.75% in 2016, as much as 54.45% in 2017, prior to the infamous crypto winter, 10.65% in 2019, and 27.92% in 2020, when the price was on the threshold of the last bullish cycle.

But even though everything seems rosy on the chart, as Bitcoin appears to be preparing to recapture the $60,000 area in the coming days, as the graph clearly shows, the same historical data suggests that in the past three years, November has been more of a month of bleeding for BTC as it had shed 37% in 2018 and 17.43% in 2019.

Besides, if you check the trading volume on the back of which the rally is occurring, you will notice that it has been declining since its very start, which suggests that the price spike could be unsustainable. And despite numerous crypto analytics, like PlanB, the creator of the famous Stock-to-Flow model, suggesting that BTC is on its way to new all-time highs: he predicts that Bitcoin would reach $63,000 by the end of October, $98,000 in November, and $135,000 in December (his predictions for August and September price levels were spot on), they can’t predict the impact of macroeconomic factors, which, as the situation with the COVID-19 pandemic has shown, always have a profound effect on the cryptocurrency market, especially now that crypto is becoming more and more intertwined into the fabric of the global economy. Therefore, it’s of vital necessity to understand how and why Evergrande got itself in this sticky situation.

The inflation of the Chinese housing bubble and Evergrande’s path from riches to rags

In order to get a better grasp of the magnitude of the unfolding crisis and the role that Evergrand plays in it, it's of vast importance to dive into the origins of the real estate bubble in China - how it emerged and how it could impact the entire world. After all, it was the unprecedented growth of that bubble that made it possible for Evergrande to first become the second-largest property developer in Asia and then the most indebted real estate company in the world that casts a shadow over its entire economy. There is absolutely no doubt that this market is in a bubble; in fact, it might be an understatement, because the rate at which it has been developing is truly staggering - it's a bubble of epic proportion, and should it pop, everyone, including crypto, will get hurt.

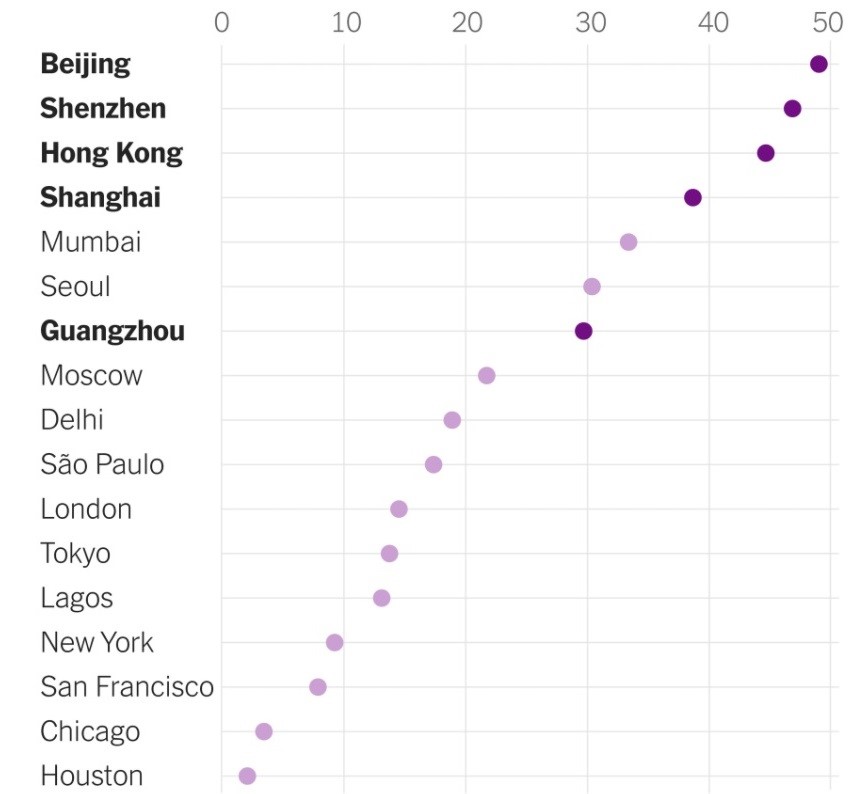

Some experts compare it to the real estate bubble that occurred in Japan in the 1980s, but the key difference lies in the property price to average annual income ratio. According to numerous reports, the apartment prices in the city of Shenzhen are the mind-blowing 57 times higher than the average annual income in China. In Beijing, this number goes to 55 times the average income. In comparison, at the peak of the bubble formation in Japan, the price of an apartment in Tokyo was "only" 18 times higher than the average annual income. When the bubble in Japan had popped, its real estate and stock markets had tanked to all-time lows, a crisis that was worsened by the 2008 recession. This period came to be known as the "lost decade" as it took Japan nearly 12 years to recover to being close to the pre-bubble levels.

Ratio of property prices to household income across major cities of the world

As you can see, major Chinese cities occupy the top of this chart, which is a huge red flag that the bubble has reached epic proportions and is about to pop. In fact, it even overshadows the showings seen on the eve of the "perfect storm" that had hit the world in 2008.

Nevertheless, for years, the economy of China has been growing at a much better pace than that of the rest of developed countries, which allowed the government to sustain the bubble as the income of the middle-class families has been increasing rapidly enough for them to be able not only to cover the mortgage payments but also to acquire new property.

In fact, the market had been so "on fire" that the off-plan units in major cities had been selling like hotcakes. For instance, according to the reports from March, nearly 300 apartments in Shenzhen's prestigious area were sold online in - wait for it - less than 8 minutes! The apartment resales in Shanghai were also beating all possible records; people were buying hundreds of condos in Suzhou in record time. In one instance, thousands of people had put down a deposit of over $100,000 for the apartments in the same Shenzhen to be qualified to buy the property in two-to-three years' time.

The reason why the Chinese have been buying property like there's no tomorrow, and instigating the exponential growth of that market, lies in the fact that they perceive it as a lucrative investment.

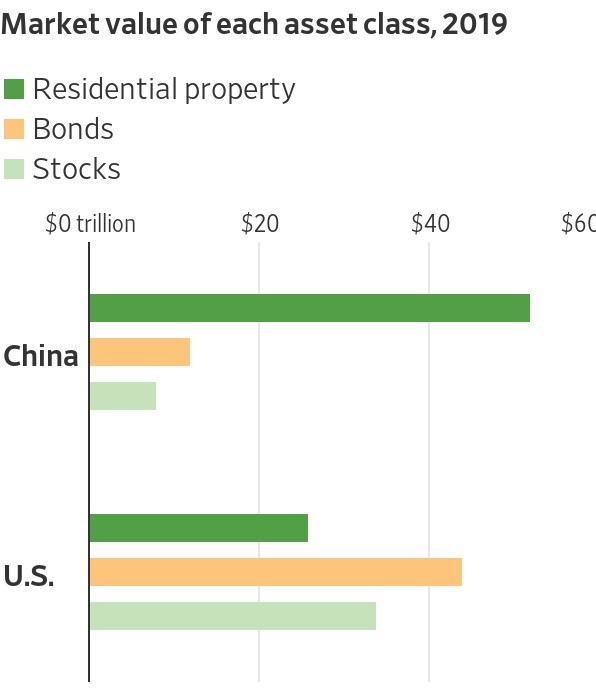

Source: Goldman Sachs

There is an interesting chart published back in the day by Goldman Sachs, which shows that the Chinese own far more residential property than their U.S. counterparts and practically disregard bonds or stocks. We are not sure whether it's a cultural or a mentality thing, or whether it's considered unsafe to hold such financial assets in an authoritarian country, but the fact remains that real estate is the best store of value in the PRC, certainly better than Bitcoin, especially in the wake of all those nagging bans.

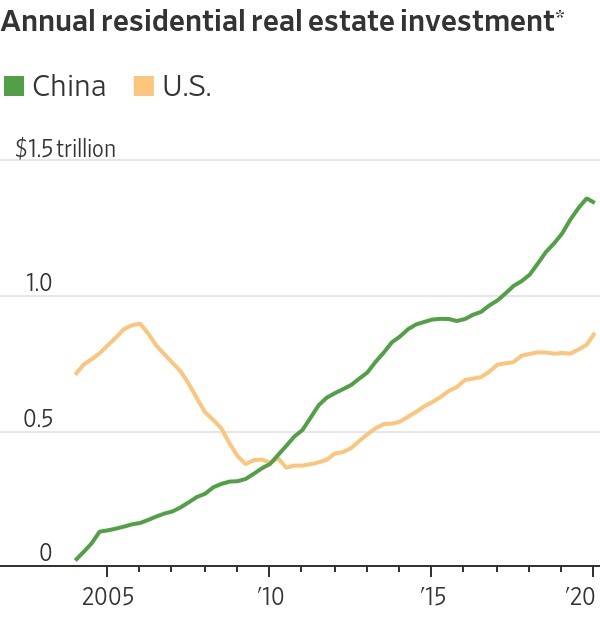

The People's Bank of China reported that nearly 96% of households in the country have at least one home in their possession, which is almost double the house ownership rate registered in the United States (65%). The stats also has it that the yearly investment in real estate in China reached $1.4 trillion this year, which is 3.5% more than the annual investment into that market in the United States, recorded at the peak of the infamous bubble.

However, when seeing the price of real estate rising continuously, the representatives of the Chinese middle and upper class began perceiving property as an opportunity for speculation. There was a popular, and as it turned out, an erroneous belief that real estate is the ultimate hedge against the possible economic downturns as they thought that the property prices would climb uphill forever - a typical mistake of the "bubble victims."

Source: FactSet

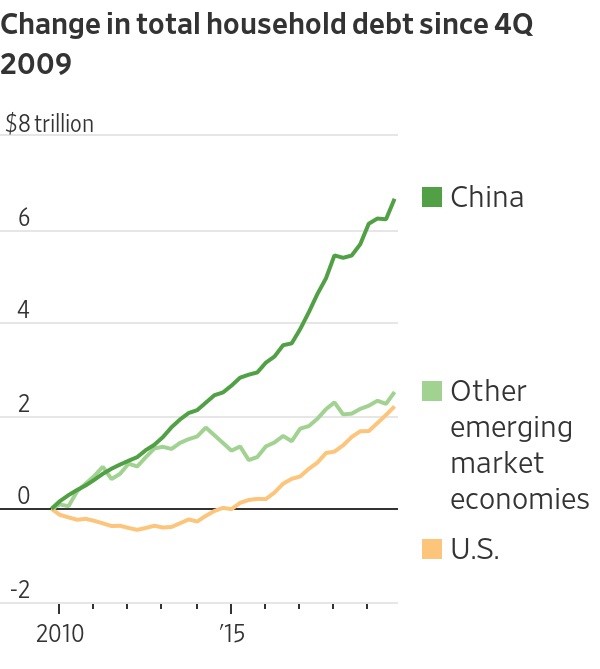

This belief has been forming over the past couple of decades, as the chart that represents the annual residential real estate investment shows. What's interesting about it is that the Chinese began to actively participate in the property market right when the one in the United States had been crumbling. Ironically, only two decades ago, the communist law had explicitly forbidden the overwhelming majority of citizens to own property - this legislation was repealed in 1998, and since that time, the ownership, and the household debt, have been rising exponentially, to the extent that it currently exceeds the collective debt of all emerging market economies and that of the United States by light years, as shown on the chart below.

Source: Bank of International Settlements

Over the past decade, China's share in global household borrowings had soared to 57% in contrast to that of the United States, which amounted to a mere 19%. In effect, the growth of the bubble led to a significant increase in property prices and the cost of living in general.

The first signs of trouble emerged when the pandemic was announced, and the global economy had entered the freefall state. As the housing sales tanked by nearly 40%, the first ones to swallow the bitter pill of bankruptcy were 200 smaller developers, while the top-tier ones like Evergrande resorted to introducing considerable discounts to stimulate sales on the one hand, and on the other hand, they induced into a more vigorous borrowing.

What is interesting, though, is that the government of China, with Xi Jinping at its helm, didn't lift a finger to halt the growth of the housing bubble. In fact, it benefited vastly from the revenue that came from the land sales and the taxes that were imposed on developers. Besides, people were happy to park their wealth in such a "solid" asset class as real estate and not some pesky cryptocurrencies. This has resulted in a situation where the government is witnessing the development of the biggest financial crisis in the history of the communist state, and probably the history of humankind for that matter, but can't do much about it, at least with the use of methods that are conventional in the capitalist countries, like the practice of bailing out the companies or banks that are mistakenly deemed "too big to fail."

The Party can't use this leverage because it would create a dangerous precedent for other big firms in this and other industries, much like it did in the U.S., nor it can intervene and try to deflate the bubble "manually" through legislative framework because, as already mentioned, real estate is the citizens' favorite investment option, and deflation of the bubble would result in the nearly instant annihilation of savings and wealth of millions of people - it might well be the Tiananmen Square once again. But as the story of another now-disintegrated huge communist state had proven, the will of the Party can't beat the economic laws, no matter how hard it tries. And this is where the Evergrande tale begins.

The Evergrande tale that is far from being a fairy one

Founded in 1996, Evergrande is one of the three largest property developers in China, along with Country Garden and Greenland Holdings. Its founder, the Chinese billionaire Xu Jiayin, got into the property development business on the ground floor because the 90s was the period when mass urbanization had begun across the country, which is the reason why the company started to grow at an astounding pace. No wonder that Xu Jiayin was at one point the wealthiest man in China, as his net worth had soared after Evergrande went public in 2009.

Throughout the years, the company accumulated nearly 600 million square meters of development land in all major cities in Mainland China. Before the crisis unfolded, Evergrande had been running 1,300 development projects in 280 cities and towns, and employed nearly a quarter of a million people, and hired almost 4 million as contractors and subcontractors.

With a revenue of over $77 billion, as of 2020, the company didn't restrict its operations to property development. In the past decade, Evergrande got involved in numerous industries for the purpose of diversification: it had built two huge theme parks; in 2010, purchased the sports team Guangzhou F.C., and poured tons of money into it that helped to propel the club to the Asian elite; the corporation got heavily involved in the automotive industry and introduced the brand of electric vehicles called Hengchi and began developing charging stations. It had also established a strong foothold in such industries as healthcare (Evergrande Health), agriculture, finance, and entertainment - not a bad diversification bouquet for the company that already dominated the real estate market.

But as you might have already figured out, a significant portion of these ambitious projects was fueled by reckless borrowing that resulted in the accumulation of a staggering debt of $300 billion that Evergrande owes to 171 Chinese banks and 121 financial services companies, which ultimately made it the most indebted property developer in the world.

The developer has been piling on debt in many forms, including bank loans, bonds, and international (USD) bonds. But it had a special place reserved in its debt pile for commercial papers, which is an unsecured form of promissory note that pays a fixed interest rate. Commercial papers are generally issued by large financial institutions and corporations to carry out short-term financial obligations.

Evergrande had been issuing these papers en masse and giving them left and right to its suppliers and contractors, who had gladly accepted them because, at that time, these promissory notes were considered immensely secure. At some point, the Evergrande commercial papers were used as an unofficial currency since those contractors and subcontractors used them to settle their financial matters with other market participants. Other Chinese development corporations have also issued commercial bills, but none of them were even close to matching Evergrande's printing machine. For instance, in 2020, Evergrande issued 205.7 billion yuan worth of commercial papers, while its closest rivals, the mentioned Greenland and Country Garden, created the unsecured debt bills worth only 21.1 billion yuan and 19.3 billion yuan, respectively.

Last year alone, the corporation borrowed $107.4 billion from banks and trust firms to finance its aggressive expansion to other industries. There is nothing wrong with borrowing large, especially in big business, but as Robert Kiyosaki puts it, "The debt is okay if used wisely," which is obviously not the case when it comes to Evergrande. As mentioned above, the coronavirus pandemic had pulled the rug from under the feet of many property development companies, including the one in question.

According to experts' reports, the company's operating income had declined by 75% in 2020, compared to the earnings in 2018, and also saw its gross margin diminish significantly. Therefore, it possessed only a fraction of previous income, but no one had exempted it from the obligation to pay interest on its outstanding debt.

The rumors about Evergrande being unable to fulfill its obligations began circulating among traders in the middle of the summer as Chinese courts began freezing the company's deposits at the request of several banks that wanted to secure at least some form of collateral. The global rating agencies like Fitch had immediately reacted to these developments and downgraded Evegrande's credit rate all the way to CCC-, which signifies the near-default state of the company.

1-month Evergrande price chart

Obviously, the price of Evergrande shares reacted immediately and not in a favorable way. As you can see on the chart above, the price had already been in a downtrend upon peaking at $32 in 2017, but after the emergence of the news about the possible default on its debt obligations, it had tanked from around $12 all the way to $2.95, an 88% drop since the beginning of the year.

And after the firm missed an important bond interest payment, the Hong Kong Stock Exchange (HKEX) has suspended the trading of Evergrande shares amid the rumors of a major deal regarding the acquisition of a majority (51%) stake in the corporation's core management arm, Evergrande Property Services Group. It's believed that the potential buyer is Hopson Development Holdings, the Beijing-based real estate private company, as its shares have also been suspended from trading in anticipation of the "merger or a takeover."

Various media outlets speculate that Hopson Development is prepared to lay out $5 billion for the said share. But even if this deal pans out, it would solve only a part of the burning problem that might cause a contagion effect across global markets since there are numerous counterparties that could suffer greatly if even a partial default is to occur. The mentioned commercial paper might pose a huge problem for those that have been involved in this grey remittance system. Besides, such a low price tag on the majority stake in the company's crucial division means that it's trying to organize a fire-sale of its assets in order to cover at least a part of its liabilities. With stakes out of the picture, the only asset class that Evergrande could sell to raise some more capital and relieve the liquidity crunch would obviously be its vast amounts of property. But in that case, the hasty sale might result in a property crash that would be felt by everyone from Beijing to Lisbon, not to mention the property developers in China itself and all those citizens that have been speculating on the real estate market. Let's not forget that there are many investment firms outside China that hold a large portion of Evergrande's dollar bonds. These include Ashmore Group, BlackRock, UBS Group, and HSBC Holdings - these holdings alone amount to $1.2 billion. The contagion effect has already shown itself on the Hong Kong property stocks that had recorded the biggest loss since the inception of the coronavirus pandemic. And if this effect is to spread, the emerging markets would suffer a great deal, and that includes the cryptocurrency market.

The Chinese connections of USDT

Despite what Bitcoin or crypto maximalists might say, cryptocurrencies are far from being a safe haven and a hedge against mishappenings on the global financial markets or in other macroeconomic areas, as the crises of the past two years have clearly demonstrated. To those who don't have diamond hands, BTC is still a risky asset that has to be dumped when push comes to shove. And despite Bitcoin's current uncorrelated rally above $50,000, its correlation with the gold and other equity markets has been growing tighter. And in the situation when the Asia-based funds would be forced to lighten up their portfolios to cover the losses incurred even by a partial default of Evergrande or other Chinese developers, crypto would be the first item on their portfolio to get on the chopping block.

Besides, it's obvious that even though the Chinese government has been slapping a ban after a ban on the crypto market, there are still plenty of retail investors in that country who hold vast amounts of crypto that they would immediately sell to settle their debt if the full-blown property crisis ensues.

But the possible Bitcoin selloff isn't the biggest concern because that market has survived all kinds of hardships. What's more worrisome is the presumed exposure of the largest stablecoin, USD Tether (USDT), to the Evergrande-related risks.

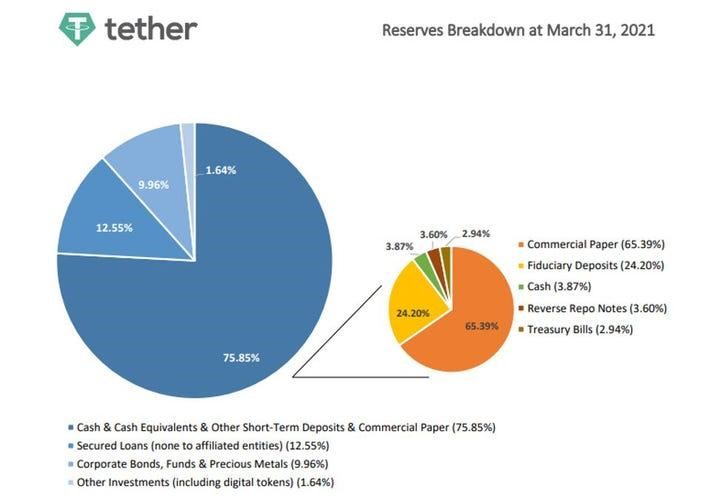

According to an attestation report issued by the audit and assurance services company Moore Cayman on June 30, Tether Holdings Limited has consolidated total assets in the amount of $62 billion - $68 billion at the time of writing. Out of those $60 billion, $30.8 billion (nearly 50%) is held in the form of commercial paper and certificates of deposit. There are two main reasons as to why Tether might be holding nearly a half of the assets that are backing USDT in commercial papers: the company wants to earn interest on these papers, or it's was forced to put the money in those papers because not a lot of banks would be willing to provide custody to such a hefty sum to a company that is constantly under fire from financial regulators.

There is no definitive way of telling whether the commercial papers or corporate bonds mentioned in the report came from Evergrand, but the possibility of that is quite high. And even if it's only a small fraction, the knowledge that Tether reserves are backed by securities issued by the failing company would further spoil its already tainted reputation and create a lot of doubt regarding the practicality of holding this stablecoin. Let's assume that there is not a single Evergrande paper or bond there - even then, the mentioned contagion effect could have a detrimental impact on the coin that forms the majority of crypto/stablecoin trading pairs and represents a key component for Bitcoin liquidity. The market capitalization of its closest rival, USD Coin (USDC), is $31.7 billion.

To summarize, should the Evergrande situation invoke a crisis of confidence in USDT, the trading volume across all cryptocurrency markets might decline significantly and result in a systemic liquidity crisis. This comes to show that despite its opposition to the traditional financial system, cryptocurrencies are growing more reliant on macroeconomic factors, which must be taken into account when investing in this asset class.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 84.4% | 25 | $64 236.27 | -3.80% | 4.75% | $1 264 805 139 574 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 73.2% | 49 | $3 158.67 | -3.04% | 5.31% | $385 509 306 079 | |||

| 3 | Tether predictions | 91.6% | 1 | $0.999852 | -0.02% | -0.04% | $110 447 216 461 | |||

| 4 | Binance Coin predictions | 88.4% | 18 | $606.93 | 0.03% | 10.61% | $89 575 802 259 | |||

| 5 | Solana predictions | 67.6% | 71 | $147.73 | -6.78% | 10.27% | $66 040 427 220 | |||

| 6 | USD Coin predictions | 93.6% | 2 | $1.000087 | 0.01% | 0.02% | $33 443 613 205 | |||

| 7 | XRP predictions | 66.8% | 62 | $0.527628 | -4.06% | 6.49% | $29 087 702 292 | |||

| 8 | Dogecoin predictions | 70.4% | 60 | $0.151351 | -6.56% | 2.44% | $21 798 428 537 | |||

| 9 | Toncoin predictions | 65.2% | 66 | $5.53 | -4.40% | -9.19% | $19 201 948 482 | |||

| 10 | Cardano predictions | 65.2% | 72 | $0.476617 | -6.22% | 5.71% | $16 983 732 684 | |||

| 11 | SHIBA INU predictions | 61.2% | 82 | $0.000025 | -7.12% | 14.30% | $14 877 091 584 | |||

| 12 | Avalanche predictions | 68% | 66 | $35.76 | -9.52% | 3.68% | $13 516 558 275 | |||

| 13 | Lido stETH predictions | 96% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | Polkadot predictions | 71.2% | 64 | $6.96 | -6.08% | 4.48% | $10 002 091 467 | |||

| 15 | TRON predictions | 84.8% | 21 | $0.114080 | 0.56% | 3.81% | $9 990 510 318 |