Algorand (ALGO): The Upgrade Expectations Pushed the Price to Year’s High

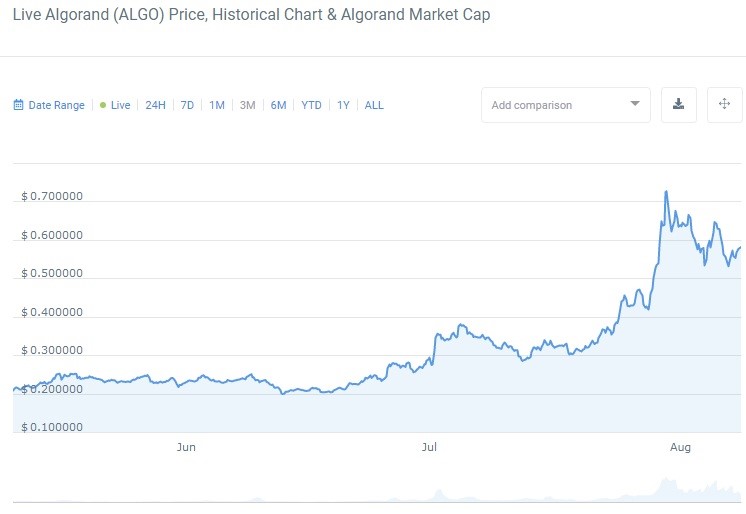

After more than a successful month, during which the price had risen from $0.3 to $0.72, which constitutes the 150% growth in a matter of just 11 days, Algorand (ALGO) has already begun to retrace, cutting the gains from the past month to 75% against USD and 42.5% against Bitcoin.

Forming a bullish flag after reaching new heights

3-month ALGO price chart

The reason behind such an impressive rally lies in the recently released upgrade of the Algorand network that is said to help the project to make the transition to decentralized finance through the incorporation of smart contacts at the base layer, along with such features as fast catchup and re-keying. The news regarding the upgrade was announced on August 19, but the price had risen significantly prior to that, incentivized by the expectations around ALGO becoming a part of the powerful DeFi movement.

The rule of thumb in trading says to buy the rumor and sell the news, which is true in the case of ALGO as its price has been making lower highs ever since the rejection at $0.75, accompanied by decreasing trading volume, and the buying volume in particular, which is nearly always the sign that the bullish momentum has been extinguished for the time being.

1-day ALGO/USDT chart

At the same time, the key technical indicators are also flashing bearish signals that suggest the possibility that the ongoing retracement could end up going below the current support level at $0.5, which the price has been testing quite well during the last six days.

- MACD has already made a bearish crossover, and since the indicator is now high in the overbought area, we are expecting a fall to the zero line that would ultimately drive the price below $0.5, possibly to the interim support at $0.47 that would still make for a healthy retracement and the preservation of the uptrend structure. The increasing red histogram only confirms that the bearish momentum will start building up;

- The bearish narrative is also supported by RSI that has formed a very distinctive hidden bearish divergence, which is not as strong a sell signal as the proper divergence, but in combination with showing described above, it makes the overall situation clearer.

Presently, it is important to see how the price behaves near these key support levels and have a stop-loss in place in case Algorand decides to take a nosedive.

- $0.5 - if the price resolves the bullish flag to the upside without descending below that support, it will come as a great show of strength on the part of the buyers; thus, the uptrend will persist with new force;

- $0.47 - as already mentioned, this level is the last bulls’ stronghold at that juncture, maintaining which would keep the uptrend structure intact;

- $0.39 - descending to that level would entail either a prolonged consolidation or the fully-fledged trend reversal.

To summarize, Algorand has already proven itself as a fairly strong gainer that could be further incentivized by the entrance into the DeFi space. The trading tactic here is quite simple: watch out either for the breakout of the bullish flag or the descent to $0.5 or $0.47, at which point, ALGO will provide clearer signs of its intentions.

Author: Alex Paulson for Crypto-Rating.com

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 84% | 27 | $64 203.15 | 3.45% | -4.71% | $1 264 004 464 139 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 78.4% | 45 | $3 065.06 | 2.10% | -5.73% | $368 028 026 393 | |||

| 3 | Tether predictions | 92.4% | 1 | $1.000489 | 0.01% | 0.02% | $109 523 072 665 | |||

| 4 | Binance Coin predictions | 88% | 18 | $562.11 | 3.35% | -4.12% | $84 053 571 260 | |||

| 5 | Solana predictions | 74.8% | 51 | $143.82 | 3.67% | -6.14% | $64 261 307 327 | |||

| 6 | USD Coin predictions | 92.8% | 2 | $1.000074 | 0% | 0% | $33 905 462 667 | |||

| 7 | XRP predictions | 70% | 58 | $0.512745 | 5.10% | -5.94% | $28 267 200 418 | |||

| 8 | Dogecoin predictions | 68% | 59 | $0.156598 | 5.98% | -9.17% | $22 543 595 430 | |||

| 9 | Toncoin predictions | 67.6% | 64 | $6.11 | -8.47% | -10.27% | $21 225 942 606 | |||

| 10 | Cardano predictions | 72.8% | 60 | $0.489311 | 10.25% | -3.74% | $17 431 544 156 | |||

| 11 | SHIBA INU predictions | 58.4% | 85 | $0.000023 | 5.53% | -5.27% | $13 674 804 188 | |||

| 12 | Avalanche predictions | 72.8% | 60 | $35.59 | 5.13% | -7.86% | $13 453 046 997 | |||

| 13 | Lido stETH predictions | 90.8% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 | |||

| 14 | Wrapped Bitcoin predictions | 82.8% | 31 | $64 142.82 | 3.15% | -4.98% | $9 966 750 805 | |||

| 15 | Polkadot predictions | 72.4% | 57 | $6.78 | 3.72% | -6.69% | $9 726 046 193 |