Stocks Surge to New Highs Amid Dovish Fed Stance, While Cryptocurrencies Experience a Retreat

Kate Solano

Accomplished fintech journalist and analyst.

In a week marked by significant market movements, stocks raced to all-time highs, driven by a dovish stance from the Federal Reserve (Fed), while the cryptocurrency market experienced a notable retreat. These contrasting trends offer insights into the dynamics shaping the financial landscape as we approach the year-end.

Cryptocurrency Volatility

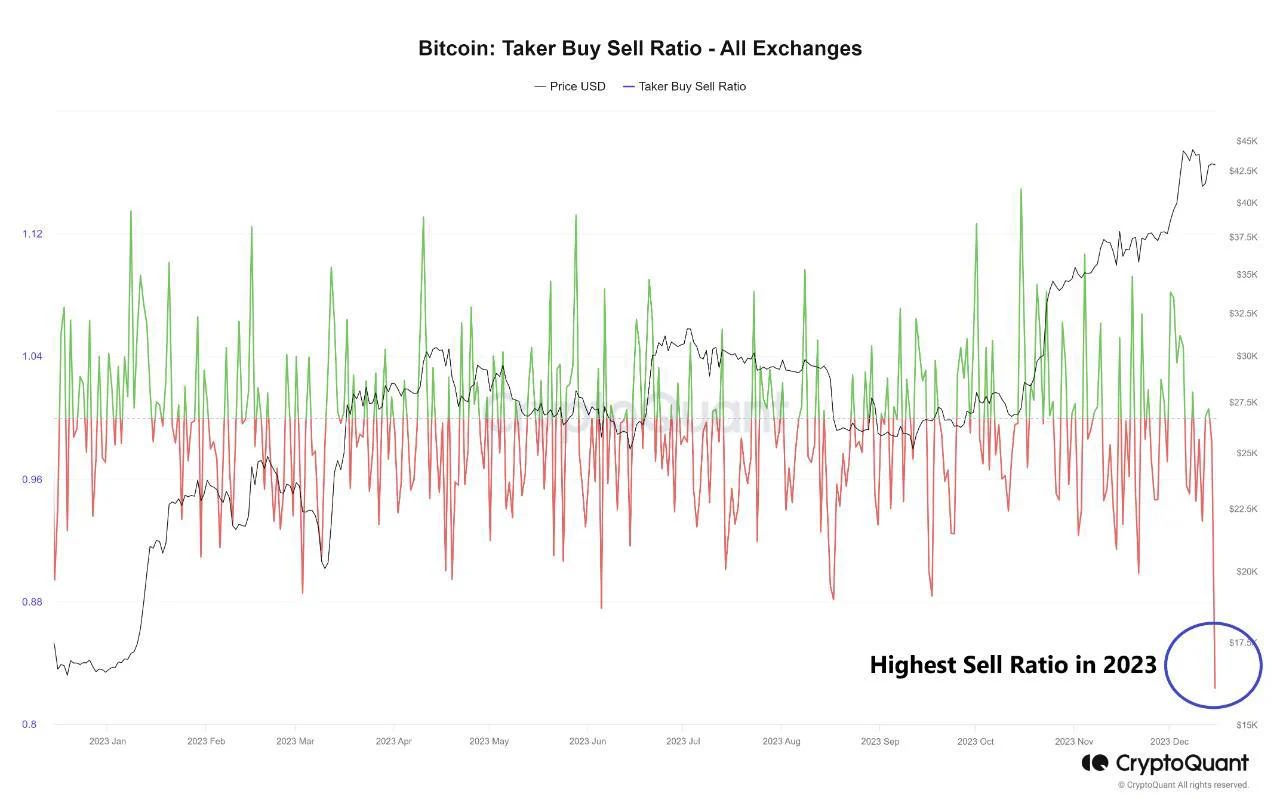

The cryptocurrency market witnessed one of the most substantial dips of the year, primarily triggered by Bitcoin's sudden drop in price. Investors became jittery as the slightly hotter-than-expected Consumer Price Index (CPI) data was released, leading to short-term investors exiting the market. The anticipation of year-end activities and the looming Fed meeting added to the market's unease.

Meanwhile, borrowing activities among altcoins surged early in the week. Airdrop farmers on popular DeFi protocols leveraged substantial amounts to short the market, generating trading volume to accumulate points for future airdrops. This heightened activity resulted in a widespread price correction among altcoins that had recently experienced substantial gains, including AVAX and SOL, which had become overbought.

Market Reset and the Fed Meeting

The market-wide correction played a beneficial role by resetting open interest and funding rates to neutral levels, aligning perfectly with the Federal Reserve's meeting. As anticipated, the Fed left interest rates unchanged. Fed Chair Powell's comments further boosted risky assets by noting that inflation was falling faster than expected, leaving room for potential rate cuts in the coming year.

Most officials now expect three rate cuts in 2024 as inflation inches closer to a 2% target. Fed Governor Christopher Waller even suggested that rate cuts could commence in the spring if inflation performs well, encouraging investors to increase their long positions.

Cryptocurrency Recovery

Following the Fed meeting, cryptocurrency prices rebounded strongly, with Bitcoin briefly touching $43,000. Altcoins also followed suit with even more robust recoveries, erasing the losses seen earlier in the week. Notably, AVAX and INJ stood out as the strongest performers, surpassing their pre-dip prices. However, the inability of both Bitcoin and the majority of altcoins to reach new highs hinted at potential exhaustion in the two-month rally, especially with the traditionally bearish final two weeks of the year approaching.

While short-term traders took profits and late leveraged longs faced liquidation, long-term whales continued to accumulate Bitcoin.

Whales Accumulating Bitcoin

Large Bitcoin whales capitalized on dip opportunities to accumulate substantial amounts of BTC. The past week witnessed a significant accumulation of approximately 150,000 BTC units, signaling strong confidence among long-term whales regarding BTC's future price trajectory. As the year-end holiday season neared, increased selling pressure was observed across the market, as traders naturally locked in profits, causing Bitcoin's price to drop from $43,000 to around $41,000.

CME Gap and Market Sentiment

A looming CME gap around $38,900 has captured the attention of many investors. Some believe that most price gaps in any trend need to be closed before the trend can continue. In this case, closing the gap could be essential for the ongoing Bitcoin uptrend to sustain significant momentum. Fear of this gap possibly contributed to Bitcoin's inability to surge higher after the Fed meeting, despite stock markets reaching new all-time highs.

Altcoins and Year-End Profit-Taking

Altcoins experienced less impact from year-end profit-taking compared to Bitcoin. Many altcoins continued to climb even as Bitcoin retraced. However, aggressive profit-taking hit altcoins over the weekend, resulting in retracements of 10-50% in coins that had surged significantly over the past two months. This trend is expected to persist in the final two weeks of the year, with intermittent pump-and-dump activities likely.

Cryptocurrency Activity in Asia

Crypto trading activity in Asia has gained momentum as regulatory clarity has improved over the past few years. High inflation in Asian economies has also contributed to increased crypto trading. The early Asian trading session has witnessed significant price growth, making it a focal point for traders seeking to enhance their trading performance. The US trading session continues to demonstrate consistent demand, driven by the potential introduction of BTC spot ETFs.

US Stock Market Rally

The US stock market continued its rally to record highs despite slightly higher-than-expected CPI numbers. Traders anticipated a dovish stance from the Fed and were not disappointed when the central bank decided to keep rates unchanged. The Fed's guidance of at least three rate cuts in the coming year, coupled with lower inflation forecasts, provided further impetus for long bets. By the end of the week, the Dow had breached the 37,000 mark for the first time.

Impact on Yields and the Dollar

US yields declined after the Fed's dovish remarks, with the 10-year Treasury yield falling below 4%. This resulted in a substantial dollar selloff. Additionally, the Bank of England and the European Central Bank kept rates unchanged, exacerbating the dollar's decline. By week's end, the DXY index had lost more than 2%. Gold gained 0.73%, and silver rose by approximately 0.5%. Oil prices also saw their first weekly gain in seven weeks, driven by an improved 2024 demand outlook.

Looking Ahead

The coming week in the US is expected to be relatively quiet in terms of economic data, with only the final 4Q GDP figure scheduled for release. Central bank meetings, such as the Bank of Japan's meeting, will occur before trading activity slows down for the Christmas weekend. Traders are likely to have already locked in profits for the year and may not increase risk until the new year begins.

Top Cryptocurrencies with Price Predictions

| # | Crypto | Prediction | Accuracy | CVIX | Price | 24h | 7d | Market Cap | 7d price change | |

| 1 | Bitcoin predictions | 86.4% | 19 | $60 379.47 | -2.58% | -2.47% | $1 189 262 812 670 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 2 | Ethereum predictions | 86.8% | 19 | $2 888.39 | -3.90% | -6.27% | $346 917 338 140 | |||

| 3 | Tether predictions | 94.8% | 1 | $0.999802 | 0% | -0.04% | $110 788 115 133 | |||

| 4 | Binance Coin predictions | 84.4% | 18 | $583.76 | -1.70% | 0.46% | $86 154 770 856 | |||

| 5 | Solana predictions | 79.6% | 34 | $146.15 | -0.52% | 2.80% | $65 513 986 163 | |||

| 6 | USD Coin predictions | 91.2% | 1 | $1.000079 | -0.01% | 0.01% | $33 089 136 572 | |||

| 7 | XRP predictions | 87.6% | 22 | $0.504057 | -2.45% | -4.47% | $27 904 173 173 | |||

| 8 | Toncoin predictions | 73.2% | 50 | $6.76 | 6.91% | 23.24% | $23 480 446 407 | |||

| 9 | Dogecoin predictions | 80.8% | 39 | $0.143920 | -3.18% | 2.43% | $20 758 400 829 | |||

| 10 | Cardano predictions | 83.2% | 31 | $0.445048 | -2.45% | -4.72% | $15 871 150 703 | |||

| 11 | SHIBA INU predictions | 74.4% | 51 | $0.000022 | -3.66% | -7.11% | $13 125 178 464 | |||

| 12 | Avalanche predictions | 79.6% | 40 | $34.05 | -0.89% | -3.84% | $12 968 655 229 | |||

| 13 | TRON predictions | 82% | 25 | $0.127136 | 0.48% | 2.95% | $11 122 974 987 | |||

| 14 | Wrapped TRON predictions | 84.4% | 24 | $0.126931 | 0.25% | 3.10% | $11 105 024 953 | |||

| 15 | Lido stETH predictions | 93.6% | 1 | $2 941.39 | -0.40% | -3.32% | $10 258 752 564 |